Artificial intelligence, darling. It’s everywhere, isn’t it? One simply can’t turn around without tripping over another breathless pronouncement of its impending world domination. A perfectly tiresome state of affairs, really. And, naturally, the market has decided to have a little fun with it all.

Palantir Technologies, you see, has been rather enjoying the spotlight. A company that seems to believe it’s cracked the code, and, for a time, the market agreed. A rather spectacular ascent, I must say – almost vulgar, really. A 1900% rally? Good heavens. It added a perfectly preposterous $300 billion to its valuation. One begins to suspect the accountants were having a giggle.

But, as anyone with a modicum of sense knows, what goes up must, eventually, come down. And down it has. A 37% correction from its peak. Some are viewing it as a ‘buying opportunity’. Bless their optimistic hearts. I suspect a more… measured assessment is in order.

A Moat, Perhaps, But Is It Wide Enough?

Palantir, undeniably, possesses a certain… robustness. Its Gotham and Foundry platforms – rather clever names, I admit – are doing rather well. Gotham, in particular, seems to be keeping the American government exceptionally well-informed. One imagines that’s a service for which they’re eternally grateful. And Foundry, while newer, is attracting commercial clients at a respectable pace.

The lack of direct competition is, of course, advantageous. It allows them to charge a premium, and that’s always a delightful position to be in. But a lack of competition can also breed complacency. One hopes they’re not resting on their laurels.

The problem, you see, isn’t the company itself. It’s the market’s… enthusiasm. It’s taken to valuing Palantir as if it were a cure for boredom, rather than a software company.

History, That Stern Teacher

We’ve seen this all before, haven’t we? The breathless hype, the soaring valuations, the inevitable correction. The internet, dot-coms, social media… the list is depressingly long. Each time, investors convince themselves that this time is different. That this time, the rules don’t apply.

They’re always wrong, of course. New technologies take time to mature. Businesses need time to figure out how to integrate them effectively. And investors… well, investors tend to get carried away. They overestimate the potential, and they underestimate the risks.

The AI bubble, I suspect, will be no different. It will burst, eventually. And when it does, Palantir will not be immune. Its government contracts and subscription revenue will offer some protection, certainly, but they won’t be enough to prevent a significant correction.

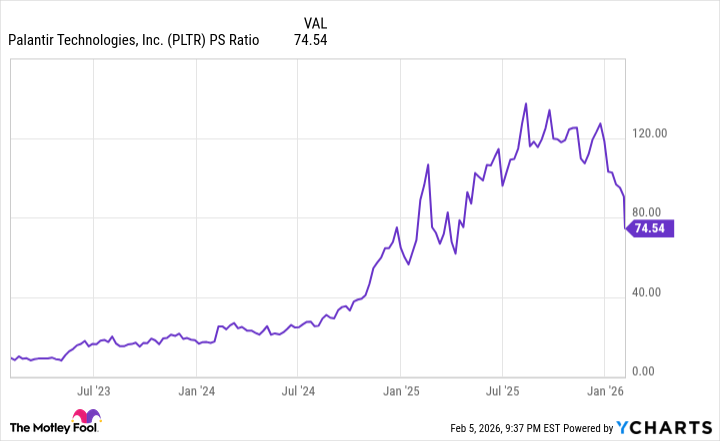

Let’s talk numbers, shall we? The market, in its infinite wisdom, has assigned Palantir a price-to-sales ratio of around 69. Good heavens! Historically, a ratio above 30 has signaled bubble territory. It’s perfectly absurd, really.

Even with a recent pullback, Palantir remains significantly overvalued. To reach a sustainable level, its shares would have to decline by at least 60% from their peak. A rather dramatic prospect, I grant you, but a perfectly realistic one.

So, what does this all mean? Simply this: Palantir is a good company, but it’s not a miracle worker. It’s subject to the same laws of gravity as every other business. And its shares, I suspect, are about to experience a rather bumpy landing.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-09 13:14