Is IonQ a Millionaire-Maker Stock?

But can it turn a meager investment into $1 million? Let’s take a look.

But can it turn a meager investment into $1 million? Let’s take a look.

In the specialized field of net lease real estate, these two Real Estate Investment Trusts (REITs) stand out as the market leaders. While they share several characteristics, it’s crucial to note that there are distinct differences between them as well.

Upon reading the news, my initial reaction was something like, “Looks like another arrangement that’ll favor Nvidia (NVDA)!” Although Nvidia wasn’t explicitly named in the announcement, I was well aware of their involvement due to the Nvidia link.

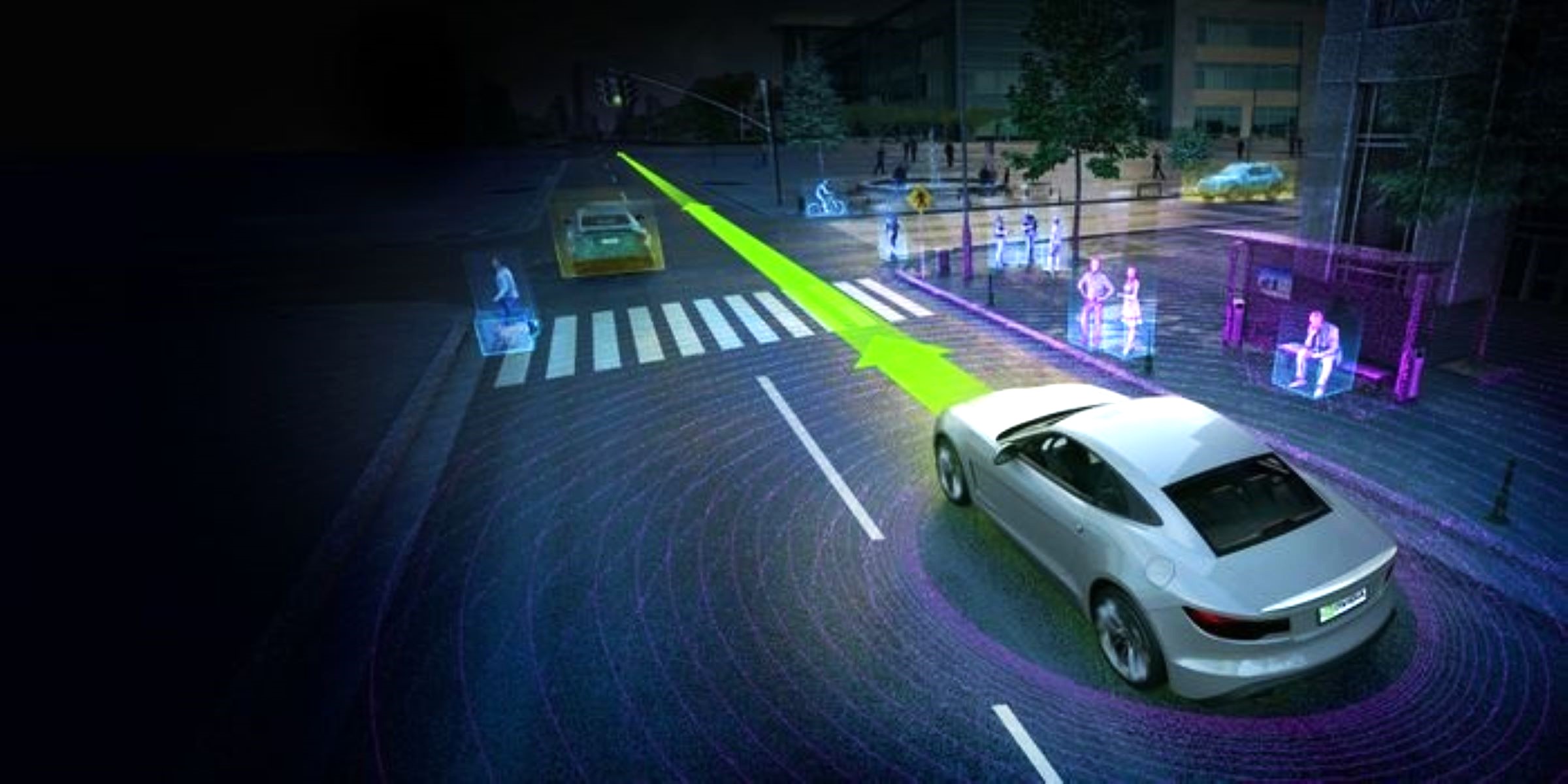

Though Nvidia seems to be the leading powerhouse in the artificial intelligence (AI) sector, it’s worth noting that the company’s expansion is also due to several strategic partnerships that have significantly boosted its growth.

Let’s put this into perspective: Bhutan holds more than 11,400 Bitcoin, which is roughly 40% of its entire GDP. To put it mildly, if Bitcoin were a national sport, Bhutan would be winning the World Cup. 🥇 But what’s even more impressive is how they’ve managed to play the market like a fiddle.

Bitcoin’s at record highs, and altcoins like Kaito, Avalanche, and Pi Network are at critical junctures – will they soar or nosedive? 🤔 The coming days will be crucial in determining whether crypto’s next move is consolidation or continuation.

Even within the technology sector, there are many hidden gems with substantial values that have yet to receive their due recognition. Some exceptional growth stocks may not have received the notice about skyrocketing in 2025. When you consider their unassuming stock charts alongside strong long-term business prospects and reasonable valuations, it’s definitely worth reevaluating these overlooked growth stocks.

The market, that wild beast, seems to grin with a sardonic twist—LTC is perhaps just warming up, stretching its legs before a marathon of madness. The so-called “experts,” curled up in their armchairs, whisper of a grand bull run, a 900% surge that will make your grandmother’s penny stocks look dull. Oh, yes—the sky’s the limit, or so they say, while the charts dance like drunken fools on a carnival float.

Instead of investing small amounts over time, consider putting $25,000 into an exchange-traded fund (ETF) like the SPDR S&P 500 ETF (SPY), which follows the S&P 500 index, and keeping it for 25 years. Could this strategy potentially make you wealthy enough to comfortably retire? Let’s find out.

It appears that the denizens of these rarefied financial circles, specializing in the arcane art of merger arbitrage, have been rewarded with a bonanza of, quite literally, billions of dollars. The 20-month court arbitration, a veritable eternity in the fast-paced world of high finance, has finally come to a close, and the spoils are being divvied up with all the decorum of a Victorian-era gentlemen’s club, minus the decorum and the gentlemen 🙃.