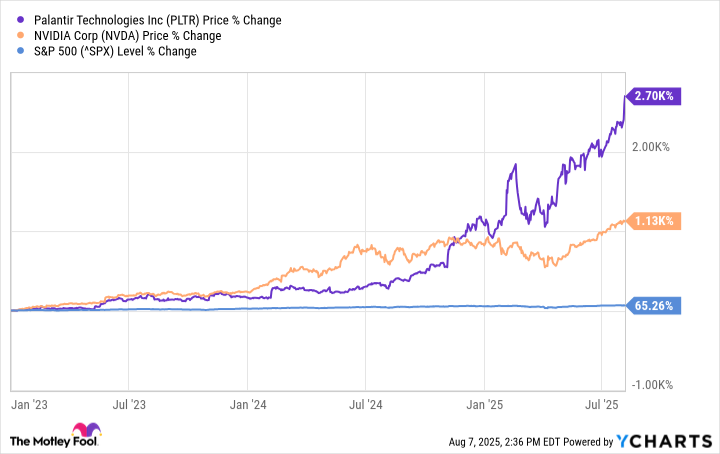

In an age where artificial intelligence has ascended to the altar of modern industry, Palantir Technologies has emerged as both prophet and profiteer. One might almost admire the company’s meteoric rise were it not for the faint scent of overcooked financings wafting through its stock price. For the investor with a taste for caution-and perhaps a dash of irony-the spectacle is as instructive as it is disquieting.

Where Palantir’s financials stand

The company’s Artificial Intelligence Platform, that most modern of alchemical tools, has worked wonders on the balance sheet. One might almost believe the U.S. government and its corporate sycophants have discovered a new form of currency more valuable than gold. Revenue figures for the second quarter read like the ledger of a Victorian railway baron: $733 million in U.S. revenue, with the commercial segment tripping along at 93% year-over-year growth. It is a performance that would make Dickens’ Mr. Bumble weep into his corned beef.

Yet for all this numeric grandeur, there lingers a peculiar asymmetry. The government segment, though slower, remains the elder statesman of the family, while the commercial arm flails about in gilded rags. One imagines the boardroom at Palantir to be a parlor of magicians, each pulling rabbits from hats labeled “contract value” and “total sales.” The $843 million in U.S. commercial total contract value, up 222% year-over-year, is a feat that borders on the miraculous-or perhaps the delusional.

And then there is the matter of operating income. From a mere $4.1 million in Q1 2023 to $269 million in the recent quarter, one might suppose Palantir has discovered a new law of economics: that profits can be conjured like dervishes in a desert. Yet such feats, while impressive on paper, often precede the kind of reckoning that leaves investors clutching their portfolios like children clutching a deflated balloon.

Here’s why I would avoid Palantir stock right now

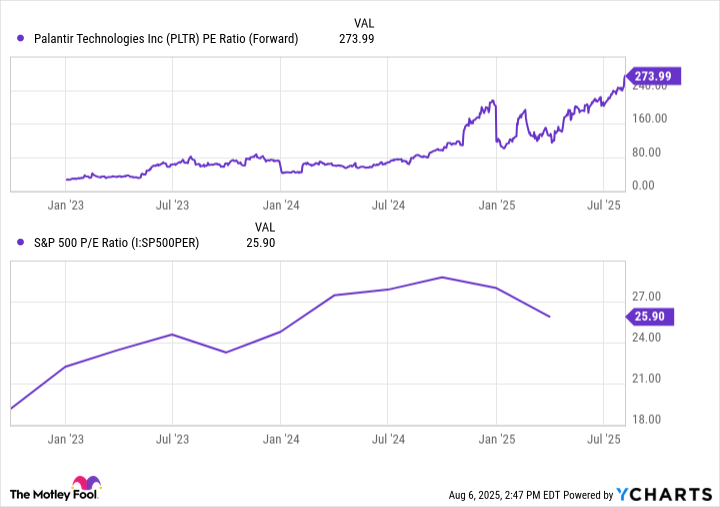

The stock’s valuation, however, is a different beast entirely. At 274 times forward earnings, it is as if the market has decided to price Palantir not on its merits but on the hope that gravity itself will one day forget to exist. Compare this to the S&P 500’s modest 26 times forward earnings, or even Nvidia’s already exorbitant 41 times, and one is left to wonder if Palantir’s shareholders have all been reading the same financial manual-or perhaps a different language altogether.

The price-to-sales ratio is equally absurd. At 132 times sales, the stock is not merely expensive-it is a monument to hubris, a Gatsby-esque edifice built on sand and speculation. One might as well buy a ticket to Mars on the premise that aliens will soon be investing in stock options. The disconnect between Palantir’s financial reality and its market price is so stark it borders on the surreal, like watching a man in a top hat claim to have tamed the wind.

To own Palantir at this juncture is not necessarily to commit folly, but to initiate a position now is to dance on a tightrope without a net. The market, that most fickle of partners, may yet waltz away, leaving investors to stumble into the abyss. The February sell-off, which saw the stock shed a quarter of its value in a mere seven days, is a reminder that even the most resplendent castles can crumble under the weight of their own grandeur.

For those with the fortitude-and perhaps the masochism-to believe in Palantir’s long-term narrative, dollar-cost averaging might offer a pragmatic shield against the market’s capricious whims. Yet even this strategy feels like betting on a horse that has already collapsed at the finish line. The prudent investor, one suspects, would do well to observe from the sidelines, sipping tea and murmuring wryly about the follies of the age. 🎩

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2025-08-08 15:12