Bitcoin’s Daring Leap to $120K: Traders Abandon Bearish Bets and Embrace the Crypto Dream

Bitcoin derivatives show reduced demand for downside protection, suggesting renewed investor confidence.

Bitcoin derivatives show reduced demand for downside protection, suggesting renewed investor confidence.

Earlier this year, with bravado that would make a Cossack blush, Semler bought 455 more coins for $50 million. Average price per coin: $109,801. These are numbers that don’t warm your hands, but make your heart race and your wallet sweat.

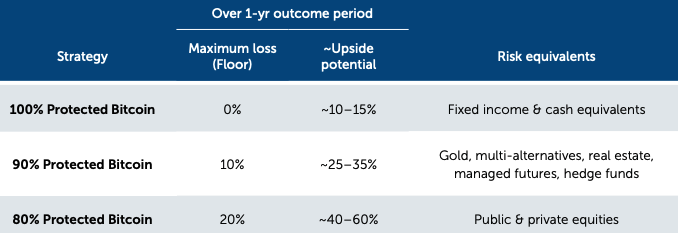

Bitcoin (BTC) is becoming the new black for institutions, but let’s face it, it’s still a wild ride. On June 7, global investment firm Calamos introduced its “protected Bitcoin” strategy, which is like a safety net for your crypto dreams. 🦸♂️

Ethereum’s (ETH) price action has reached a pivotal point, with the asset now trading at a high time frame resistance level of $2,590. This zone is technically significant, as it aligns with the 0.618 Fibonacci retracement and the midpoint of the active Fibonacci-based price channel. While bullish momentum remains intact, this region could act as a short-term ceiling, potentially triggering a corrective move that sets the stage for a larger breakout. It’s like the calm before the storm, or in this case, the calm before the crypto surge. 🌪️

In the year gone by, U.S. President Donald Trump, ever the showman, has established a strategic Bitcoin [BTC] reserve and announced an altcoin reserve, as if to say, “Why have one when you can have a whole collection?”

The Las Vegas-based firm produced 685 BTC last month, bringing its year-to-date output to 3,968 BTC. All coins were self-mined, and total bitcoin holdings reached 12,608, ranking the company seventh among publicly traded bitcoin holders, one spot ahead of Tesla. I guess Elon can’t keep up with the miners. 🚗➡️💻

Ripple’s (XRP) price, a rebellious teenager, refuses to conform to the broader market’s weakness. After establishing a solid foundation at $2.99, the asset is now climbing back toward the major resistance levels, like a mountaineer determined to conquer the summit. However, the next key challenge lies at the $2.42 region, a level that could determine whether this rally is a temporary reaction or the beginning of a broader bullish move. Let’s delve into the current structure and what traders should be watching next, with bated breath.

Fidelity, that stalwart bastion of capitalist fervor, had filed its S-1 registration statement with the agency on June 13, no doubt with the expectation that the wheels of progress would turn with all due haste. Alas, it seems the SEC has other plans. Or, rather, no plans at all, for the time being. 🕰️

On the hourly chart, LINK has confirmed a short-term bullish breakout after forming a series of higher lows. Price accelerated beyond the $13.40 mark and briefly touched $13.70 before consolidating near $13.48. This movement followed a clear rebound from the July 2 low at $12.90, forming a rounded bottom pattern that typically precedes continued upside.