A sector undergoing rapid change due to the increasing influence of Artificial Intelligence is the field of business software, often referred to as enterprise software.

In contrast to cloud computing giants like Microsoft, Amazon, and Alphabet who’ve gained significantly from new AI services, two other software companies have become popular choices among stock market investors. This popularity is largely due to their wide range of applications they offer, providing investors with a more comprehensive investment opportunity compared to the specialized businesses provided by major tech firms.

By the end of trading on July 17th, the stocks of Palantir Technologies (PLTR) and BigBear.ai (BBAI) have surged by an impressive 104% and 85%, respectively, in the year to date. However, I’d advise investors not to jump on this momentum bandwagon without careful consideration.

Let’s dive into understanding Palantir versus BigBear.ai by examining their financial and operational profiles side-by-side, with a focus on the Rule of 40. Are you ready to explore this exciting comparison?

What is the rule of 40 in SaaS?

Beyond common financial indicators like revenue, gross profit, and net earnings, businesses in various sectors may employ specialized measures to provide investors with a clearer picture of the company’s wellbeing. For instance, software-as-a-service (SaaS) enterprises might utilize non-standard accounting metrics such as Annual Recurring Revenue (ARR) or the Rule of 40 to supplement their financial reports on income or cash flow statements.

In simpler terms, the Rule of 40 is calculated by combining a company’s growth rate in revenue and its free cash flow as a percentage. Typically, Software-as-a-Service (SaaS) businesses aim to surpass a total score of 40%.

The Rule of 40 is a helpful guide for evaluating Software-as-a-Service (SaaS) businesses, but it’s important to note that it comes with certain subtleties.

Initially, certain businesses may opt for alternative profit-related indicators like operating income ratio or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) ratio rather than Free Cash Flow. Furthermore, these companies might manipulate non-Generally Accepted Accounting Principles (GAAP) figures such as EBITDA and Free Cash Flow by incorporating adjustments like stock-based compensation in their computations.

While the Rule of 40 might not be as infallible as conventional valuation indicators like Price-to-Sales (P/S) or Price-to-Free Cash Flow (P/FCF), it remains a valuable resource for comparing different Software-as-a-Service (SaaS) businesses in a broader sense.

Comparing Palantir and BigBear.ai across the Rule of 40

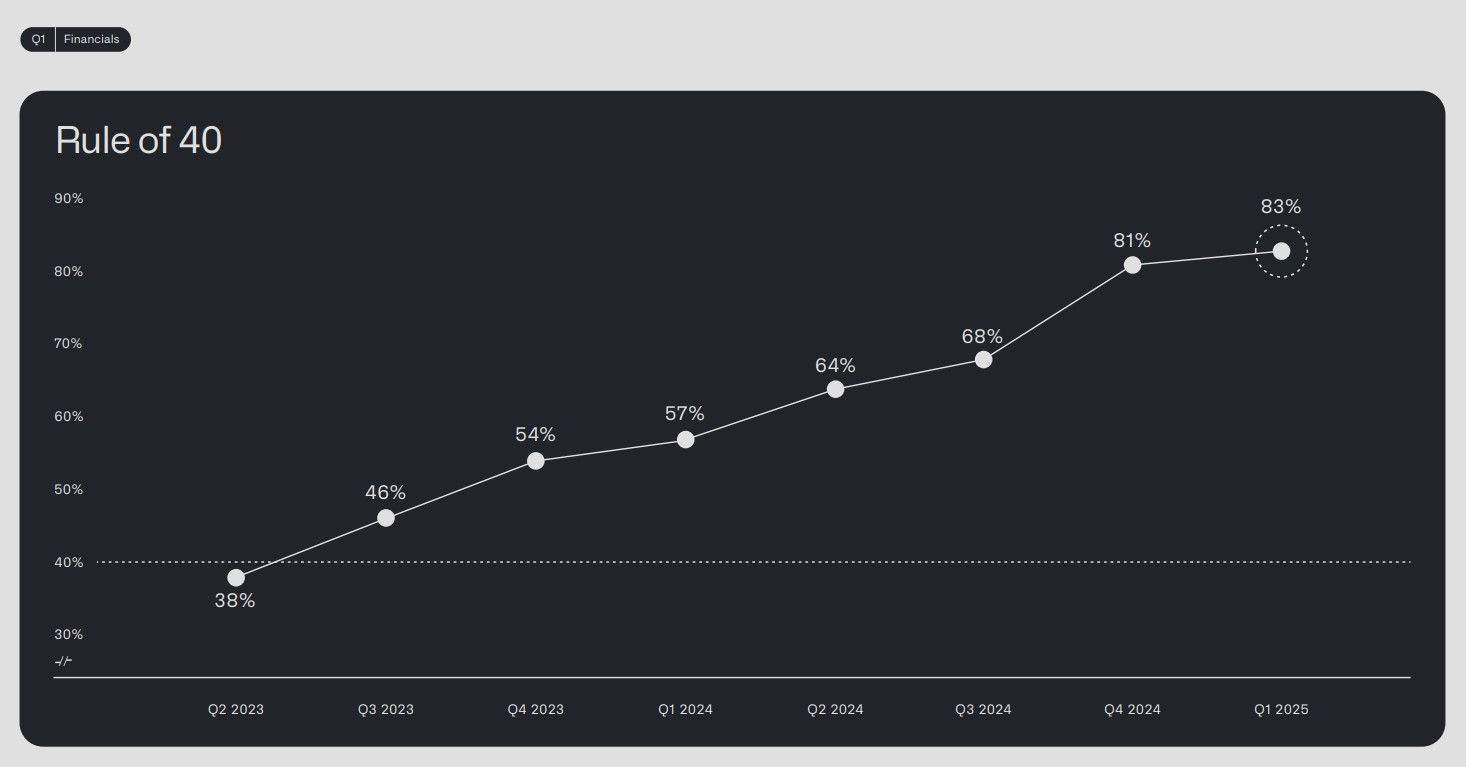

One advantage of Palantir’s financial reporting is that it offers investors insights into non-traditional metrics, like the Rule of 40. After the first quarter, Palantir reported a Rule of 40 score of 83%, which was calculated by combining their revenue growth rate (39%) and adjusted operating income margin (44%).

Here, I’ve provided the key financial details from the first quarter to determine BigBear.ai’s Rule of 40 score.)

| Financial Figure | $Amount |

|---|---|

| Revenue ($) | $34.8 million |

| Revenue growth rate (%) | 5% |

| Free cash flow ($) | ($8.3 million) |

| Free cash flow margin (%) | (24%) |

| Adjusted EBITDA ($) | ($7 million) |

| Adjusted EBITDA (%) | (20%) |

| Rule of 40 (free cash flow margin) | (19%) |

| Rule of 40 (adjusted EBITDA margin) | (15%) |

What’s the verdict?

From the breakdown provided, it’s clear that despite using enhanced EBITDA numbers, BigBear.ai’s Rule of 40 ratio still falls significantly short of 0%. In contrast, Palantir’s Rule of 40 score has experienced a substantial rise, more than doubling over the last two years.

In my view, these trends reveal a more significant underlying story. The continuous enhancement of Palantir’s Rule of 40 score indicates that the company is reaping substantial success from its AI platforms, Foundry and Gotham, in a clear sense. However, BigBear.ai’s entry into the AI market has not brought the same financial rewards this is evident in modest revenue growth and an uncertain road to profitability, casting doubt on its potential as a wise investment choice in the long run.

From my perspective, BigBear.ai’s increasing stock value might stem largely from an optimistic market trend related to certain sectors it operates in, especially defense technology. This sector is currently where Palantir holds significant influence. Essentially, some investors may be anticipating that if Palantir thrives, then BigBear.ai could mirror the same growth path. However, it’s crucial to remember that success stories don’t always repeat themselves in real life. Furthermore, relying on hope as an investment strategy is generally unwise.

Palantir significantly outperforms BigBear.ai in terms of growth and profitability. From my perspective, Palantir stands head and shoulders above the other emerging AI software companies.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2025-07-24 01:31