Since its emergence onto the exchanges in the year 2012, Palo Alto Networks has, undeniably, outpaced the broader market. A fortunate confluence of timing and circumstance allowed it to flourish as the digital realm expanded, providing essential defenses for networks and devices amidst a veritable revolution in computing and communication. It was a period of bold expansion, of unbridled optimism, and the company, for a time, seemed destined for enduring prominence.

Yet, the currents of the market are ever shifting, and the landscape of cybersecurity, once a fertile field, has become crowded, fiercely competitive. A certain weariness now clings to the stock, a perceptible decline over the past year—some fifteen percent, to be precise—suggesting a loss of momentum. The question that now occupies the discerning investor is whether this is merely a temporary pause, a moment of consolidation before a renewed ascent, or the first sign of a more profound stagnation.

A State of Reflection

It is not, I believe, a matter of outright dismissal. Most analysts, possessing a cautious temperament, do not yet regard Palo Alto as a liability. Clients continue to seek its integrated security platforms, recognizing the necessity of defense in an age of escalating threats. The company, with a certain adeptness, has managed to translate these anxieties into a recurring stream of revenue—a predictable rhythm in a world of unpredictable events.

Indeed, Palo Alto has demonstrated a respectable growth trajectory. Revenue increased by sixteen percent in the initial quarter of fiscal 2026 (concluding October 31st), and fifteen percent throughout fiscal 2025. This, it must be acknowledged, surpasses the estimated compound annual growth rate of twelve percent projected for the cybersecurity industry by Grand View Research through the year 2033. Still, one observes a subtle deceleration, a waning of the initial vigor. The growth of twenty-five percent witnessed in 2023 now appears a distant memory, a golden age receding into the past. Analysts anticipate this slowing trend to persist, forecasting increases of fourteen percent for fiscal 2026 and thirteen percent in the subsequent year. A gradual settling, as if the company is seeking a more sustainable, yet less spectacular, pace.

Furthermore, the company has embarked upon a series of substantial acquisitions, most notably the proposed purchase of CyberArk Software for a sum of twenty-five billion dollars, expected to finalize in the latter half of fiscal 2026. One cannot help but wonder whether these expansions, while ambitious in scope, will be successfully integrated into the existing structure. The absorption of Chronosphere, acquired for three and thirty-five million dollars and completed in January, presents a similar challenge. The art of synthesis, it seems, is a more elusive skill than the pursuit of acquisition.

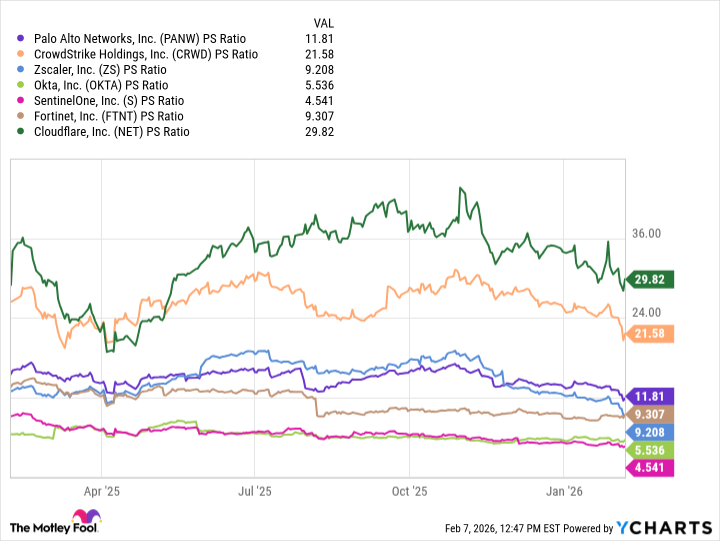

Valuation, too, warrants consideration. The price-to-earnings ratio currently stands at one hundred and one, a figure that, while not unprecedented, suggests a degree of optimism bordering on exuberance. Even at a forward price-to-earnings ratio of forty-one, the company’s earnings multiples remain considerably above the average of twenty-nine observed in the S&P 500. A price-to-sales ratio of approximately twelve, while not uncommon for a growth stock in the technology sector, places it at a premium compared to its peers. Considering the decelerating revenue growth, one is left to ponder whether Palo Alto can justify such a valuation in the near term.

A Year Hence

While a long-term perspective suggests Palo Alto Networks will ultimately move higher, it seems likely to underperform the S&P 500 over the next twelve months. It will, I suspect, remain a prominent player in the cybersecurity landscape, but one that operates with a more subdued rhythm, a quieter dignity.

Palo Alto Networks, despite its strengths, finds itself at a crossroads. Its revenue growth has undeniably slowed, and analysts foresee this deceleration continuing. The success of its recent acquisitions remains uncertain, and its valuation, while not exorbitant, appears stretched given the current circumstances. In the present moment, there are few compelling reasons for investors to add to their holdings. A sense of waiting, of observing, seems the most prudent course of action. The company, like a seasoned traveler, appears to be pausing before embarking on a new, and perhaps more challenging, journey.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-12 00:23