So, here we are, folks! After a dramatic plunge that would make even the most seasoned soap opera star gasp, our beloved meme coin, PEPE, has decided to make a comeback. It’s like watching a cat fall off a table and then land on its feet—only this cat lost 80% of its dignity since December 2024. 😹

Now, analysts are dusting off their crystal balls and predicting that PEPE might just break the $0.000010 barrier if it keeps this bullish momentum going. The price chart is looking like it’s trying to form some fancy technical patterns—because who doesn’t love a good pattern, right? 📈

But hold your horses! Patience is key, and the signs of a breakout are popping up like unwanted ads on a website. Analysts are noticing that buy volume is rising while sell volume is doing the opposite. It’s like watching a game of tug-of-war where one side is just… not pulling. This could mean PEPE is gearing up for a wild ride upwards! 🚀

If this breakout happens, we’re looking at resistance levels of $0.0000075 and $0.000010. If we’re lucky, we might even see a glorious leap to $0.00002095—a whopping 220% increase! But let’s not get too excited; if PEPE can’t hold above $0.00000298, we might be in for another sad sell-off. 😬

Whale Activity and Institutional Interest Fuel Optimism

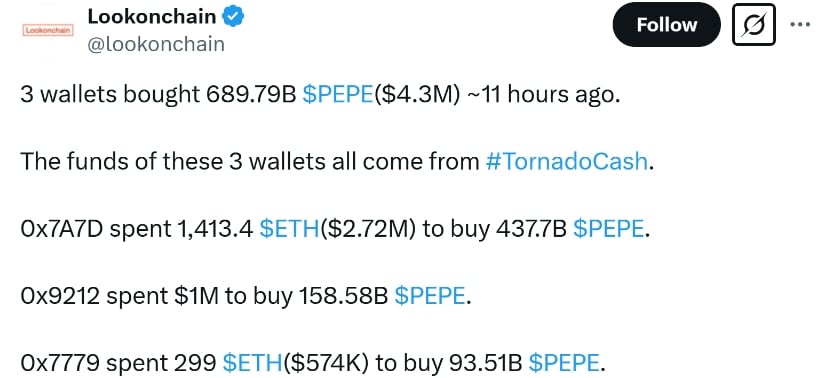

In the latest episode of “As the Crypto Turns,” PEPE’s price spike has been accompanied by some serious whale action. Three major investors decided to throw down a combined $4.3 million for 689.79 billion PEPE tokens. That’s right, folks—whales are back in town, and they’re feeling confident! 🐋💰

Historically, when whales start accumulating, it usually means a price rally is on the horizon. So, let’s keep our fingers crossed and our wallets ready! 🤞

Macroeconomic Factors Supporting PEPE’s Recovery

But wait, there’s more! It’s not just the whales that are making waves. Recent U.S. inflation data showed a drop in the Consumer Price Index (CPI) from 3.0% to 2.8%. This means the Fed might not be as aggressive, and suddenly, everyone’s interested in risk assets again—hello, cryptocurrencies! 💃

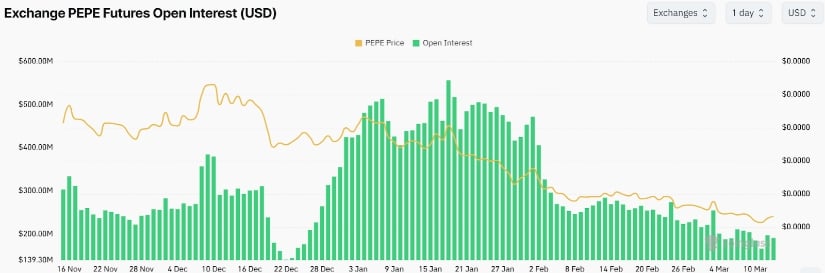

Plus, PEPE’s futures open interest has skyrocketed to $198 million, the highest since March 7. Traders are clearly gearing up for something big, and the bullish sentiment is palpable! 🤑

Can PEPE Sustain the Rally and Hit $0.000010?

Despite the recent surge, PEPE is still playing hard to get, trading under its 200-day Exponential Moving Average (EMA). Experts say if it can stay above $0.0000062, we might just see it break through to $0.000010 and beyond. Fingers crossed, everyone! 🤞✨

Our favorite crypto analyst, Max, has spotted a bullish divergence, which means more buying while selling is on the decline. It’s like a party where everyone’s dancing, but the DJ is still playing sad songs. Some analysts are predicting a short-term appreciation of 60%, with target prices of $0.000012 (a 90% increase) and $0.000020 (a 215% increase). 🎉

But let’s not get too carried away. Traders need to be cautious—short-term fluctuations are lurking around like that one friend who always shows up uninvited. If PEPE can’t hold those vital support levels, we might be in for a bumpy ride. 😬

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-13 19:21