PepsiCo (PEP) recently presented its second-quarter 2025 pronouncements, figures that, shall we say, surprised Wall Street with a degree of… optimism. The share price responded with a predictable spasm – a 6% upward twitch. A fleeting enthusiasm, naturally. Market sentiment, much like a restless spirit, is rarely concerned with long-term value. One mustn’t mistake a momentary revival for genuine health.

The more pertinent observation, the one that clings to the discerning eye, is that the stock still languishes some distance from its former glory. A circumstance, I submit, that makes it… interesting. Particularly for those of us who find ourselves contemplating the possibility – and honestly, it’s only a matter of time – of a rather unpleasant bear market. Allow me to provide a rationale, in three sober measures.

1. The Imperturbability of Staple Goods

PepsiCo deals in necessities, or what passes for them in this age. Beverages, comestibles of a salty nature, packaged provisions. Brand names that have insinuated themselves into the very fabric of public consciousness: Pepsi, Frito-Lay, Quaker Oats— echoes of a simpler, perhaps more illusory, past.

Their scale is considerable, their distribution networks a marvel of logistical organization, their marketing campaigns… pervasive. They are, for all intents and purposes, indispensable allies to retailers of all stripes. It is not a business prone to dissolution, at least not overnight. Such empires rarely crumble swiftly, usually through internal decay.

And here lies the crucial point, a detail often overlooked in the frenzy of speculation: PepsiCo offers affordability. Its wares are purchased with regularity, imbued with a loyalty bordering on habit. This resilience to economic fluctuations is the defining characteristic of the consumer staples sector, a haven sought by investors when anxieties begin to bloom like poisonous flowers. PepsiCo’s trajectory isn’t one of meteoric ascent, but rather of steady, incremental growth – a subtle, almost imperceptible, climb. A tortoise, rather than a hare, if you will.

If the specter of a bear market haunts your portfolio, consumer staples represent a prudent fishing ground. This is, admittedly, a generalization. However, it leads us neatly to the matter of valuation.

2. A Bear in its Own Garden

Let us not dwell on minutiae. The truth, bluntly stated, is that PepsiCo has not recently set the world ablaze with innovation. Rivals, particularly Coca-Cola (KO), have exhibited a more… spirited performance. Wall Street, ever fickle, has responded accordingly with a degree of disapproval.

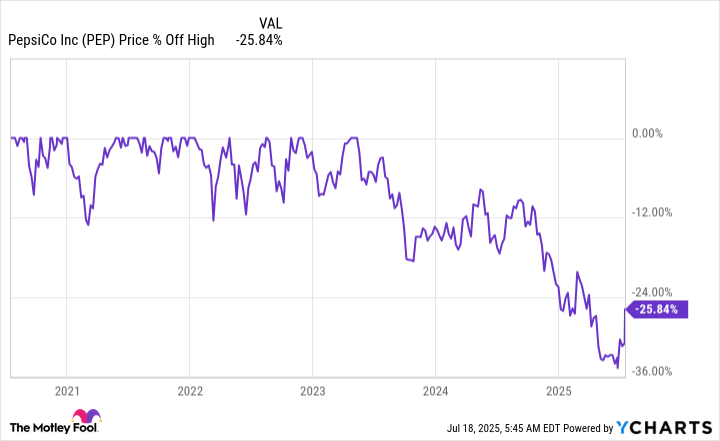

Even after the recent, aforementioned blip of positive sentiment, shares remain diminished by over 20% from their 2023 zenith. A bear market, you’ll recall, is defined as a decline of 20% or more. It appears PepsiCo is already experiencing a private, localized downturn. A peculiar state of affairs, wouldn’t you agree?

A broader market retraction could very well prompt a flight to safety, directing capital towards companies already humbled, and thus offering a comparative degree of protection. PepsiCo might rediscover its luster, almost by accident. And even if this celestial alignment does not materialize, the existing drawdown suggests that the stock would likely withstand a general downturn with greater fortitude than its more highly-valued peers.

3. The Weight of History, or, A King’s Ransom in Dividends

The final consideration: PepsiCo’s status as a Dividend King. More than five decades of annual dividend increases. A remarkable achievement, a testament to the company’s ability to navigate the treacherous currents of economic history – bear markets, recessions, and assorted calamities. Such a record is not born of chance, but of deliberate, often ruthless, fiscal prudence.

Consider, too, the current dividend yield, hovering around 4%. A substantial return, earned simply for the privilege of ownership. A cushion against the inevitable storms. A small, but not insignificant, bulwark against despair.

A Steady Course Through Murky Waters

To reiterate: PepsiCo is not presently operating at peak efficiency. It is, however, undertaking measures to address its shortcomings, engaging in cost optimization and strategically acquiring brands with greater contemporary relevance. Small adjustments, delicate maneuvers amid a chaotic sea.

It is, in essence, behaving responsibly. Combine this with the inherent stability of the business, the discouragingly low share price, and the appealing dividend yield, and one arrives at the conclusion that this stalwart represents a worthwhile addition to the portfolio. Even for those of us who lack a morbid fascination with impending market corrections. Indeed. 😌

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2025-07-27 04:15