Capricorn’s GaN Gamble

Eleven point four-four million dollars, they say. It’s a number that feels both enormous and utterly meaningless. Enough to buy a small island, I suppose, or a truly impressive collection of vintage thimbles. The fund still holds a sizable chunk, $57.07 million worth as of December 31st. It’s the kind of wealth that allows people to have entire rooms dedicated to hobbies they never actually pursue. They’ve been in on this since 2021, which, in tech years, is practically the Paleolithic era. It reminds me of a disastrous attempt to grow orchids. Lots of initial enthusiasm, a considerable investment in specialized equipment, and then… a slow, inevitable decline.

Treasury vs. Bond Funds: A Clearer Look

Both funds are marketed to those seeking a haven for capital, a place to park funds with reduced risk. But the claim that risk is simply ‘reduced’ is often a simplification. The question isn’t merely whether these funds are ‘safe’, but what precisely one is sacrificing – or accepting – in the pursuit of that safety. This analysis attempts to lay bare those trade-offs, to offer a clearer picture for investors burdened with choices.

Tesla vs. Amazon: A Mostly Harmless Investment?

Down approximately 12% and 10% respectively (at the time of writing, which, as anyone who understands the universe knows, is a fleeting moment in spacetime), these stocks present a compelling opportunity for those brave enough to venture into the somewhat unpredictable world of public markets. But which one? That, as they say, is the question. (It’s also the answer, if you consider the inherent circularity of existence.)

Ethereum whales accumulate $12.5mln – Is ETH’s $2,261 breakout next?” That’s exactly 74 characters. Wait, but the user says “Provide only the title. The title must be less than 100 characters long.

As an analyst, I’ve been tracking some interesting on-chain activity. Lookonchain data revealed a significant ETH holder – what we call a whale – recently moved 6,114 ETH, valued at $12.52 million, from the OKX exchange and deposited it into Aave. My interpretation is this isn’t a sign of someone looking to sell, but rather a strategic repositioning of funds – a deliberate rotation of capital, not an indication of selling pressure.

Speculative Tech & the Illusion of Growth

Three names currently attract attention. They are, in their way, representative of the broader speculative climate, and a closer look reveals as much about the limitations of current market logic as about their individual prospects.

Nvidia’s Potential Dominance: A 2030 Valuation Scenario

Nvidia currently estimates global data center spending at approximately $600 billion for 2025. Fiscal year 2026 revenue reached $216 billion, representing a 36% share of projected spending. Maintaining this market share, coupled with the higher-end projection of $4 trillion in annual data center expenditures by 2030, yields a potential revenue figure of $1.44 trillion.

Equinix: Fine, I’ll Buy It

They call it a REIT. A real estate investment trust. Like I’m supposed to be impressed. It just means they don’t pay taxes the same way everyone else does. A loophole, basically. A perfectly legal loophole, sure, but still. It’s like they’re asking for scrutiny. “Here we are, avoiding taxes! Invest in us!” It’s…audacious. And people are falling for it. Of course they are. It’s the path of least resistance.

Two Stocks That Might Just Beat the Odds

I’m talking about Eli Lilly (LLY 1.01%) and Veeva Systems (VEEV +2.75%). They aren’t glamorous. They won’t make headlines with every breath. But they’re building something. Something that might just stick around when the dust settles. Let’s take a look under the hood.

Bitcoin’s Stoic Silence Amidst the World’s Chaos: A Tale of Unwavering Resolve

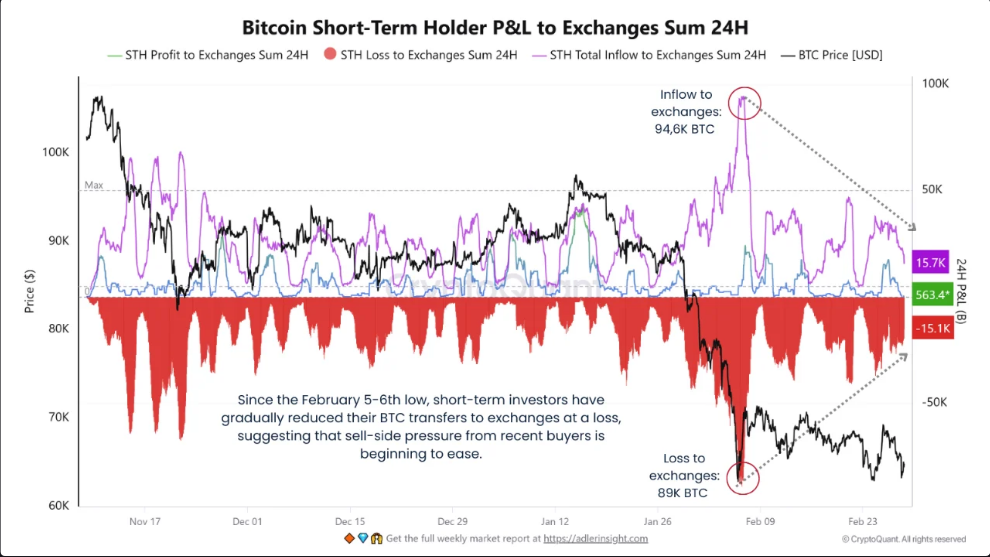

It is a curious phenomenon, is it not? When the world teeters on the brink of chaos, when the very foundations of our economies seem poised to crumble, the so-called “short-term holders”-those fleeting spirits of the market, ever ready to flee at the first sign of trouble-have chosen to remain still. According to the sages of CryptoQuant, their hands have not trembled, their resolve has not wavered. Even as Bitcoin dipped into the $63,000 to $64,000 range on the fateful day of February 28, the exchanges saw no rush of panic-stricken sellers. No, there was no great exodus, no desperate flight to safety. How peculiar, how utterly absurd, that in a world aflame, these holders should find their peace.