The year, as these things are wont to do, has begun rather badly for both Palantir and Microsoft. Microsoft, a solid, if somewhat predictable, concern, has suffered a decline of nearly twenty per cent. Palantir, meanwhile, has fared worse – a plunge exceeding twenty-five per cent. One might expect, given their recent performance, a certain degree of investor displeasure. The curious thing is, when one consults the oracles of Wall Street, the matter remains distinctly unclear.

Which, one is compelled to ask, is the lesser of the two evils? Let us, with a sigh, attempt to discern some pattern in the prevailing madness.

The Analysts’ Prophecies

According to Yahoo! Finance – a source one approaches with a necessary degree of skepticism – the consensus price target for Microsoft stands at $596, a considerable distance from its current $400. A forty-nine per cent upside, they assure us. If these gentlemen are to be believed, it’s practically a gift. Palantir, too, enjoys similar optimism. Trading around $130, the analysts foresee a rise to $190 – a forty-six per cent improvement. It’s entirely possible, of course, that Palantir might, on any given day, exhibit a more spirited ascent. The market, after all, is a caprice.

The truth, as always, is more elusive. The potential, at least according to the aforementioned soothsayers, is roughly equivalent. However, a crucial distinction emerges. Microsoft enjoys near-universal approval. The lowest price target, a mere $392, is scarcely below the current valuation. Palantir, on the other hand, divides opinion. The low end of the spectrum plunges to $70 – a precipitous drop that suggests a rather gloomy prognosis. Why this disparity? It is a question that demands consideration.

The Premium of Expectation

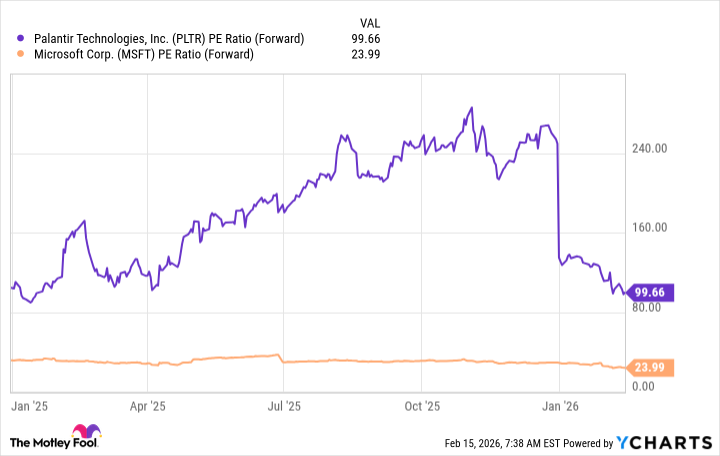

Palantir, it must be said, trades at a rather extravagant premium. A forward price-to-earnings ratio that would make a Medici blush. Yet, it also boasts a rate of growth that is, undeniably, impressive. This combination breeds uncertainty. Some investors cling to traditional metrics, while others are captivated by the allure of rapid expansion. It is a conflict of ideologies, played out on the ticker tape.

Valuing a company that thrives amidst the current technological upheaval – generative artificial intelligence, no less – is a near-impossible task. Especially when it has recently experienced a seventy per cent increase in revenue. Management, predictably, anticipates further growth. Microsoft, in contrast, has enjoyed a mere seventeen per cent increase. A perfectly respectable figure, certainly, but lacking the same dramatic flair. Investors, accustomed to such modest gains, find it easier to assess the value.

Palantir’s ratio hovers around one hundred times forward earnings. Microsoft, a comparatively modest twenty-four. Is it justifiable to pay four times as much for the same expected earnings? This, ultimately, is the crux of the matter.

Microsoft, in my estimation, is the more sensible investment. While Palantir’s growth is undeniably impressive, it is not, alas, sufficient. If Microsoft maintains its seventeen per cent growth and Palantir continues at seventy per cent, and these metrics scale accordingly, it will take approximately four years for their forward earnings ratios to converge. Assuming, of course, that these rates persist. Sustaining such a pace is not impossible, but it is, to put it mildly, ambitious. It is not unreasonable to expect that Palantir’s growth will eventually decelerate, and that the gap will widen. Is a four-year premium truly warranted? Perhaps for the patient investor, willing to endure the inevitable volatility. But for those of a more cautious disposition, Microsoft offers a far more secure, and frankly, less exhausting, proposition.

One might say, in the current climate, that it is a phenomenal bargain.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- Elden Ring’s Fire Giant Has Been Beaten At Level 1 With Only Bare Fists

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- HSR Fate/stay night — best team comps and bond synergies

2026-02-19 16:12