Okay, let’s talk about Palantir (PLTR +0.33%). It’s been a few months where owning this stock felt a bit like wearing Crocs to a gala. Understandable. The valuation is…ambitious. We’re talking about a company trading at roughly 200 times what it’s expected to earn this year. It’s like paying for a lifetime supply of avocado toast based on a really good Instagram photo. And everyone’s whispering about an AI bubble, which, let’s be honest, is always a fun thing to hear when you’re holding a stock like this.

But here’s the thing: the new year’s arrived, and the robots haven’t taken over just yet. So, there’s a chance Palantir’s stock might perk up. If it does, it won’t be because of magic. It’ll be because people finally understand what this company actually does. And that’s a surprisingly tricky thing to explain, even to other adults.

Not Reinventing the Wheel (Just Making it Really, Really Complicated)

Developing AI platforms for clients ranging from AT&T to Novartis to the Department of Defense is…a process. It’s not like downloading an app. It’s more like building a spaceship. Expensive, time-consuming, and requires a lot of people in hoodies. But once you have the spaceship, getting it to fly to a new planet is relatively easy. That’s the Palantir model. The more clients they add, the more profitable things become. It’s basic leverage, really. Like realizing you can wear the same blazer to three different work events.

We’ve seen glimpses of this in their recent earnings reports. Last quarter, revenue jumped 63% to $1.18 billion. Costs only grew 42%. Operating expenses? A modest 25%. The result? Operating income tripled. Net income doubled. (A slightly larger tax bill was the only real drag. The government always finds a way, doesn’t it?)

In short, the company seems to be at a tipping point. A financial one, not an existential crisis about the meaning of algorithms. Yet.

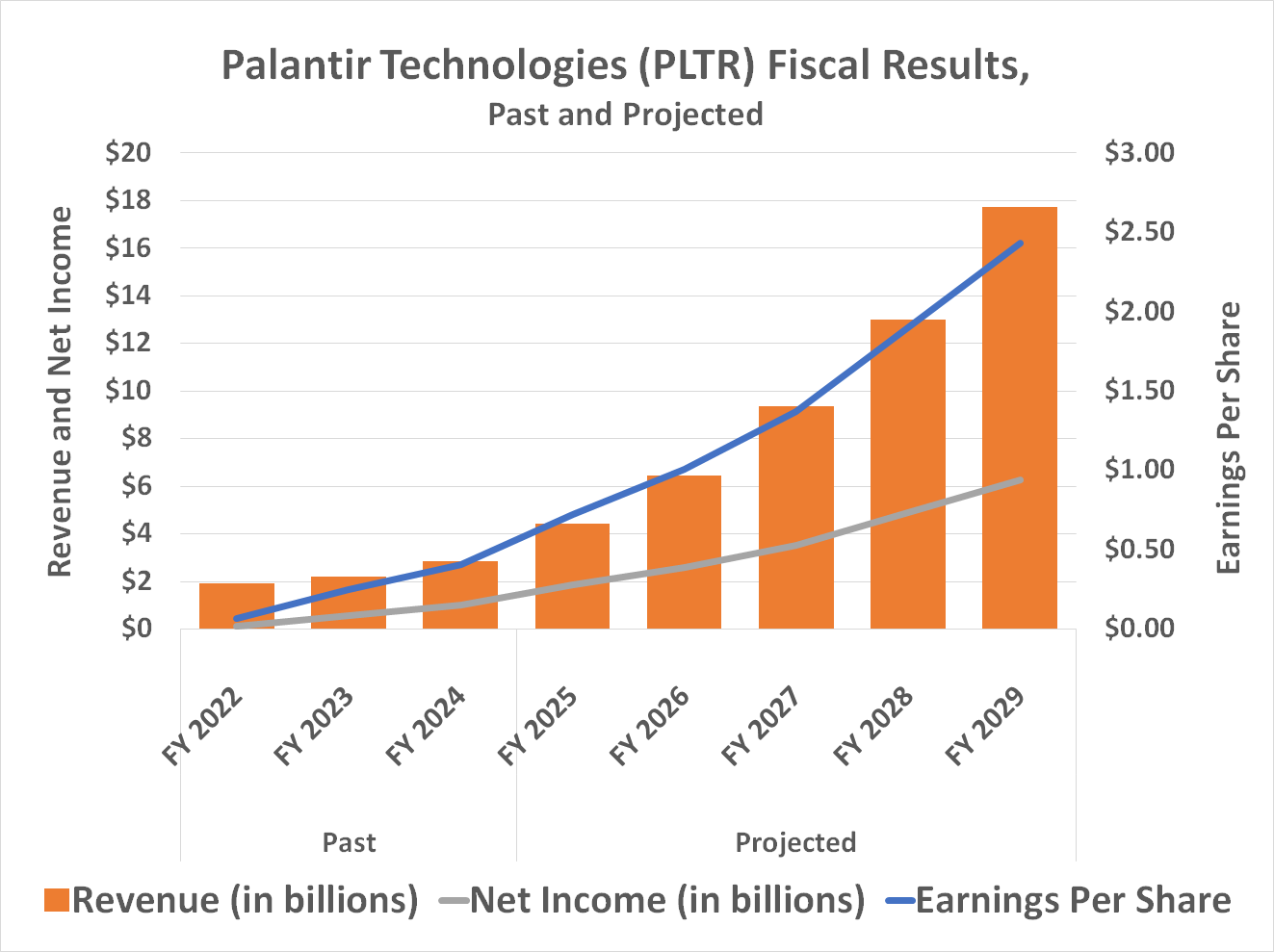

Analysts seem to agree. They’re predicting revenue will keep growing, but profits will grow even faster – from an estimated $0.72 per share this year to a lofty $2.21 in 2029. Which, let’s be real, is a long time from now. I’m pretty sure my toaster will be obsolete by then.

Clear Hope is Enough (For Now)

This doesn’t magically solve the valuation problem. Palantir trades at 112 times trailing sales and 172 times projected 2026 earnings. Investors were willing to ignore that for a while, focusing on the “compelling story.” But time marches on, and eventually, you have to ask yourself if this company will actually grow into its current market cap. It’s like buying a timeshare in a place you’ve never been.

Palantir doesn’t need to do that overnight. It just needs to demonstrate that its profit margins will improve enough to justify the premium. It’s a simple equation, really. Except for the fact that it involves complex algorithms and a lot of very smart people who probably haven’t slept in days.

It’s still speculative, sure. But there’s a good chance investors will recognize that improving margin trajectory in 2026 and, as a result, light a fire under the stock price. It’s a gamble, like ordering the sushi from the gas station. Risky, but sometimes, you just have to go for it.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-22 20:12