XRP’s Wild Surge: Is This the End of the Road? 🚗💥

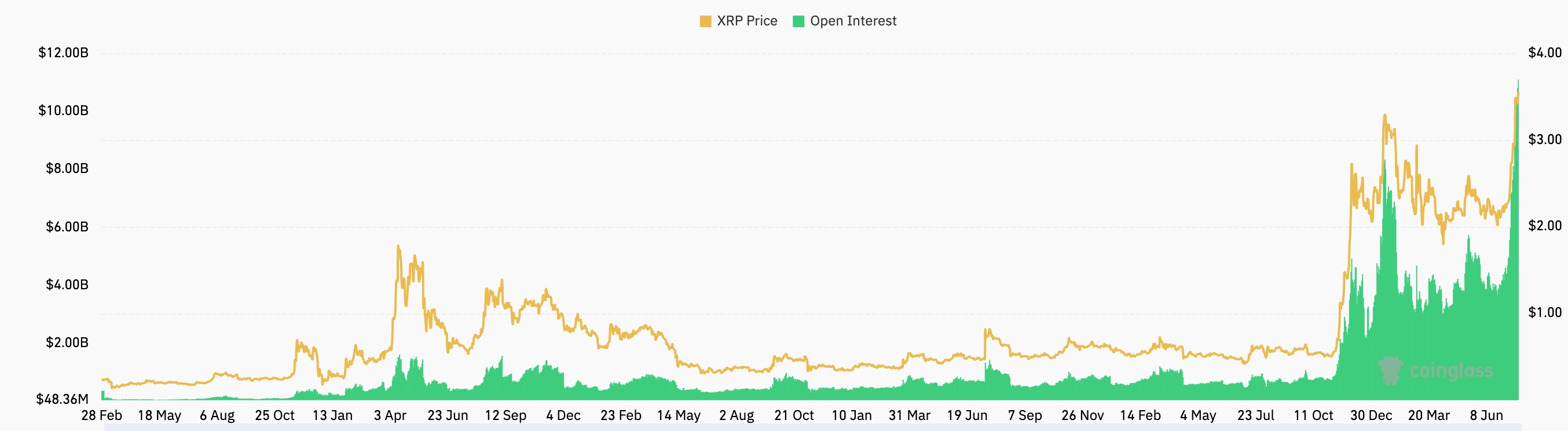

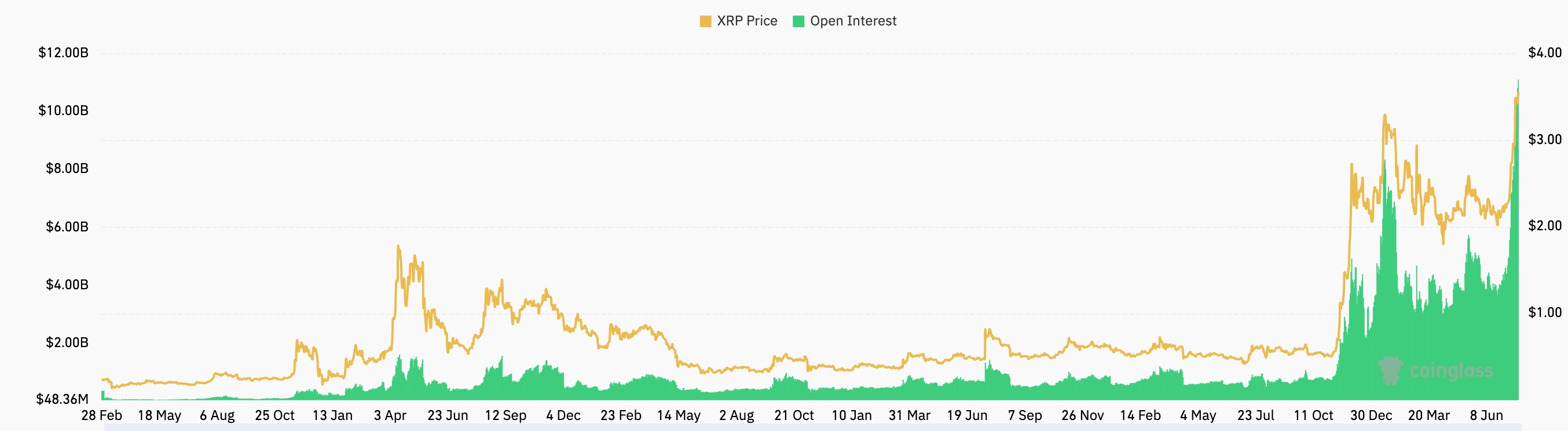

Ripple (XRP) jumped to $3.55, up by over 120% from its lowest point in April. Technicals? Please. The only thing “technical” here is how they’re using a spreadsheet to predict the future. 📊

Ripple (XRP) jumped to $3.55, up by over 120% from its lowest point in April. Technicals? Please. The only thing “technical” here is how they’re using a spreadsheet to predict the future. 📊

In approximately three months, the stock price reached $173, positioning the chip supplier as the world’s most valued publicly traded company, boasting a market capitalization exceeding $4.2 trillion. Given shares are nearing their peak, we’ll delve into Nvidia’s latest financial reports, insights from management about future prospects, and whether it remains a worthwhile investment opportunity today.

Yes, dear reader, Whatsapp faces the grim specter of banishment from Russian cyberspace, accused of being a “legal breach of national security.” Imagine that—a humble messaging app as a threat to a nation’s very soul! Deputy Nemkin, who clearly moonlights as a dramatist, laments that millions of Russians entrust their precious data to a foreign company controlled by what he calls a “hostile government.” Hostile? Perhaps Meta declined to send a fruit basket to Moscow one year. Who can say?

This week, the stock experienced additional growth as President Donald Trump eased restrictions on exporting Nvidia’s chips to China. We’ll explore the significance of this move for Nvidia and its implications on global artificial intelligence (AI) adoption patterns.

A significant sector where investors can anticipate substantial expansion is data centers. These facilities are multiplying nationwide, providing space for the processing hardware necessary for artificial intelligence (AI). It’s predominantly through these infrastructure developments that businesses earn revenues stemming from AI.

If pushed to select an AI-focused stock for purchase right now, I wouldn’t opt for Nvidia. This is not a reflection on Nvidia’s quality or potential, as it undeniably possesses both in abundance. However, there’s another stock that appears more enticing to me at the moment.

Ethereum jumped to $3,793. $3,793! Institutions are interested? In *Ethereum*? I need to lie down. Apparently, it’s all because of “treasury products” and “ETF flows.” What does that even *mean*? It’s up 25% in a week, they say. A week! It’s preposterous. And the ETH to BTC ratio is rising? It’s starting to…outperform Bitcoin? This is a disaster. A disaster, I tell you. 😠

Where Bitcoin treads next is as certain as a prisoner’s release date in a Siberian camp. The fiscal ruins of nations and the ceaseless printing presses of central banks may yet inflate its value—though the next “black swan” (or perhaps a pink flamingo of chaos) could just as easily trample it. 🤷♂️💸

As an avid investor, I must clarify that while Palantir has seen remarkable growth, it’s far from being the hottest stock on the market. In terms of performance among large-cap stocks, there are others that outshine it significantly.

Federal Realty’s dividend yield stands at approximately 4.4%, which outshines the S&P 500 index’s modest 1.3% and the typical real estate investment trust (REIT) average of around 4.1%. However, what truly sets this retail-focused REIT apart is its impressive dividend history.