Ah, the intriguing ascent of Palantir Technologies (PLTR)-a narrative that arcane skeptics like myself cannot help but scrutinize. With shares exhibiting a prodigious increase of 107% this year, one cannot ignore the palpable excitement amongst the cheerleaders of the market. These boosters sing praises as the nebulous aura surrounding Palantir is invigorated by the fervent embrace of artificial intelligence (AI) through its data analytics solutions. Yet, one must ponder, in a land rife with ephemeral glories, how long might this jubilant rally endure?

What is Palantir, you ask?

In spite of its clandestine reputation, the essence of Palantir’s offerings is disarmingly transparent. Among the vast chaotic landscapes of data, the company whisks away the dross, revealing nuggets of insight, unearthing treachery, and refining the gears of bureaucracy for both enterprises and governmental bodies. While it may not possess the untainted accolades of an AI purist like OpenAI, it remains firmly wedded to the advancements of large language model (LLM) technology.

These LLMs serve as gentle guides, inviting users to engage with the bewildering array of data via simple conversational prompts, a stark contrast to the laborious and often bewildering workflows of yore. In urgent scenarios-on battlegrounds or within the hallowed halls of law enforcement-such a methodology becomes invaluable.

In the year of our Lord 2023, Palantir unveiled its Artificial Intelligence Platform (AIP). Notable contracts have materialized, illuminating the firm’s path: alliances with the valiant forces of Ukraine and Israel. Perhaps in April, within the shadows of warfare and strategy, Palantir captured a monumental feat, as NATO embraced its Maven Smart System-a bastion of AI, enhancing battlefield awareness and tactical decision-making.

Business is undoubtedly booming

With the dawn of its AI-fortified solutions, Palantir witnessed an exuberant surge in operational results. The second-quarter revenue soared 68% year over year, reaching a substantial $733 million. This growth was underpinned chiefly by a near doubling of revenue from the U.S. commercial segment, which serves its enterprise clients. However, let us not hastily rejoice; profitability, though commendable, is a double-edged sword in the realm of lofty expectations.

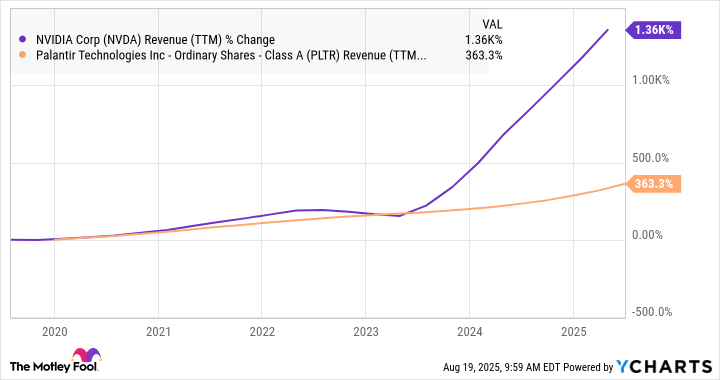

Yet, one must scrutinize the overarching narrative; a stellar company does not necessarily equate to a promising investment in the long arc of time. Indeed, Palantir’s current valuation raises an eyebrow with a forward price-to-earnings (P/E) multiple of 243, casting it in stark contrast to its industry counterparts-wherein Nvidia, with a mere P/E of 40, revels in its own superior growth.

Palantir could be worth just $26

Envision, if you will, an alternate reality where Palantir’s equity is weighed with the same critical eye meted upon Nvidia. The revelations would be nothing short of staggering: a share price luminescing downwards by 84%, from a fanciful $174 to a mere $26, should the P/E languish at a more palpable 40.

To assuage concerns, let it be noted that this remains a harrowing case. Nvidia’s valuation is a testament to its colossal market cap of $4.3 trillion, an insurmountable grandeur. Conversely, Palantir, in its infancy, possesses room for expansion, yet even a benevolent forward P/E of 80 (yielding a stock price of $52) remains a foreboding proposition against its current valuation.

Moreover, the landscape of business ventures does not weave a fabric robust enough to substantiate such elevated valuations eternally. While its revenues blossom, the pace of acceleration teeters on uncertainty. Palantir is hardly an outlier; competitors like Microsoft and Snowflake lurk ominously, their AI-driven analytics services casting a long shadow over the firm. Such rivalry invites the specter of stagnation upon Palantir’s growth and profit margins.

Where shall Palantir find itself in the next three years?

Within the cradle of its inflated valuation, one might surmise that the expectations are tantamount to clouds drifting high above, far removed from the earthbound realities. As three years stretch before us, it seems mere folly to anticipate further elevation; rather, a plateau or a descend seems feasible as the collective fervor swells and wanes.

Nevertheless, let us temper our skepticism; it appears that Palantir has garnered an ardent following, a devoted congregation ready to fend off storms, thus preserving its valuation longer than reason might dictate. To initiate a short position could indeed prove riskier than merely enduring the currents of its current fate.

In the realm of markets, as in life, one must remain ever vigilant-one’s faith can be as fickle as the winds of change. 🌫️

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-24 12:35