The markets, as they often do, reacted with a swiftness bordering on the theatrical. PayPal, a name once synonymous with the burgeoning digital currents, saw its shares retreat – a nine percent ebb on the twenty-ninth of July. A tremor, yes, but one that feels, to this eye, disproportionate to the shift in the underlying terrain. The scent of panic is rarely a signal for shrewd reckoning.

The current disquiet centers, predictably, upon the flow of coin. The second quarter’s free cash flow, a sum of $692 million, appears to have unsettled investors. A decline of forty-nine percent year on year. To the casual observer, a darkening of the ledger. Yet, such metrics are but shadows cast by the sun of expectation.

The company itself anticipates, unchanged, between six and seven billion in free cash flow by 2025. This temporary constriction, therefore, is a matter of rhythm, a fleeting pause in an otherwise steady pulse. A misalignment of timings, not a sickness at the core. The market’s recoil, then, is a momentary lapse in perspective, akin to judging a tree by the barrenness of a single branch.

The question, inevitably, arises: is this decline a chance to acquire, to gather strength during a perceived weakness? It is a question one always asks, leaning close to the wind to read its intentions.

A Quiet Persistence

PayPal, it must be acknowledged, has entered a phase of diminished velocity. Revenue growth of five percent in the last quarter, accompanied by a mere two percent uptick in active accounts. It is not a roaring ascent, certainly, but a subtle shift – a slow, geological movement rather than a volcanic eruption. But beneath this subdued surface, a quiet reshaping is underway.

The arrival of Alex Chriss as Chief Executive Officer marked a turning point. He perceived, with a clarity often reserved for those who truly listen, the erosion of margins. The willingness to concede profit in pursuit of volume – a siren song for many – had begun to compromise the essence of the enterprise. He understood the delicate balance between expansion and enduring worth.

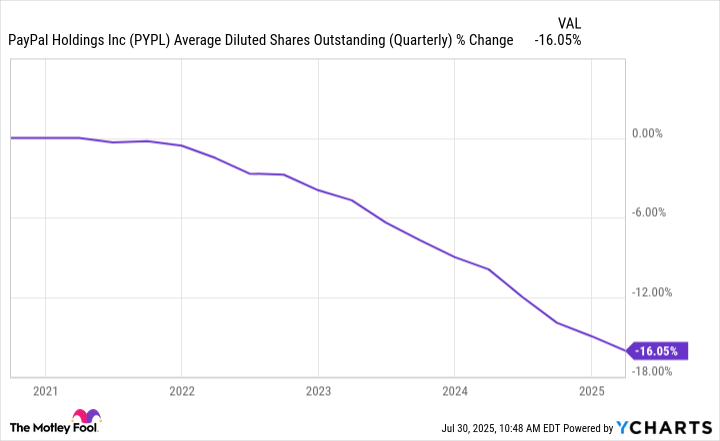

Since his ascendance, contracts have been revisited, re-negotiated. The price of access has been recalibrated, lifting the profit derived from each transaction by seven percent. A modest gain, perhaps, but one that whispers of restored equilibrium. The bottom line sings a more melodic tune. Aggressive share buybacks, funded by these profits, have reduced the share count, elevating earnings per share by a substantial twenty percent. A pleasing geometry.

This reduction in share count, visible in the chart below, is a steady hand upon the tiller, guiding the vessel towards a more concentrated value.

Clouds on the Horizon

The nine percent dip, as we’ve noted, is a symptom of prevailing anxieties. The stock now trails its fifty-two-week peak by twenty-three percent. The question remains: is this a correction, an adjustment towards true value, or an omen of deeper troubles? A careful weighing of factors is required.

The most pressing concern is the deceleration of user growth. The two percent increase in active accounts is meager. More troubling still is the four percent decline in transactions per active account over the preceding twelve months. A worrying reverse in a trend previously marked by uninterrupted ascent. It is as though the river, once flowing steadily towards the sea, has begun to thin, to lose its momentum.

Stagnant user growth, coupled with dwindling transactional activity, presents a challenge. The S&P 500, in its ceaseless striving, demands more vigorous expansion. To remain competitive, PayPal requires a rekindling of its innate dynamism.

A Calculated Pause

While present growth may be wanting, the potential for future blossoming exists. Venmo, PayPal’s subsidiary, currently accounts for eighteen percent of total payment volume – a noteworthy contribution. Its growth trajectory has recently steepened, rising from eight percent in the first quarter to twelve percent in the second. A promising acceleration.

Furthermore, the newly unveiled PayPal World initiative – a partnership designed to foster interoperability with global digital wallets – holds significant promise. Early collaborators include MercadoLibre of Latin America and Tencent of China. The successful integration of these systems, scheduled for this autumn, could unlock substantial new avenues for adoption.

My assessment, then, is cautiously optimistic: PayPal remains a suitable acquisition, tempered by the understanding that its current growth is unlikely to surpass the S&P 500 within the next five years. Its inherent value lies in its potential, in the unseen currents that could yet propel it forward.

This stock presents a relatively low level of risk. Its immense scale, robust cash flow generation, and commitment to shareholder value—through stock buybacks—provide a solid foundation. Even in the event of continued sluggish growth, earnings per share should exhibit modest gains, sustaining the share price. The capacity for surprise, perhaps a gentle rising of the tide.

The present decline from its yearly high offers a margin of safety, a cushion against unforeseen storms. In conclusion, even if present conditions persist, the downside appears limited. And should the seeds of innovation—particularly within Venmo—bear fruit, PayPal could yet prove a market-beating investment. 🧐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-02 11:57