As a seasoned crypto investor with a decade of experience under my belt, I can’t help but marvel at Pantera Capital’s remarkable journey with Bitcoin. Back when Bitcoin was just $74 in 2013, I remember debating whether it was worth investing in this ‘digital gold’. Little did we know that this seemingly insignificant investment would turn into a 1,000x return!

According to Pantera Capital’s predictions, Bitcoin might reach an astounding $740,000 by the year 2028. Lately, their Bitcoin Fund has celebrated a significant milestone, achieving an impressive 1,000-fold return.

The fund’s lifetime performance now stands at 131,165%, net of all fees and expenses.

Pantera Capital’s Bitcoin Fund Has Returned Remarkable Profits

Initiated back in 2013, Pantera’s Bitcoin Investment Fund was one of the pioneering investment options in the United States allowing access to Bitcoin. At that point, each Bitcoin cost around $74. Seizing this opportunity, the company managed to secure approximately 2% of the worldwide Bitcoin stock.

Conversely, Bitcoin recently surpassed $99,000 for the first time this month. This signifies that the return on Pantera’s 2013 investment has now exceeded a staggering 1,000%.

In his recent statement, Pantera Capital’s Dan Morehead emphasized that Bitcoin stands out as a global currency, surpassing cash, electronic currencies, gold, bonds, and even ancient forms of money like large stone discs. Essentially, Bitcoin shares the functionalities of each of these. He further stated that Bitcoin is the first global currency since gold and the first borderless payment system ever created.

Pantera Capital previously projected Bitcoin’s price to reach $117,000 by 2025.

As a researcher delving into the dynamic world of cryptocurrencies, I’ve found myself venturing beyond the realm of Bitcoin with Pantera. Our latest endeavor, Pantera Fund V, is strategically designed to broaden our investment horizons by focusing on blockchain assets, thereby diversifying our portfolio.

As an analyst, I’ve been exploring the potential of private tokens, specifically the locked Solana tokens stemming from FTX’s estate. Additionally, we at Pantera Capital have recently secured funding in June with the goal of increasing our investment in Toncoin.

Bitcoin Facing Correction After Month-long Rally

Over the last few days, I’ve observed a 6% drop in Bitcoin’s price – a noticeable decrease from its record highs set in November. This downward trend seems to be partly driven by reduced demand among US investors, as suggested by the fluctuations in the Coinbase Premium Index.

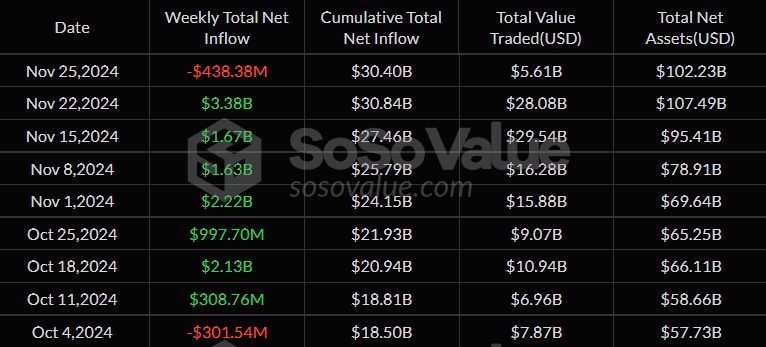

Concurrently, there’s been a varying interest in Bitcoin Exchange-Traded Funds (ETFs). On November 25, these ETFs experienced a net withdrawal of approximately $438.38 million, following five consecutive days of investments totaling around $3.5 billion.

Despite a significant decrease in realized profits from Bitcoin, falling from $10.58 million to $1.58 million on Monday, the diminished selling pressure might suggest potential opportunities for further price increases in the future.

Additionally, it’s worth noting that the typical holding duration for Bitcoin has risen by approximately 65% in the last seven days. This trend indicates growing commitment from investors and supports a favorable perspective on the future.

As an analyst, I find myself buoyed by Pantera’s long-term outlook on Bitcoin, despite the current market turbulence. The reason for my optimism lies in the fact that Bitcoin, as the foremost cryptocurrency, consistently garners growing institutional attention – a trend that underscores its significant growth potential.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Does Oblivion Remastered have mod support?

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DODO PREDICTION. DODO cryptocurrency

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-11-26 19:26