Palantir Technologies, one observes, has enjoyed a rather spirited ascent in recent years, propelled by the prevailing enthusiasm for all things Artificial Intelligence. The company purveys software – platforms, if one must use the jargon – designed to assist its clients in extracting some semblance of order from their data. A lucrative undertaking, naturally. One might even say, a necessary one, given the general state of affairs.

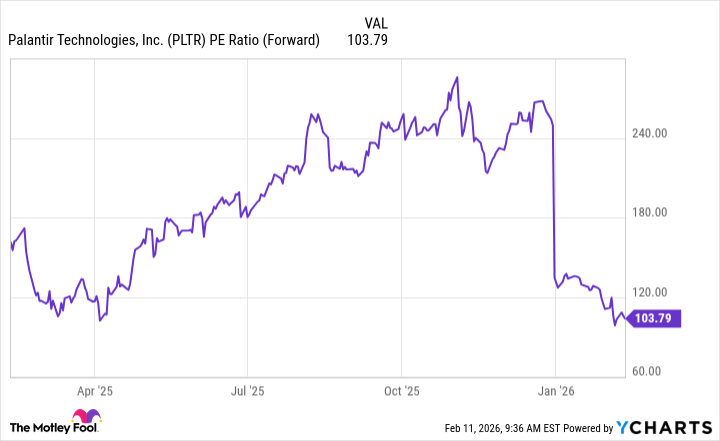

The earnings, while undeniably robust, have not entirely quelled a certain disquiet amongst investors. The valuation, shall we say, remains… ambitious. There is a distinct apprehension that should the current AI infatuation prove to be merely a passing fancy – a bubble, if you will – Palantir might find itself rather exposed. The stock has, after all, performed a most impressive, if improbable, dance upwards – a gain of seventeen hundred percent in three years. This year, however, it has surrendered approximately a fifth of its value. A sobering correction, perhaps, or merely a prelude to further anxieties.

The question, then, is this: is Palantir a venture best avoided, or does it represent a genuine opportunity, one of those rare occasions when a decade’s worth of profit might be realised? Let us examine the matter with a degree of circumspection.

From Obscurity to the Spotlight

It is important to note that Palantir is not some ephemeral start-up, newly sprung from a Silicon Valley incubator. It has, in fact, been in existence for over two decades, a considerable lifespan in the current climate. This longevity has afforded it ample time to refine its offerings and accumulate a certain degree of expertise. Initially, its revenues were largely derived from contracts with governmental bodies – a reliable, if somewhat unglamorous, source of income. As a private entity, it remained largely beneath the notice of the more excitable elements of the investment community.

However, it was only recently, with the advent of the initial public offering in 2020, that Palantir truly began to capture the imagination. The real turning point, though, arrived in 2023 with the launch of its Artificial Intelligence Platform, or AIP. This system, it is claimed, assists clients in gathering, analysing, and utilizing their data. A rather banal description, one might think, until one considers the potential applications. AIP, we are told, can streamline workflows, predict outcomes on the battlefield, and facilitate innovation. One suspects a degree of hyperbole, but the possibilities are, at least, intriguing.

The demand for AIP has been, predictably, substantial. In an age obsessed with the integration of Artificial Intelligence, Palantir offers a convenient solution – a ready-made platform that eliminates the need for costly infrastructure development. A shrewd move, if one is inclined to such things.

A Novel Growth Engine

Quarter after quarter, Palantir continues to report impressive earnings growth. The company is no longer solely reliant on government contracts; a new driver has emerged. The U.S. commercial business, it seems, is thriving. The number of commercial clients has increased from a mere fourteen a few years ago to a rather remarkable 571 in the latest quarter. Revenue in this segment has climbed at a triple-digit rate, and contract values have soared. One begins to suspect a rather clever marketing campaign.

These trends have, understandably, propelled the stock upwards. However, in recent months, a degree of hesitation has crept into the market. The valuation, as previously noted, remains a cause for concern. It is, shall we say, somewhat detached from conventional metrics.

The Question of Acquisition

So, is Palantir a prudent investment at these levels, or is it a venture best left to the more adventurous souls? Any new technology, naturally, carries a degree of risk. There is always the possibility that enthusiasm will wane and that the technology will fail to live up to the initial hype. However, the indications thus far suggest that Artificial Intelligence will play a significant role in our lives, so a degree of optimism is warranted.

It is also important to note that Palantir has a proven track record of success, having developed viable software platforms before the current AI frenzy. This suggests that it is capable of navigating the inevitable ups and downs. Furthermore, conventional valuation metrics – those based on past or near-term earnings – may not fully capture the company’s long-term potential. Therefore, while a high valuation is certainly a cause for caution, it should not necessarily preclude an investment in a company that may be on the cusp of explosive growth.

In conclusion, if one is seeking a potentially lucrative investment in the field of Artificial Intelligence, Palantir should not be dismissed. It may, indeed, represent a rare opportunity – a chance to acquire a stake in a company that could deliver substantial returns over the coming decade. Though, one should always remember that the market has a peculiar fondness for disillusionment.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-14 12:12