Peloton. It began, as so many things do, with a good idea. People stuck at home, wanting to avoid the plague, buying expensive bicycles. It was a moment. A blip. So it goes. Now, the company is a case study in how quickly fortunes can change. The stock? Down 96% from its peak as of January 12th. A statistic, really, but one that suggests a certain… gravity.

The question isn’t whether Peloton can turn around. It’s whether it deserves to. A harsh thought, perhaps. But the market, that fickle beast, has already rendered its verdict. The stock is cheap, yes. But cheapness doesn’t always equate to value. Sometimes, it just means… well, you get what you pay for.

Cost Cuts and Empty Calories

Peloton has been diligently trimming fat. Barry McCarthy, the previous CEO, started the diet. Peter Stern, the current one, continues to serve the portion control. They’ve reported a couple of quarters of actual, honest-to-goodness profit. A small victory. But victories, like everything else, are temporary.

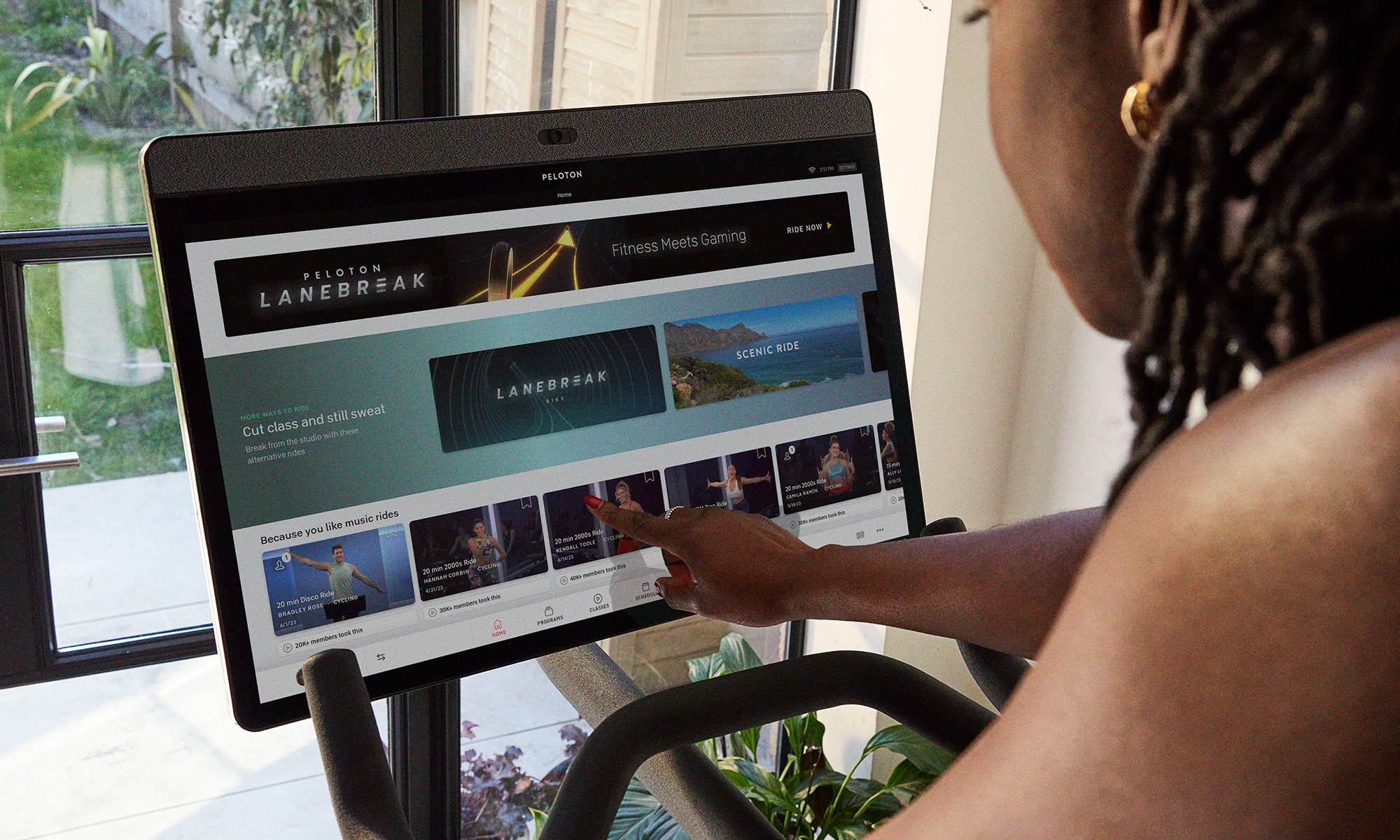

They used to lose money on the hardware itself, which is a bit like selling the gun and then giving away the bullets. Now, at least, they’re making a little something on the bikes. 72% of their revenue comes from subscriptions, which is good. People are paying to be told what to do. It’s a very old business model.

They’ve cut jobs, shrunk their retail footprint, and dialed back on product development. These are all sensible things to do, I suppose. But it’s like rearranging the deck chairs on the Titanic. Eventually, you run into an iceberg. And in Peloton’s case, the iceberg is called… reality.

Subscriber numbers are down 6% year over year, to 2.7 million. Analysts expect revenue to decline another 0.5% between now and next year. These aren’t catastrophic numbers, not yet. But they are… persistent. Like a cough you can’t quite shake.

The Fitness Fantasy

The stock is cheap, undeniably. A price-to-sales ratio of 1.1 is… low. Some people see a long-term opportunity. They believe in the power of fitness, the human desire for self-improvement. It’s a nice thought.

I see a high-risk turnaround story. A gamble. The stock might bounce, briefly. But I wouldn’t count on it. Not unless they can somehow convince people to actually use the machines.

The fitness industry is a tough business. It relies on people sticking to their resolutions. But people are fickle. They’re easily distracted by the next shiny object. And in Peloton’s case, they’re competing with an endless stream of free workout videos online. Plus, the market for $4,000 exercise bikes is… limited. It’s a niche, really. A very expensive niche.

Investors would be better off looking elsewhere. There are other companies, other gambles. Some of them, at least, don’t involve quite so much sweat. So it goes.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Gold Rate Forecast

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- EUR UAH PREDICTION

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2026-01-17 13:12