The market, that intangible colossus of ceaseless transactions and whispered calculations, divides itself into two uneasy kingdoms: value stocks, those stolid monoliths of yesteryear’s earnings, and growth stocks, the jittering phantoms of tomorrow’s promises. Value stocks, with their dividends and weathered balance sheets, cling to the earth like barnacles to a ship’s hull. Growth stocks, however, are the ship’s wake-ephemeral, turbulent, and propelled by the ceaseless churn of speculation. One invests in stability; the other, in the fevered dream of escape.

Growth stocks are the province of the sleepless, those who perceive in their charts and projections a path to transcendence. These companies, often perched on the jagged peaks of technological novelty, promise not merely profit but transformation. Their financial statements resemble blueprints for utopias: revenues rising like smoke, earnings evaporated into research budgets, valuations so inflated they threaten to float into the stratosphere. To invest in them is to wager against gravity itself.

Palantir’s inescapable machinery

Twenty years ago, Palantir Technologies embarked on its odyssey-not as a merchant of mundane software, but as an architect of systems so complex they might have been designed by Kafka’s Castle. Their platforms, ingesting data from hundreds of sources like a bureaucratic mill grinding infinite scrolls, promised to distill order from chaos. Originally forged in the crucible of intelligence agencies, the company’s tools became instruments of both revelation and entrapment. Osama bin Laden’s capture in 2011 was attributed to their algorithms, a testament to their power-or perhaps to the universe’s cruel irony.

The year 2023 marked a turning point, or so the narrative insists. Palantir unveiled its Artificial Intelligence Platform (AIP), a creation as inevitable as a tax audit. Customers, herded into “bootcamps” like bewildered pilgrims, were shown how to extract “actionable insights” from the firm’s labyrinthine databases. Generative AI, that most mercurial of sorcerers, now whispered its secrets through Palantir’s conduits. Commercial clients, previously uninitiated, now found themselves clutching fragments of prophecy printed on punch cards.

“The growth rate of our business has accelerated radically,” wrote CEO Alexander Karp in a missive that read like a confession to an unseen tribunal. “After years of investment on our part and derision by some… an ascent that is a reflection of the remarkable confluence of the arrival of language models, the chips necessary to power them, and our software infrastructure.”

The numbers as divine punishment

Consider the numbers, if you dare. Revenue in Q2 2025 surged 48% year-over-year, breaching $1 billion as if the figure were merely a checkpoint in an eternal ascent. Government contracts bloomed like toxic roses (53% growth to $426 million), while commercial clients-those desperate souls seeking clarity in a fragmented world-contributed $306 million, a 93% increase. The company’s ledger reads like a Gnostic scripture: 157 deals worth $1 million or more, 66 of them exceeding $5 million, 42 surpassing $10 million. Customer count swelled from 593 to 849 in a single year, a migration toward dependency that no mortal could halt.

| Quarter | Adjusted Operating Income | Margin |

|---|---|---|

| Q2 2024 | $254 million | 37% |

| Q3 2024 | $276 million | 38% |

| Q4 2024 | $373 million | 45% |

| Q1 2025 | $391 million | 44% |

| Q2 2025 | $464 million | 46% |

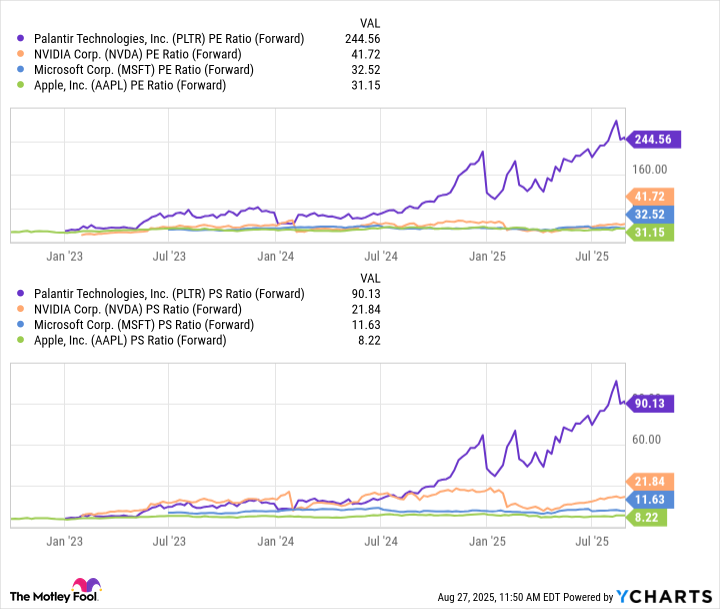

Yet the valuation looms-a grotesque, grinning specter. A forward price-to-earnings ratio of 243, a price-to-sales ratio near 90: these are not figures but accusations. Analysts murmur of “overcrowded” trades, of a stock that might collapse under its own momentum. JPMorgan’s Dubravko Lakos-Bujas, that Cassandra of the markets, warns of a second-half reckoning. But what is risk to those who have already sold their souls to the algorithm?

Palantir’s stock is not for the faint of heart. It is for those who understand that in the modern market, one does not invest in companies but in inevitabilities. To purchase shares is to acknowledge that the labyrinth has no exit, only deeper corridors. Yet within this maze, Palantir offers a perverse comfort: a partner in the chaos, a mirror to the absurdity. The trader who buys now does not seek profit so much as absolution. 🕳️

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2025-08-31 02:16