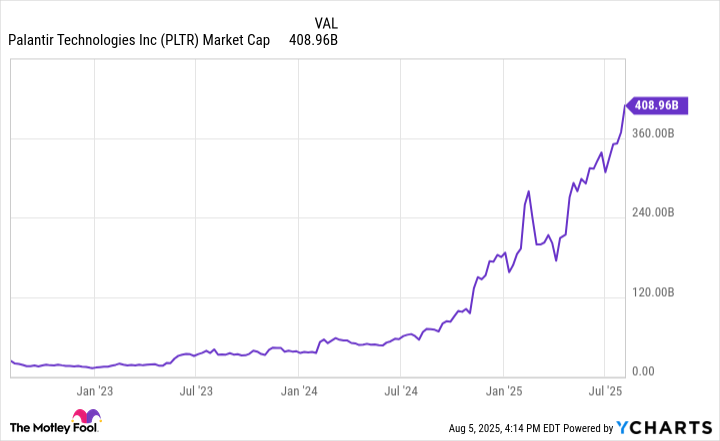

Palantir Technologies (PLTR), like a runaway locomotive with no brakes, just keeps chugging along faster than most folks’ minds can follow. Their latest earnings report for the third quarter was like a shot of bourbon straight to the arm-sending the stock climbing higher than a squirrel in a pecan tree. In the grand ol’ game of the S&P 500, Palantir’s stock has exploded this year-up 128%, which sounds just about natural if you believe everything you hear-except that it’s also shot up 600% over the last twelve months, making it the poster child for Wall Street’s delirium.

Before the numbers rolled out, I took a moment to consider three vital gauges-revenue growth, customer expansion, and the company’s backlog-like a good old boy eyeing a new tractor. And wouldn’t you know it, Palantir outperformed expectations on all fronts, which is just fancy talk for “they’re doing better than the folks with the calculators thought they would.” No wonder the share prices are pushing new all-time highs-like a gambler convinced he’s found the fountain of youth.

Now that the dust has settled, I reckon it’s high time we peek behind the curtain again. Should investors be hollering “Buy, buy, buy!” or “Hold your horses,” or maybe just wait like a prudent farmhand till the storm blows over? The truth is, the curtain’s still drawn, and it pays to know what’s really going on beneath.

Palantir’s Stand in the Big Leagues

Palantir’s platform is the kind of fancy machinery that puts a man in the driver’s seat of a riverboat-only instead of piloting on water, they’re steering through the chaos of data like a seasoned captain. Their Gotham platform, used by folks in uniform and government alike, processes satellites and secret sources faster than a town crier shouting bad news. It’s the same outfit that helped find Osama bin Laden-one of those stories where you’d think the whole world was built for such espionage. Under the Trump administration, they’ve been pushin’ into Homeland Security, the State Department, the FAA, and even the CDC-seems like they’re trying to run the whole federal show from behind the curtain.

“With focus, execution, and little patience for nonsense, Palantir’s destined to be the software king of tomorrow, and the world’s finally waking up to that fact.”

Why You Might Want to Hightail It Outta There

Now, don’t get me wrong-I’m a fan, but even a blind hog finds an acorn now and then. Their valuation’s enough to scare a rat out of a eel. P/E ratios of 777 and a forward of 307? That’s like betting the farm on a three-legged mule and calling it a racehorse. They’re reinvesting so fiercely they forgot about profits, and markets like reasonable shoes-if you keep overpuffing the value, eventually the air runs out. Adjusting for sales, if they keep growing-say, 40% next year-they’ll hit about $4.4 billion in revenue, which might translate to a market cap nearly $470 billion. But that’s only an 18% upside if you’re feelin’ patient-just a tidy little pile, considering how wild they’ve already been.

If the market’s honest-though honesty’s rare these days-the valuation should return to earth or the stock’s price will stay bloated until the cows come home. Riding this roller coaster for more than a year past six hundred percent gains? Reckon I’d likely be the one to step off and take a cooler position. Greed is a mighty tenant in the city of Wall Street, but fools rush in where wise men fear to tread.

Playing the Waiting Game

Here’s the real trick: sit tight, don’t go chopping your investments like a butcher at market day. Most folks lose money trying to outsmart the market’s winds, and as Warren Buffett smartly advises, patience often pays in the end. If you’re convinced Palantir’s a good horse, there’s no shame in letting it nibble at your pasture while you wait for clearer signs.

The Last Word on the Matter

Me? I reckon I’ll take the middle road. The stocks’ momentum sings a siren song, yet the math-like an ornery old mule-whispers caution. I’m inclined to hold my position, recognizing that Palantir’s potential is mighty, but so is its price tag. If you got it cozy in a diversified pasture, this might be just the right time to trim a bit and rebalance-less chance of getting caught in the storm’s aftermath. After all, a wise man plants his crops while looking both ways, especially when the world’s spinning faster than a cat on a hot tin roof.

In the end, whether you wade in or step back, remember: it’s all a game of odds- and sometimes, the prudent man just waits for better days. 🌾

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- USD PHP PREDICTION

- 9 Video Games That Reshaped Our Moral Lens

2025-08-07 12:03