The cost of PENGU dipped approximately 10% over the past day, following its title as Solana’s most prominent meme token. Although it has seen increased interest lately, its progression seems to be decelerating, and technical signals hint at the possibility of consolidation or additional declines.

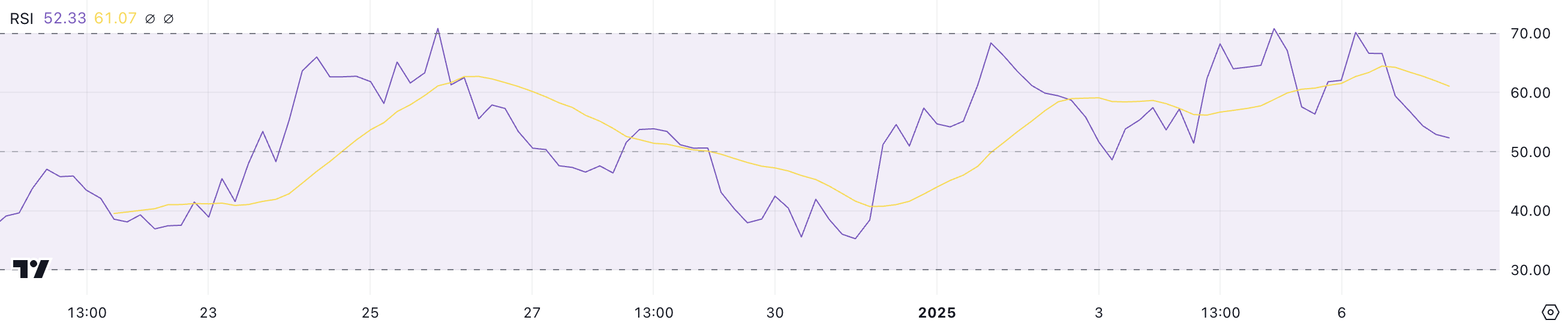

As a researcher, I’ve noticed a significant drop in the Relative Strength Index (RSI) of PENGU, moving from 70 to 52.3. This suggests a decrease in buying pressure. However, if there’s a resurgence of enthusiasm for PENGU, it could potentially regain bullish momentum and challenge important resistance levels.

PENGU RSI Is Going Down Fast

Today, the Relative Strength Index (RSI) for PENGU stands at 52.3, marking a substantial decline compared to yesterday’s overbought status of 70. The RSI is a popular tool among traders, which assesses the rate and intensity of price fluctuations on a scale ranging from 0 to 100.

In simple terms, when the Relative Strength Index (RSI) exceeds 70, it’s usually a sign of overbought conditions, which might hint at an impending pullback or decline. Conversely, if the RSI drops below 30, it suggests oversold conditions, possibly implying a recovery or upturn. When the RSI is around 50, it signals a neutral momentum, meaning that buying and selling pressures are roughly equal at this point.

Based on PENGU’s Relative Strength Index (RSI) currently at 52.3, the indicator indicates a temporary holding pattern in the near future. This level signifies decreased buying activity compared to past peaks, but it still hints at a slightly optimistic outlook. If the RSI remains stable or increases, it might indicate a restart of the bullish trend.

On the contrary, if the value falls below 50, it may suggest a decrease in bullish enthusiasm, possibly resulting in further price stabilization or minimal drops. Under such circumstances, there’s a chance that PENGU could be overtaken by BONK as the leading meme coin on Solana.

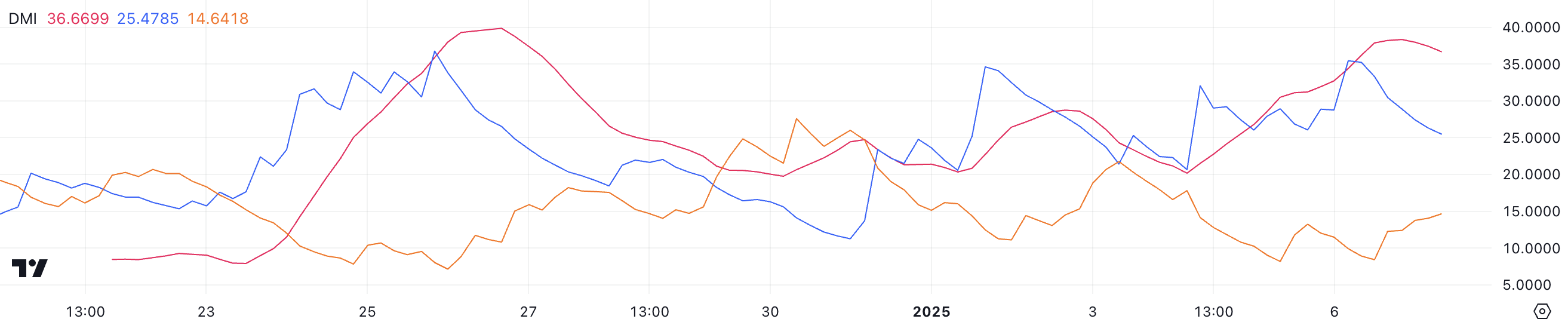

PENGU DMI Chart Shows the Downtrend Could Get Stronger

presently, the PENGU Average Directional Index (ADX) stands at 36.6, marking a substantial increase from 20 it was three days ago. The ADX assesses the intensity of a trend, ranging from 0 to 100, where values surpassing 25 signal a robust trend and values below 20 imply weak or non-existent momentum.

In simpler terms, an increasing ADX value indicates a stronger trend, be it an uptrend (bullish) or downtrend (bearish).

In the meantime, the directional indicators offer insights about the trend’s character. The +DI, symbolizing buying pressure, has decreased from 35 to 25.4, suggesting a weakening bullish trend. On the other hand, the -DI, representing selling pressure, has risen from 8.4 to 14.6, indicating an increase in bearish activity.

If the Positive Directional Indicator (DI+) keeps decreasing while the Negative Directional Indicator (DI-) increases more, it might suggest an increase in selling pressure for the PENGU price, hinting at a potential short-term bearish reversal.

PENGU Price Prediction: Will It Fall Below $0.03 Again?

At present, the trends on the PENGU charts appear to favor a bullish outlook. However, recent market behavior hints that the coin might be shifting towards a declining trend. If the bearish movement continues to gain strength, it’s possible that PENGU may approach the $0.034 support level.

If we can’t maintain this current level, it could result in additional drops. Two significant points to keep an eye on are $0.0296 and $0.0251. The former value is approaching the historical lows of PENGU.

Conversely, there’s been a lot of buzz around the cryptocurrency known as PENGU in recent times. It has climbed up to be among the top 10 largest meme coins. If interest in this coin picks up again, it might challenge the $0.0439 resistance level once more.

If we surpass this current level and witness a resurgence of bullish energy, it’s possible that the PENGU price could climb beyond $0.05 for the initial occasion.

Read More

- PENGU PREDICTION. PENGU cryptocurrency

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

2025-01-08 03:24