Palantir Technologies (PLTR) stands at the edge of a precipice. On August 4th, the company will release its quarterly earnings, a moment of truth not only for the firm itself but for the broader market, which has long held it in high regard. These reports—sought after by the avid investor like the rarest of vintages—are among the few sanctioned moments each year when the company opens its ledger and reveals the underlying realities of its operations. It is during these sacred sessions that the disconnect between market perception and the business’s actual output becomes most glaring, especially in the case of a company like Palantir.

As the date draws near, the expectations are colossal. But as with all things inflated, the question remains: Will these expectations be met, or will the gulf between promise and performance widen into an abyss?

Palantir’s Illusion of Strength

Palantir’s software, a mesh of data analytics and artificial intelligence, is not the latest revelation from the cryptic world of Silicon Valley. No, this is a tale that began over two decades ago, when Palantir, under the guise of government contracts, set out to transform raw data into actionable insight. Its crowning achievement—allegedly—was the intelligence that led to the final resting place of Osama bin Laden, a feat that cemented its place in the annals of espionage.

Though its genesis in government operations remains pivotal, Palantir has made a deliberate foray into the commercial sector. The results, while certainly notable, are not without their limitations. Still, it would be a fallacy to assume that Palantir’s reliance on government contracts spells stagnation. Quite the opposite. Despite a somewhat sluggish embrace of artificial intelligence in commercial sectors beyond the United States, the company’s government revenue for the first quarter of the year soared by a staggering 45%, compared to a more modest 33% growth in commercial sectors.

However, the company’s commercial AI adoption remains a sore point. While the U.S. has shown marked enthusiasm for these new technologies, Europe‘s uptake has been more languid, reflected in an underwhelming 33% increase in revenue from international commercial markets. Should Palantir’s August 4th report indicate any meaningful shift in this pattern, the stock may experience a brief but intense upward movement, driven by the fervor of traders who never miss an opportunity to bet on the next big thing.

The Illogical Leap: Valuation vs. Business Performance

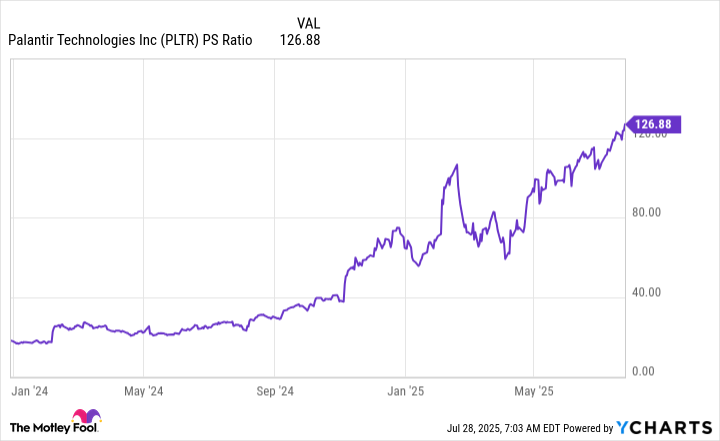

Yet here lies the crux of the matter: Palantir’s stock price has ascended to giddy heights in a manner that betrays its fundamental performance. A 39% growth in revenue for the first quarter of 2024 is, by any measure, respectable. However, in the shadow of an 800% increase in its stock price since the beginning of the year, this figure seems almost irrelevant—an afterthought. The market, seemingly unconcerned with the realities of the business itself, has propelled the stock to a valuation more than 125 times its revenue.

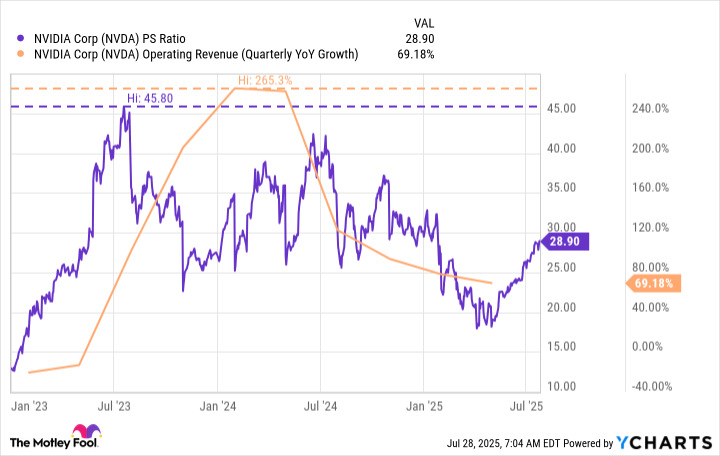

This leap in valuation, though ostensibly driven by the promise of Palantir’s advanced technology, flies in the face of reason. In comparison, Nvidia—a company that has witnessed a meteoric rise in revenue, with a staggering 265% year-over-year increase—never saw its stock trading at more than 46 times its sales.

In stark contrast, Palantir, despite promising a 38% growth rate for Q2, is priced as though it were experiencing a radical and sustained expansion. There is a dissonance here, a profound inconsistency between the company’s actual operations and the fervent valuation ascribed to it by the market.

This creates a rather precarious situation for Palantir’s stock. Should the earnings report fall short of investor expectations—already inflated to such an extent that reality itself seems an obstacle—the company’s stock may suffer a steep decline. Even should the report exceed expectations, the inevitable question will remain: can such a premium valuation be sustained? It is a question of values—both corporate and market-driven—and one that no answer will satisfy until the stock returns to a level of reasonability.

Indeed, Palantir’s current valuation is a fragile construct, built not on the firm foundations of consistent growth, but rather on the winds of speculative fervor. Should this speculative bubble burst, as bubbles inevitably do, the repercussions for Palantir’s stock could be swift and severe. While the company’s future may still be bright, there is no compelling argument to justify the current levels of hype surrounding its stock price.

So, we watch with bated breath as August 4th approaches. Will Palantir’s stock remain aloft, suspended by the sheer weight of its expectations, or will gravity—a force far less forgiving than any AI—bring it back down to earth?

📉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR Fate/stay night — best team comps and bond synergies

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-07-31 16:12