Palantir Technologies (PLTR) has emerged as a focal point for AI investors, delivering a 2,300% surge since 2023. Yet recent volatility has erased 20% of its peak value, reigniting debates about its valuation sustainability. RBC Capital’s Rishi Jaluria has issued a $45 price target – implying a 70% correction – prompting institutional investors to scrutinize the arithmetic behind such a dramatic projection.

Operational Duality: Government Contracts vs Commercial Growth

- Q2 revenue split: $553M (govt, +49% y/y) | $451M (commercial, +47% y/y)

- Net income margin: 33%, defying typical high-growth tech company economics

- Platform differentiation: AI-driven data integration tools with embedded automation capabilities

The dual-market strategy creates unique defensibility. Government contracts provide stable cash flows (notably through defense and intelligence agencies), while commercial adoption benefits from AI’s enterprise penetration tailwinds. This bifurcated model reduces cyclical exposure compared to pure-play software vendors.

Valuation Arithmetic: When Growth Isn’t Enough

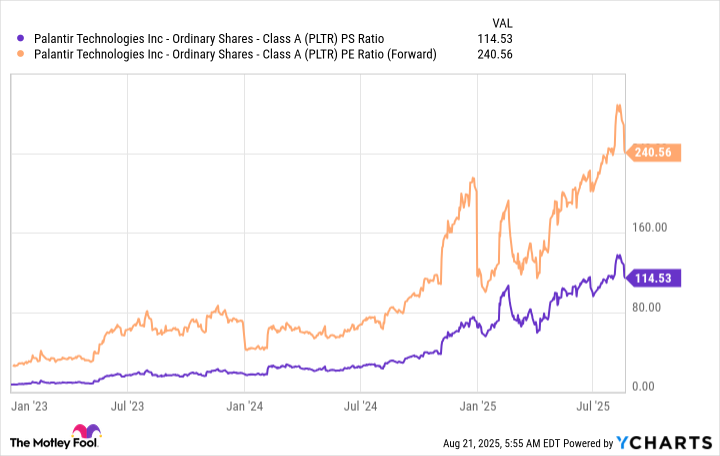

Current multiples raise material concerns:

- 115x sales (vs. 30x historical software median)

- 241x forward earnings (exceeding even hypergrowth peers)

- Market cap/revenue ratio: 9.3x (Nvidia’s peak: 5.2x)

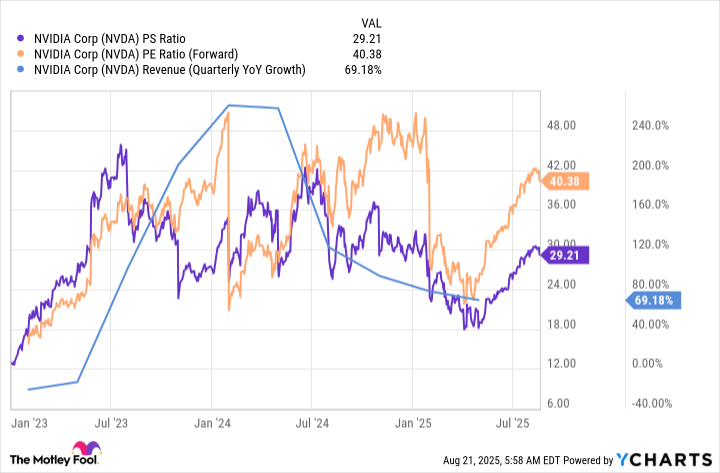

Applying standard industry benchmarks produces stark results. At 50x forward earnings (Nvidia’s 2023 multiple during AI ascent), shares should trade 79% lower. Even granting premium status at 30x sales still necessitates a 74% correction. The market’s implicit assumption of perpetual 40%+ revenue growth appears statistically improbable.

Comparative Analysis: Palantir vs AI Infrastructure Peers

| Company | Revenue Growth | P/S Ratio | P/E Ratio |

|---|---|---|---|

| Palantir | 28% (3Y avg) | 115x | 241x |

| Nvidia | 67% (3Y avg) | 48x | 31x |

| Databricks | 55% (est) | 35x | – |

The disconnect becomes apparent when juxtaposing valuation with growth velocity. While Palantir’s government vertical creates pricing power, sustaining >100x sales multiple requires federal agencies to suddenly prioritize AI budgets at unprecedented levels.

Investment Implications: Navigating the Correction

Three potential pathways emerge:

- Multiple compression with stable fundamentals (“soft landing”)

- Growth deceleration triggering earnings multiple re-rating

- Government procurement delays causing cash flow volatility

Institutional portfolios should consider:

- Reducing exposure above 8x sales ratio

- Hedging through long-volatility instruments during earnings seasons

- Monitoring federal budget allocations for AI initiatives

Rishi Jaluria’s target seems extreme until examining the mathematical inevitability of mean reversion. While operational execution remains strong, valuation theory suggests significant downside risks remain underappreciated. Patient capital should wait for 50x forward earnings entry points before establishing core positions. 📉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-24 01:28