So, Palantir. $40 billion market cap. Forty billion. It’s all the rage with the AI crowd, apparently. They’re throwing money at this thing like it’s going out of style. And for what? Because they can sift through data? Everybody sifts through data. I sift through junk mail, and I don’t need a fancy platform for that. They say it’s for the military, for “actionable insights.” Actionable insights. What does that even mean? It sounds like something you’d order at a diner. “I’ll have the actionable insights, please.”

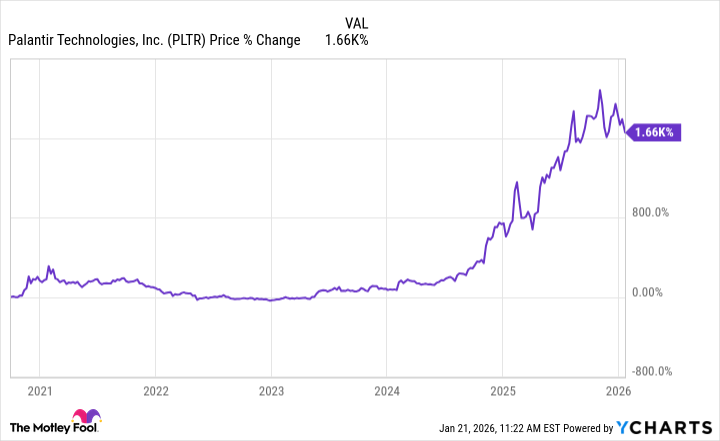

The stock jumped 1700% since the IPO. 1700%! That’s… a lot. It’s practically begging for a correction, isn’t it? You see that kind of run-up, you just know something’s going to give. And these analysts… they’re all talking about “multibagger growth.” Multibagger. It’s like they’re trying to invent new words just to justify the hype. I mean, can’t they just say “good growth” anymore? Is that too simple?

What’s the Big Deal, Really?

Okay, so they take a bunch of unstructured data – which is just a fancy way of saying “messy information” – and they find patterns. Fraud patterns, operational trends… it’s like being a detective, but with computers. And now they’re layering on this generative AI stuff. “Synergies,” they call it. Synergies. It’s a corporate buzzword designed to obscure the fact that they’re just adding more complexity to an already complicated process. I tried to use one of these AI interfaces the other day. It asked me to “optimize my data journey.” My data journey? I just want to find my bank statement!

They’re working with Israel and Ukraine, apparently, targeting assets and removing mines. Look, I’m not questioning the importance of that work, but it feels… precarious, doesn’t it? You get involved in international conflicts, you’re asking for trouble. And then you have Peter Thiel, the co-founder, backing Trump. It’s a whole mess. You’d think they’d try to keep a lower profile. But no, they have to stir things up.

This Artificial Intelligence Platform they released… suddenly everyone is paying attention. It’s like they needed a new name to make people realize they were doing something different. It’s the same data, the same algorithms, just a different label. Marketing, pure marketing.

Business is Booming… Apparently

Third-quarter earnings were up 63%. Okay, fine. But it’s the U.S. commercial business that’s really driving the growth, up 121%. So, they’re shifting away from government contracts to private sector clients. Smart move, I guess. Less scrutiny, more money. But it also means they’re relying on companies that are obsessed with efficiency gains. Which means they’re going to squeeze every last penny out of this platform. And what happens when they decide it’s not worth it anymore? They’ll move on to the next shiny object.

The advantage is that the private sector has more money. The disadvantage is that they’re also more fickle. And let’s not forget the political risk. Tesla, Target, Anheuser-Busch… they’ve all learned the hard way that getting involved in political debates is a recipe for disaster. Palantir is practically begging for a boycott.

And then there’s the competition. Microsoft Fabric, Snowflake… these companies are all vying for the same pie. Palantir hasn’t even created its own large language models! They’re just layering AI on top of existing infrastructure. It’s like putting a spoiler on a Yugo. It might look fancy, but it’s still a Yugo.

The Next Ten Years? Good Luck.

The P/E multiple is 170. 170! They’re pricing in perfection. Investors are betting on continued growth, and that’s… optimistic, to say the least. Over a decade, maybe they’ll be right. But in the short term? I’d wait for a pullback. A significant pullback. Maybe then, just maybe, it’ll be worth a look. But honestly? I have a feeling this whole thing is going to end badly. It always does.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-25 08:13