The current enthusiasm for artificial intelligence, as an investment proposition, is beginning to resemble a fever dream. Many believe we are witnessing a bubble, inflated by hope and a disregard for fundamental value. While a sudden collapse is not a certainty, a more refined assessment is required. It is not a question of if valuations will correct, but when, and which companies will suffer the most.

The situation is paradoxical. Some companies involved in AI – those providing the necessary hardware, for instance – are not unreasonably priced. They trade at multiples comparable to other established technology firms. However, certain companies focused on applying AI – particularly those not yet accessible to public investment – command valuations that defy logic. This disparity is crucial. It suggests that the market is not irrationally exuberant across the board, but selectively so.

One company, trading on public markets, has become a frequent target for those anticipating a correction: Palantir (PLTR +2.23%). The stock attracts attention, and not of the commendatory sort. The question is not whether Palantir is a bad company, but whether its price reflects a realistic assessment of its future prospects.

The Business of Prediction

Palantir specializes in data analytics software powered by artificial intelligence. The core idea is to gather information from multiple sources and present it in a manner that allows users to make informed decisions. They have even ventured into automating those decisions using generative AI. Originally serving government clients, Palantir has expanded into the commercial sector. This expansion is often touted as evidence of the company’s strength.

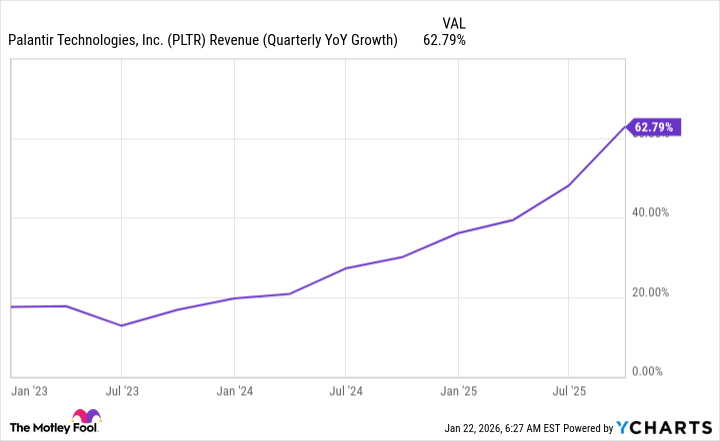

Both government and commercial clients have indeed adopted Palantir’s software with some rapidity. Revenue growth has been substantial.

This growth, on the surface, appears impressive. However, a prudent investor does not base decisions on revenue alone. One must consider the price paid for that revenue.

The Cost of Anticipation

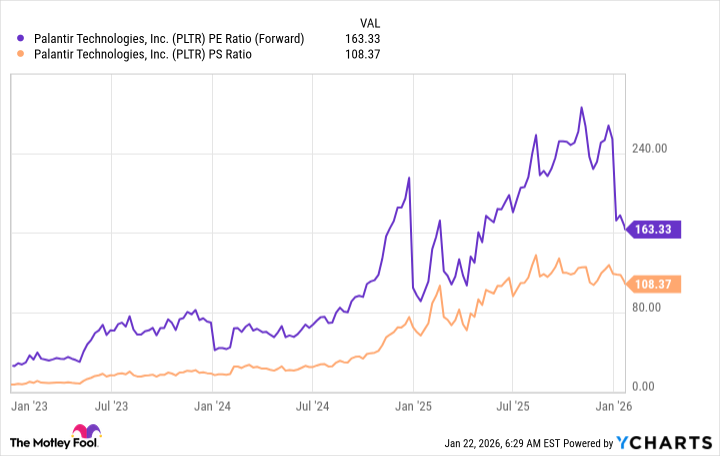

Palantir’s performance comes at a considerable cost. While many software companies trade at multiples of 10 to 20 times sales, with some reaching 30, Palantir has surpassed even these levels.

The stock trades at nearly 110 times sales. It is also profitable, allowing the use of the forward price-to-earnings (P/E) ratio. At over 160 times forward earnings, it is among the most expensive stocks currently available. This is not merely a high valuation; it is a declaration of faith in future growth that may prove unfounded.

Such a valuation leaves little margin for error. If revenue growth decelerates – as Wall Street analysts predict, with a decline from 54% in 2025 to 43% in 2026 – the stock is likely to suffer a significant correction. It is a speculative venture, reliant on continued, exceptional growth, and therefore carries substantial risk.

Shorting the stock, while tempting, is not advisable. The market has a disconcerting habit of rewarding irrational exuberance for longer than reason dictates. A more sensible approach is simply to avoid Palantir altogether. There are numerous other AI companies offering genuine value, and more importantly, offering a reasonable prospect of delivering a return on investment without relying on a sustained, improbable surge in growth. For those seeking income, and a degree of stability, Palantir is, quite simply, not an option.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- DOT PREDICTION. DOT cryptocurrency

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-01-25 15:33