In the vast and often arid plains of the stock market, where dreams are sown with the seeds of ambition and watered by the sweat of belief, there rises a peculiar monument to human ingenuity-and hubris. By the closing bell on August 12, shares of Palantir Technologies (PLTR) had surged by 147% year to date, making it the crown jewel of the S&P 500 for two years running. But as the sun sets over this gilded landscape, one cannot help but wonder: is this ascent a beacon of progress or a mirage shimmering in the heat of speculation?

They speak of Palantir’s rise as though it were a force of nature, an unstoppable tide riding the crest of the artificial intelligence revolution. Skeptics wag their fingers at the lofty valuation, warning of echoes from the dot-com era when hope outweighed reason. Yet these warnings fall like leaves into a roaring river, carried away without heed. The stock climbs ever higher, defying gravity as if mocking those who dare question its trajectory.

But there is something more here, a whisper beneath the clamor, a subtlety that escapes even the keenest observers. If history teaches us anything, it is that great heights often precede great falls. And so, we must ask: Is now the time to step back, to shield oneself from the storm that may gather on the horizon?

A Valuation That Blurs the Line Between Vision and Folly

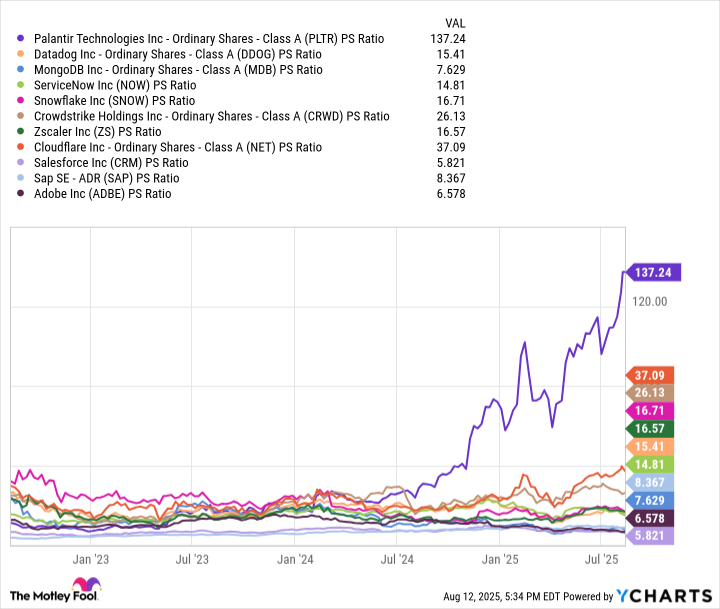

In the twilight days of the 1990s, companies were not judged by their earnings but by their allure. Amazon, Cisco, Microsoft, Alphabet, and others stood tall, their worth measured not in dollars earned but in clicks and glances. At the zenith of that fever dream, price-to-sales ratios soared between 30 and 40-a figure once deemed absurd. And yet, Palantir has taken this madness further still.

As of August 12, Palantir commands a market cap nearing $444 billion, eclipsing giants such as Salesforce, SAP, and Adobe. These are companies with roots deep in the soil of commerce, diversified and seasoned by time. Palantir, meanwhile, floats atop its own stratosphere with a P/S ratio of 137-a number that seems less a measure of value and more a hymn to unbridled optimism.

Some will tell you that traditional metrics fail to capture the essence of Palantir, that arcane formulas like the Rule of 40 reveal its true worth. They urge investors to look beyond the numbers, to see potential where others see peril. But beware the siren song of complexity, for it often masks simplicity’s truth. There is another metric, quieter and more damning, that whispers of danger ahead.

The Silent Language of Institutions

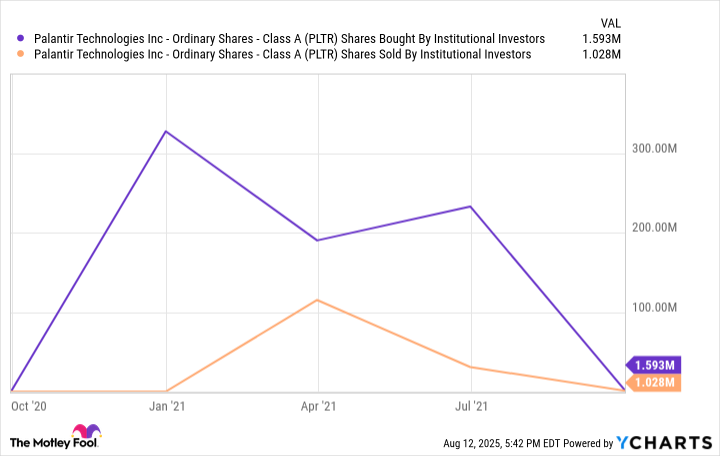

Behold the chart below, a map of institutional activity since Palantir’s initial public offering in late 2020. It tells a tale of ebbs and flows, of early enthusiasm followed by retreat, then resurgence. This dance of buying and selling speaks volumes, though few care to listen.

Institutions-the so-called “smart money”-are not immune to the pull of profit, nor are they bound solely by conviction. Many hold stocks not because they believe in their promise but because they must, to meet benchmarks and obligations. When a stock grows too large within a portfolio, they trim it, rebalancing as duty demands. It is a quiet act, almost invisible, yet it carries the weight of inevitability.

Loading…

–

In the video clip above, mutual fund titan Ron Baron recounts his obligation to take profits, even in his most cherished holdings. Such is the fate of those caught in the whirlwind of speculation: institutions sell high, leaving retail investors to bear the brunt when the winds shift. It is a cycle as old as markets themselves, a tragedy repeated with each new generation.

The Echoes of History

History does not dictate the future, but it hums a tune we would do well to recognize. While no man can predict the precise moment to exit the stage, there are signs-subtle, perhaps, but undeniable-that suggest Palantir’s journey may be nearing a crossroads. The bulls roar confidently, blind to the gathering clouds, while the skeptics watch silently, waiting for the reckoning.

And so, dear reader, I leave you with this thought: tread carefully in these treacherous lands, where fortunes are made and lost with the turning of a tide. For every ascent, no matter how grand, carries within it the seed of its undoing. 🌌

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-16 19:32