Crypto Lending: The Hottest Trend or a Financial Disaster Waiting to Happen? 💸🔥

Crypto lending is reshaping the world of finance by bringing a modern twist to the age-old practice of borrowing and lending. 🚀

Crypto lending is reshaping the world of finance by bringing a modern twist to the age-old practice of borrowing and lending. 🚀

Behind the scenes, a bigger battle is playing out: super whales are selling, retail holders are staying bullish, and short sellers are piling in on derivatives markets. With all three forces pulling ADA in different directions, one factor could ultimately decide who comes out on top. 🤷♂️💸

The Washington Post, that venerable scribe of ink and exhaustion, revealed the scheme: a five-year pilot program by the Centers for Medicare and Medicaid Services (CMS), a labyrinthine beast whose paperwork could outlast the pyramids. Under this plan, Medicare Part D insurers and Medicaid programs might, if the stars align and the forms are filled in triplicate, foot the bill for obesity drugs. For patients, this would be salvation; for Zepbound’s price tag—a monthly sum that could buy a small island in the Caribbean—it would be the bureaucratic equivalent of a magic wand.

The Ethereum Foundation, perhaps after one too many late-night brainstorming sessions, unveiled what they call the “Ethereum Lean Plan.” This isn’t just any plan; it’s an audacious attempt to scale Ethereum into oblivion, keep it running forever (or at least until humanity invents time travel), and prepare for quantum computers that may or may not decide to obliterate everything we hold dear.

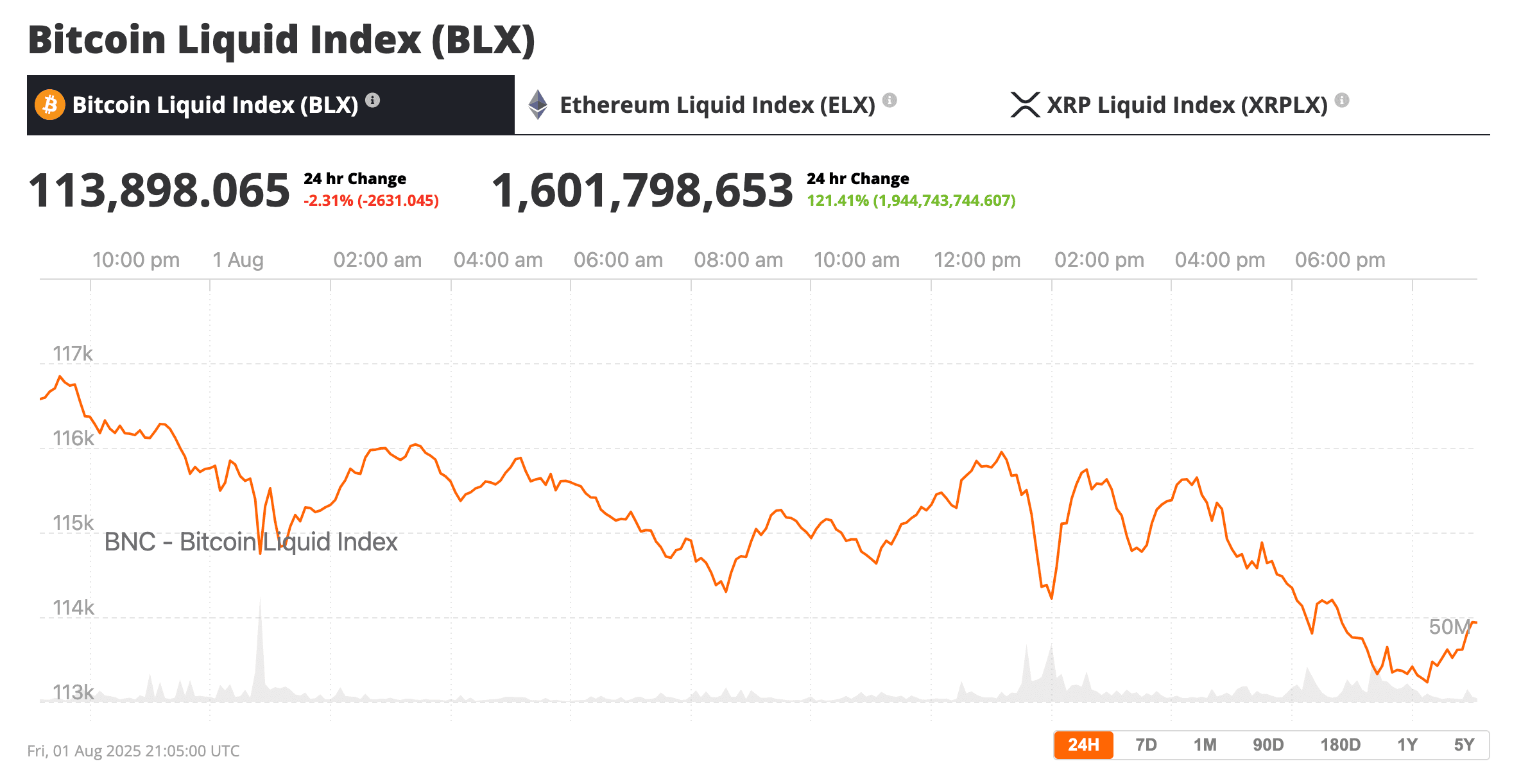

Ah, but let’s zoom in on the chaos of Thursday, July 31—a day that will live in infamy for bitcoin ETFs. The market sentiment did a little pirouette, and suddenly, Blackrock’s IBIT was bravely hoarding $18.62 million, while Franklin’s EZBC, Grayscale’s Bitcoin Mini Trust, and Invesco’s BTCO were pooling their pennies to contribute nearly $16 million. Even Vaneck’s HODL chipped in $3.31 million like a good sport. But alas, it wasn’t enough.

They’ve now announced they’re offering up to $4.2 billion in these fancy Variable Rate Series A Perpetual Stretch Preferred Stocks (try saying that five times fast). What does that mean? Well, it’s a type of security that pays dividends, has yields as variable as your aunt’s mood, and doesn’t even know when it’s supposed to stop existing. It can be called or redeemed by the company whenever they feel like it. Talk about a flexible repayment plan!

Let’s cut to the chase: there wasn’t some earth-shattering revelation about Centrus itself causing the plunge—no whistleblower with a suitcase full of radioactive secrets. No, this was something far more insidious. The Trump administration, in its infinite wisdom, decided to slap new tariffs on imports from dozens of countries. DOZENS. And Russia? Oh, they’re getting the VIP treatment here—a tightening noose of sanctions that could choke off one of the world’s largest sources of uranium.

So, logically, this should be great news for risk assets, right? Lower growth means the Fed might finally stop playing hard to get with rate cuts. Traders are now betting their last avocado toast that a September rate cut is 75% likely. Treasury yields dropped faster than my self-esteem after a bad Tinder date, and gold is basically doing a victory lap, up 1.5% and eyeing its all-time high. 🏆

In spite of a recent decline of 6.4%, tumbling to a modest $0.67 — as if it were shyly retreating from a bustling ballroom — OP’s manner suggests a penchant for steadiness, with trading volume holding firm, and bullish spectators eagerly awaiting a proper rebound. The question now is whether our dear Optimism can clutch its support and ascend towards loftier ambitions, or if it shall simply dance on the precipice of indecision.

Cryptocurrency investors, those modern-day alchemists, remain fixated on the Fed’s cryptic omens. They whisper that cheap money fuels bull runs, while tight money quenches them, as if the market were a child tethered to a pendulum of fiscal whims. Yet the digital realm of 2025, with its labyrinthine logic, thrives on engines that hum without the need for monetary octane. Behold, the tale of how this rate stasis may ripple through the crypto cosmos.