Has there ever been a stock in recent memory as beguiling as Palantir Technologies (PLTR), that digital siren whose song has lured investors into tempestuous seas? Three years past, its Artificial Intelligence Platform emerged like a phoenix from silicon ashes, and lo! Its shares soared thirteenfold—a spectacle rivaling Icarus himself.

Yet we must ask, with the solemnity of Tolstoyan introspection: does this ascent reveal prophecy or mere pyrotechnics? For while AI’s dominion expands—a colossus striding across boardrooms and war rooms alike—valuation ratios swell like the Dnieper in spring flood.

A Modern Prometheus Bound to Earth and Cloud

Palantir’s genius lies not in sorcery but synthesis. To governments it offers clarity amid chaos, transforming raw data into military campaigns or hospital logistics. To corporations, it whispers of efficiencies and golden insights, its tentacles reaching into 769 organizations—a modest number, yet each a Gulliver tethered to its Lilliputian data streams.

Consider the numbers as one might study autumn leaves: $3.1 billion in revenue, 45% growth in public contracts, 71% in commercial realms. The American landscape—both its bureaucratic forests and capitalist prairies—awaits cultivation. Yet herein lies paradox: the more fertile the soil, the heavier the harvest expectations.

The Ballad of Price-to-Sales: A Cautionary Air

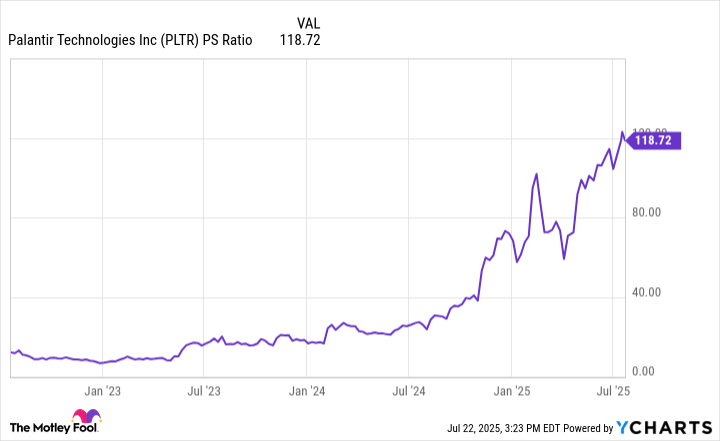

Behold the chart below—not of price, but of ratio. See how Palantir’s P/S ascends like a skylark fleeing terrestrial bonds. At 100x sales, investors bet on a future where data alchemists turn every byte into gold. Yet even Midas discovered limits to his touch.

Compare this to Snowflake’s Icarian flight or Nvidia’s measured waltz at 27x revenue. Palantir’s valuation now resembles a gothic spire—majestic, yet vulnerable to the first tremor in investor faith.

Three Years Hence: A Palimpsest of Possibilities

Let us imagine three futures, each written in fading ink:

- At 100x P/S: A $850 billion colossus, its shadow darkening Wall Street’s sun

- At 40x P/S: A humbled $340 billion entity, its wings clipped by reality’s hand

| Price-to-Sales Ratio | July 2028 Market Cap | Total Three-Year Upside or Downside |

|---|---|---|

| 100 | $850 billion | 137% |

| 90 | $765 billion | 113% |

| 75 | $637.5 billion | 78% |

| 60 | $510 billion | 42% |

| 40 | $340 billion | -5% |

These projections, dear reader, are but constellations in the financial firmament. Palantir’s growth may yet astonish—or falter like a candle in the wind. But when valuations ascend beyond the realm of reason, we enter the domain of tragedy rather than commerce.

In this grand theater of markets, where old titans clash with new phantoms, Palantir stands at a crossroads. Its story is not merely one of algorithms and APIs, but of human ambition writ large—a theme Turgenev himself might have woven into his tapestry of Russian souls. 🕯️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

2025-07-26 12:34