In the waning months of 2024, I ventured a prediction – a rather bold, perhaps foolish one, now it seems – that the shares of Palantir Technologies would descend from their precarious heights in the year to come. The market, as is its wont, has delivered a stinging rebuke. A 135% ascent in 2025! If any followed my counsel and relinquished their holdings, I offer no saccharine apologies, merely a weary observation. The core of my apprehension remains, a gnawing disquiet. Palantir’s valuation… it is still a phantom, a specter haunting the rational investor.

I underestimated a subtle, yet pervasive force, a contagion of belief. It is a phenomenon not entirely divorced from the fever dreams of humanity, and it demands consideration. The market, after all, is not a ledger of cold calculation, but a collective delirium.

The Allure of the Oracle

Palantir constructs software – a digital labyrinth, if you will – that purports to distill clarity from chaos, to grant its users a glimpse of the future before it unfolds. Initially forged in the crucible of governmental necessity, it has now insinuated itself into the commercial realm, promising similar revelations to those who can afford its exorbitant price.

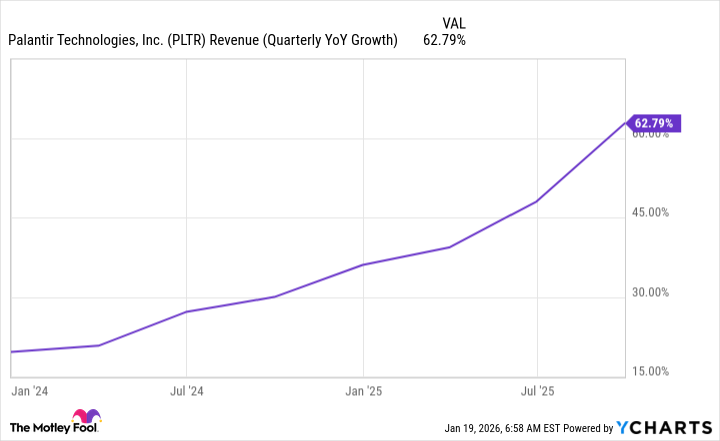

The company experienced a flourish in 2025, its revenue ascending with an unsettling consistency. One cannot deny the potency of its offering, the seductive promise of predictive power. But herein lies the danger. We are all susceptible to the allure of the oracle, to the belief that we can, through technology, conquer the inherent uncertainty of existence.

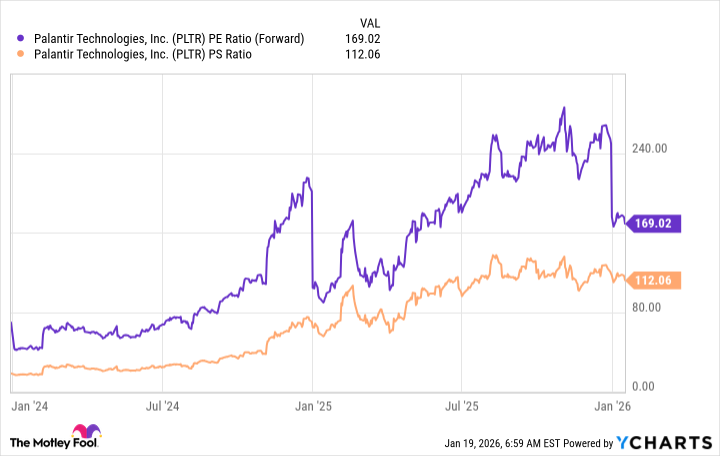

I confess, I harbor a certain admiration for Palantir’s ingenuity, its relentless pursuit of technological dominion. Yet, it is the stock that troubles me, not the enterprise itself. The two have become tragically estranged, divorced from the grounding principles of value. A price-to-earnings ratio of 169? A price-to-sales ratio of 112? These are not metrics; they are acts of faith, bordering on the heretical. A precipitous fall awaits, should the engine of growth falter, but the market, in its irrational exuberance, seems determined to ignore the gathering storm.

The first tremor, the first sign of decelerating revenue, will unleash a torrent of regret. The sell-off will be swift, brutal. But will it be of the magnitude I anticipated? Perhaps not. The market, like a wounded beast, is capable of surprising resilience.

The Weight of Individual Conviction

Palantir shares a peculiar kinship with another company, a similarly enigmatic entity that defies conventional valuation: Tesla. Both are fueled not by earnings, but by belief. A significant portion of their shares reside not in the hands of institutional investors, the pragmatic custodians of capital, but with individual speculators, dreamers, and zealots. These are the ones who cling to their holdings, even in the face of overwhelming evidence, driven by a messianic faith in the future.

The established titans – Alphabet, Microsoft – have the majority of their shares anchored by institutional ownership – 78% and 73% respectively. Palantir and Tesla, however, are held by institutions at a mere 56% and 48%. This explains, in part, the seemingly gravity-defying ascent of their valuations. It is a testament to the power of collective delusion, a chilling reminder that markets are not governed by logic, but by the fickle whims of human emotion.

Thus, I maintain my conviction: Palantir’s stock remains overvalued, a precarious edifice built on shifting sands. A correction will come. But if it does not, if the stock continues its relentless climb, I will not be entirely surprised. The market, after all, is a force of nature, and its currents are often unpredictable, resistant to reason. One can only observe, with a mixture of apprehension and morbid fascination, as the drama unfolds.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-23 00:52