As a seasoned crypto investor with a knack for spotting trends early, I can’t help but feel a sense of deja vu reading about Dan Morehead’s foresight back in 2013. I remember my own foray into Bitcoin at around the same time, when the market was as small and obscure as an ancient coin dug up from a Roman ruin.

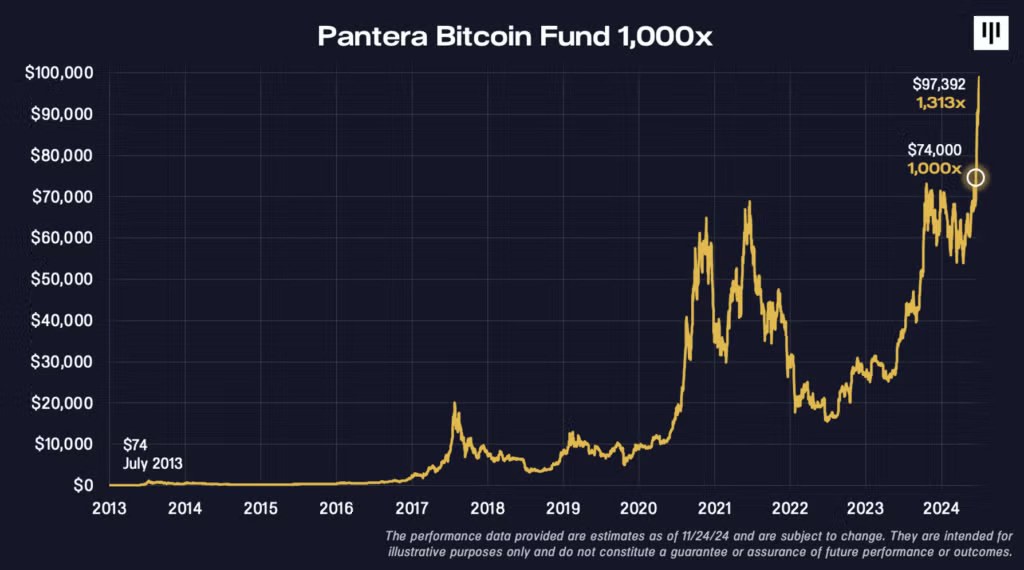

According to a recent update from crypto investment firm Pantera Capital, the cumulative return on their Partner’s Bitcoin Fund has soared past 131,000% (net of charges and costs) as the value of Bitcoin approached $100,000 following the U.S. elections.

In a blog post, Dan Morehead, CEO of Pantera Capital, published an email from July 2013 predicting that Bitcoin’s ‘washout’ had occurred at around $65 in value, indicating a significant drop, and suggesting that the price of Bitcoin would rise steadily over time.

The email mentioned that he intended to purchase approximately 30,000 Bitcoins using his own funds, when the overall value of the cryptocurrency market was about $740 million. Notably, at this time, the size of the Bitcoin market was relatively small. During the years 2013-15, Morehead pointed out that the fund acquired around 2% of all existing Bitcoins worldwide.

To Morehead, purchasing Bitcoin back then was similar to buying gold in 1000 B.C., as most of the financial wealth at that time had not yet considered or invested in Bitcoin. He pointed out that the industry has progressed since then and now estimates that 95% of the current financial wealth remains uninvested in Bitcoin, still holding a significant position to enter the market.

The CEO added that the catalyst for the figure to keep on dropping has “just happened: regulatory clarity in the United States” at a time in which massive “institutional managers like BlackRock, Fidelity, and others are now offering incredibly cheap, efficient access to anyone with a brokerage account. “

Based on his forecast, he anticipates that a single Bitcoin could reach approximately $740,000, an increase from its current value around $95,000. This surge would propel the total market capitalization of Bitcoin to an astounding $15 trillion. To Morehead, this figure doesn’t seem implausible when compared to the existing $500 trillion in financial assets worldwide.

According to him, if Bitcoin’s price continues to rise, it could reach approximately $740,000 by April 2028.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-11-28 18:31