In the grand tradition of the Guild of Alchemists and Venture Capitalists1, Norbert Lou of Punch Card Management has performed a ritual that would make even the wizards of the Unseen University raise an eyebrow. This disciple of Warren Buffett’s “buy-and-hold” incantation, known for his patience and portfolio concentration, recently summoned two new financial familiars into his investment cauldron. One such creature? The curious case of PayPal (PYPL), now accounting for 15% of his holdings. With its stock price having fallen farther than a troll off a cliff2, should value investors be sharpening their quills for this digital ledger opportunity?

The Sorcerer’s Apprentice Problem

PayPal’s descent began when it mistook acquisition for alchemy. Much like apprentice wizards adding random ingredients to a cauldron, the company swallowed iZettle, Honey, and Xoom with all the strategic clarity of a goblin at a goldsmith‘s forge. The result? A potion so convoluted even the Bursar of Ankh-Morpork couldn’t balance its ledgers.

Now under new conjurers’ hats, PayPal has embraced the ancient adage: “Simplify, then amplify.” Its once-cluttered app now serves as a portal to discount realms rather than just a magical bridge for transferring funds. By partnering with merchants in a cash-back pact that would make Death himself blush with envy, the company has conjured 8% year-over-year growth in “branded experiences.” This includes the curious phenomenon of Venmo debit cards circulating like enchanted coins in mortal markets.

Braintree’s Bazaar of Broken Bottlenecks

The Braintree acquisition, once a labyrinth of unprofitable merchant deals, has been pruned with the ruthlessness of a gardener facing carnivorous shrubbery. While payment volumes initially shrunk like a werewolf in daylight, the company now claims to have passed through the “Valley of the Shadow of Doubt” into calmer financial climes. The merchants remaining are said to be “profitable beyond the dreams of avarice,” though this has yet to be verified by the Guild of Independent Auditors (who are currently on strike).

Economical Efficiency: The Auditor’s Blessing

PayPal’s management has embraced the Doctrine of Bureaucratic Minimalism with the fervor of converts at a temple of efficiency. After hiring more employees during the Great Pandemic than the Patrician’s Tax Collection Department, the company has performed a series of “workforce adjustments” that would make the Auditors of Reality3 weep with bureaucratic joy.

The results? Operating margins have expanded from “embarrassingly porous” to “respectably airtight” at 19%. Operating income has doubled faster than a Luggage multiplying itself in the University’s vaults, reaching $4.67 billion in the past year. This fiscal fitness has caught the eye of Punch Card Management, whose investment strategy aligns with the ancient Discworld principle: “Buy low, preferably when the market is screaming.”

The Valuation Vortex

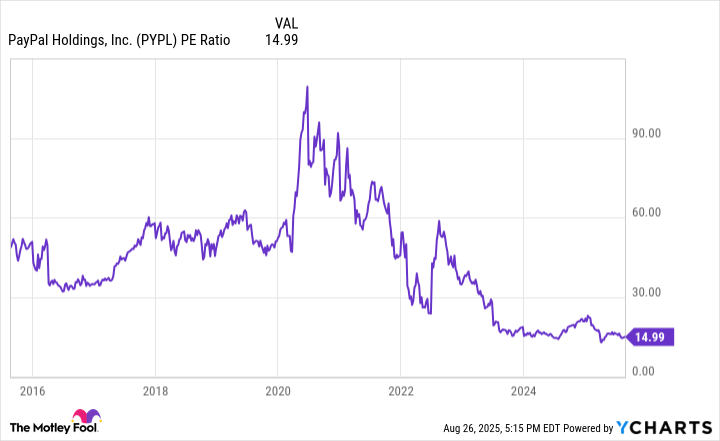

At $70 per share, PayPal trades at a P/E ratio lower than the interest rate charged by the Ankh-Morpork Thieves’ Guild. With a stock buyback program devouring shares at 10% annually, the company is performing financial transmutation that would make even Moist von Lipwig blush. Five years of shrinking share count (down 20%) means earnings per share could grow without the company needing to do anything more than continue its current path.

For investors willing to navigate the “seven-year itch” of market cycles, PayPal presents a paradoxical opportunity: a fintech dragon that’s currently guarding a hoard of cash rather than breathing fire. If the company’s core “branded experiences” continue gaining traction, this could become a tale of resurrection more impressive than the time the Librarian turned a wizard into a tree.

As the Bursar might say while counting his gold: “Buy when the market’s in a foul mood, hold when the wizards are sober, and always watch for the invisible hand.” 🧙♂️

1

Founded by the legendary alchemist-sorcerer Jerry Diamond, whose “value investing” philosophy involved literally turning lead into gold.

2

Troll physics: For every 100 feet fallen, they become 100 pounds lighter. PayPal’s market cap has fallen 77% from pandemic peaks.

3

Mysterious beings who believe efficiency is the only true religion. Rumored to live in spreadsheets.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-28 11:14