Is Nvidia Stock a Buy Now?

It’s no wonder that Nvidia’s latest surge occurred; after all, its previous drop this year appeared unjustified given the impressive growth it has maintained thanks to the robust demand for its AI processors.

It’s no wonder that Nvidia’s latest surge occurred; after all, its previous drop this year appeared unjustified given the impressive growth it has maintained thanks to the robust demand for its AI processors.

Last month, the share price of Micron Technology (MU) rose by a significant 30.5%, making it the top performer in the Nasdaq-100 index. This tech company specializes in designing and manufacturing data storage products, which are crucial for generative artificial intelligence (AI). Given the burgeoning interest in AI as many view it as a promising growth opportunity in its early stages, this sector has been attracting a lot of investor attention lately.

Depending on your unique investment strategy and objectives, you might find that the Invesco S&P 500 Growth Allocation at Risk (GARP) ETF (ticker symbol: SPGP, currently at 1.00%) could be a more suitable choice for you. Here’s why this fund may appeal to some investors:

1. Focus on growth and value: The GARP ETF targets companies that exhibit both strong growth potential and undervalued characteristics, offering a balanced approach to investing.

2. Diversification: By investing in a diversified portfolio of U.S. equities, the fund helps reduce the risk associated with putting all your eggs in one basket.

3. Low expense ratio: The SPGP ETF has a competitive expense ratio, making it an attractive option for investors seeking to minimize fees and maximize returns.

4. Solid track record: With a proven performance history, the Invesco S&P 500 GARP ETF could be a reliable choice for those looking to build long-term wealth.

It’s possible you weren’t aware that the company intentionally sells its hardware at a lower price to stimulate user growth. While Roku is well-known as the top seller of TV software in North America, it might surprise you to learn that they’ve only recently begun offering streaming sticks and TVs in regions such as Western Europe and Latin America. Additionally, it may interest you to know that before Amazon (AMZN 0.39%) selected Roku as its preferred advertising platform, Roku’s ad sales were expanding at a faster pace than the platform itself.

In a shift from focusing solely on Tesla, it’s worthwhile to explore other forward-thinking businesses that are catching the attention of investors. Let me introduce you to one such company, Rocket Lab USA (RKLB 7.61%), which has been experiencing remarkable growth this year. Unlike Tesla, shares of Rocket Lab have already surged over 60% in 2021.

Over the course of 2024, the share price of the quantum computing specialist surged an astounding 1,449%. However, during the first half of 2025, there was a noticeable dip or pullback. Contrasting this, the stock has experienced substantial growth in trading during July and has now recovered more than it had lost during earlier sell-offs in the year.

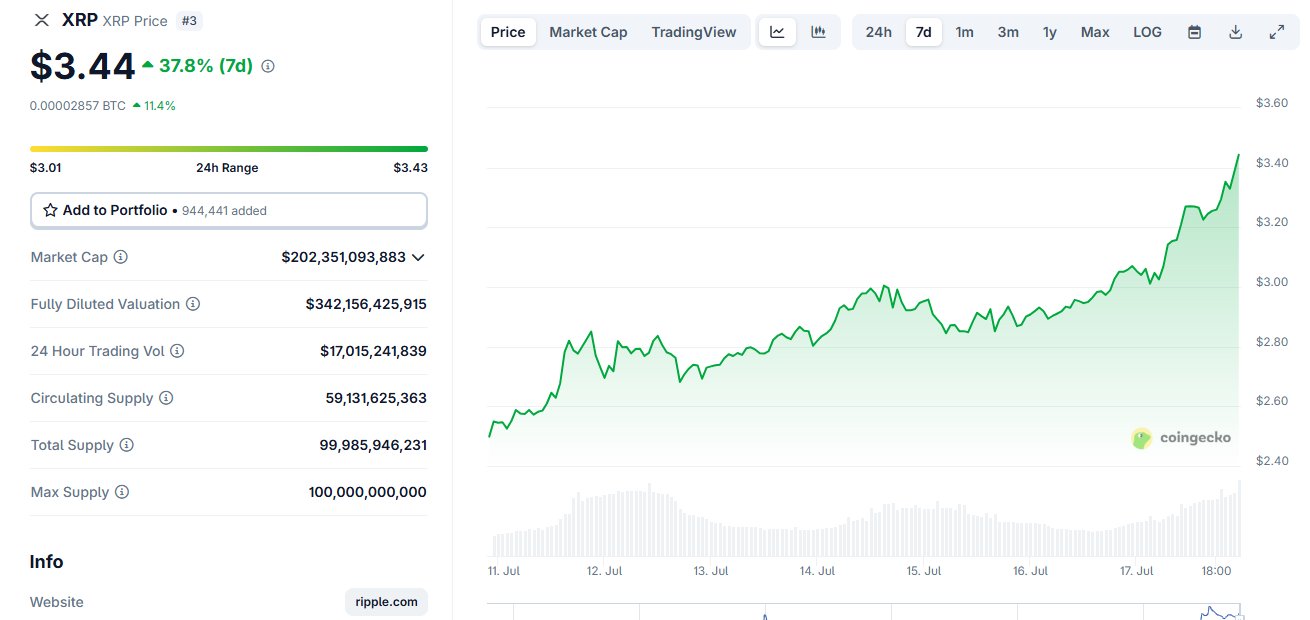

XRP is throwing a network growth fiesta, reaching a six-month high in what appears to be a bid for attention. You know it’s serious when the number of new addresses is skyrocketing like my blood pressure at family gatherings.

Based on a recent SEC document, Ayrshire Capital Management LLC has completely offloaded its shares in UnitedHealth Group. They sold a total of 11,424 shares, which amounted to approximately $5.98 million. As a result, as of the June 30th reporting date, the firm no longer holds any shares in the health care company.

It’s no wonder that some of the leading AI companies are currently valued at high prices. Companies like Nvidia, Broadcom, Palantir Technologies, and SoundHound AI fall into this category. If you’re considering investing in a premier AI stock, be prepared to pay substantial premiums for these stocks at present.

In the first six months of this year, D-Wave Quantum experienced significant fluctuations. However, major announcements and growing enthusiasm about the future of quantum computing technology have led to a significant increase in its valuation. Furthermore, the company’s stock has continued its upward trend at the start of the second half of 2025, resulting in an approximately 1,230% rise over the past year.