The current enthusiasm for artificial intelligence, one gathers, is not entirely divorced from desperation. A voice-activated system that doesn’t require one to shout repeatedly at a machine, or receive instructions delivered with the inflection of a particularly dim-witted automaton, remains, alas, a distant dream. SoundHound AI, whilst showing a degree of promise, strikes one as rather… optimistic in its prospects. A clever platform, perhaps, but one adrift in a sea of similar contrivances.

Palantir Technologies, however, is a different proposition altogether. It is not merely a purveyor of algorithms, but a constructor of order from chaos. One detects a certain governmental fondness for the firm, which is, in these anxious times, hardly surprising. Governments, after all, have always had a weakness for systems that promise to tell them what they already suspect, but with a veneer of scientific respectability.

The Art of Knowing What You Didn’t Know

The company’s offering, in its simplest form, is the ability to extract meaning from the monstrous piles of data that now constitute modern existence. Spreadsheets and databases, one supposes, can achieve something similar, but lack the… finesse. Palantir doesn’t simply collate; it interprets. Airbus, for example, employs it to anticipate mechanical failures, a task previously reliant on the somewhat unreliable pronouncements of engineers. Axel Springer, meanwhile, is discovering what its readers actually desire, a revelation that may or may not prove beneficial to the quality of journalism.

But it is in the corridors of power that Palantir truly flourishes. The Department of Defense, the Centers for Disease Control, even the Internal Revenue Service – all are clients. The pandemic, naturally, provided a particularly lucrative opportunity, forcing the company, rather unwillingly one imagines, into the public eye. It is a chilling thought, to be sure, but one cannot deny the efficacy of a system that can track the spread of disease with such ruthless efficiency.

To suggest that Palantir is merely a provider of ‘decision intelligence’ feels rather inadequate. It is, in essence, the architect of the modern panopticon, and one suspects its creators are not entirely unaware of the implications. It is, quite simply, a business that understands the value of information, and how best to exploit it.

A Growth Story, Despite the Price

Naturally, all this competence comes at a cost. The valuation, one gathers, is… ambitious. A price-to-earnings ratio of 150 is, to put it mildly, a trifle extravagant. The price-to-sales ratio, exceeding 100, is similarly unsettling. But to dwell on such trivialities is to miss the point entirely. Palantir is not a company for the faint of heart, or the financially timid. It is a bet on the future, and a rather substantial one at that.

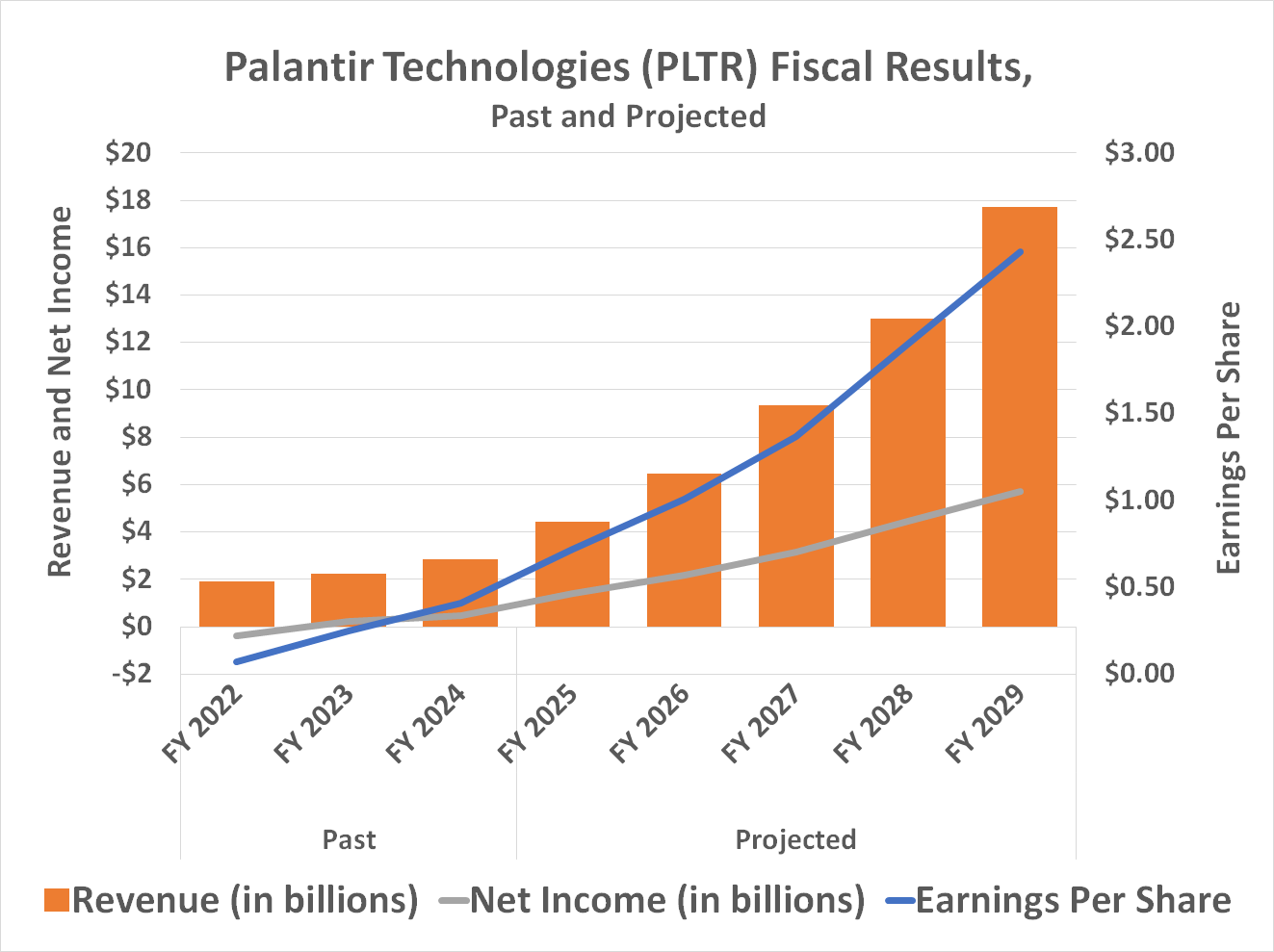

The recent quarterly results, however, offer a glimmer of hope. Revenue increased by a respectable 63%, and operating income by 51%. More importantly, this trajectory is expected to continue. The company, it seems, is not merely selling a product, but building a sustainable ecosystem. The ability to adapt the same basic coding framework to multiple clients, reducing developmental costs, is a particularly astute maneuver.

The market for ‘decision intelligence platforms’, one learns, is poised for substantial growth, with an average annual increase of over 15% projected through 2035. Palantir, as the dominant player in this nascent field, is ideally positioned to capture the lion’s share of this expansion. One anticipates a degree of competition, naturally, but few rivals possess the same level of governmental penetration, or the same air of quiet competence.

A Calculated Risk, For Those Who Can Afford It

This is not a stock for widows and orphans. Volatility is, undoubtedly, a persistent feature. A conservative retirement portfolio would be ill-advised to include it. But for those with a taste for risk, and a long-term investment horizon, Palantir offers a compelling opportunity. The recent lackluster performance since August of last year, one suspects, is merely a temporary aberration. A bullish catalyst, perhaps the upcoming fourth-quarter earnings report, may well provide the necessary impetus.

Even if the numbers prove disappointing, this remains a promising play in the artificial intelligence arena. A portfolio geared towards growth, and willing to tolerate a degree of turbulence, would be well-advised to consider it. After all, in a world increasingly defined by data, the ability to decipher it is not merely an advantage, but a necessity.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2026-02-03 06:33