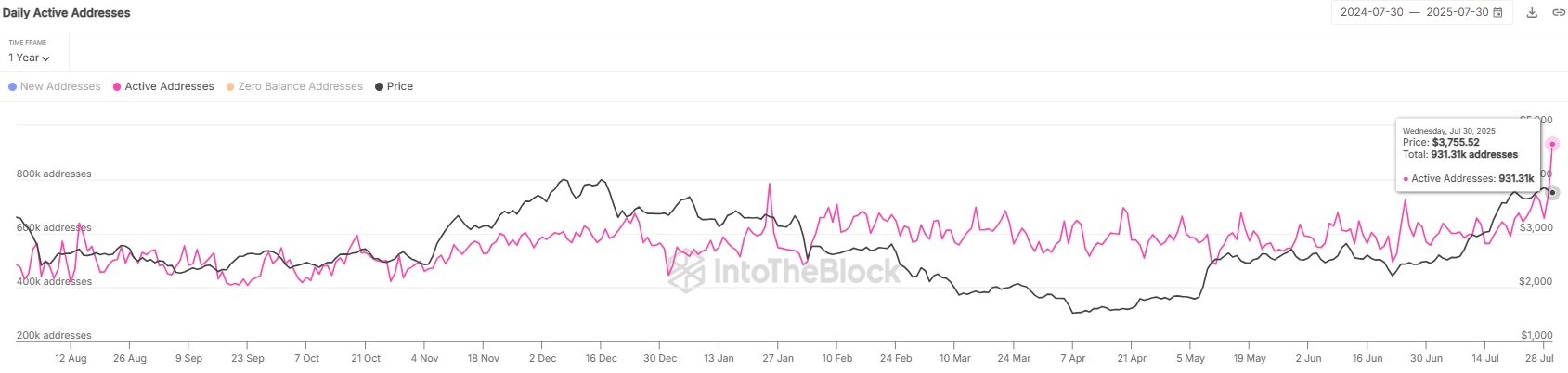

Ethereum Whales Make It Rain, While Critics Still Wonder Why 🐋🔥

In the first days of August, these aquatic giants collectively dropped over $400 million into ETH, shouting, “We believe in this digital magic pudding.” Apparently, confidence in the long-term future of their digital goldfish is a thing — or at least, it’s what they tell themselves as they watch their $300 million silverfish swim around in the deep end of Galaxy Digital’s OTC pool.