Dogwifhat Poised to Explode? The Hilarious Truth Behind Those Crazy WIF Charts! 🚀

Now, WIF took a little nap at around $1.08, probably dreaming of better days—or maybe just running out of snacks. But don’t panic! The big picture still looks prettier than Aunt Edna’s infamous casserole. Indicators are whispering, “Hey, it might hit $2.20 next,” which is fancy talk for “Keep your coffee; things are about to get spicy.”

Dogecoin’s Wobbly Day: A Growth Investor’s Diary

It’s not that I didn’t see this coming. No one gets rich without occasionally feeling poor, right? Investors have been cashing out left and right after months of what can only be described as crypto euphoria—a phase so intense it made people forget their passwords to Coinbase accounts while simultaneously naming their newborns Satoshi. And then there’s Tesla. Oh, Elon Musk, you enigmatic trickster. The company sold off 75% of its Bitcoin holdings in Q2, which has sent ripples through the market faster than my cat knocks over a glass of water when she thinks I’m ignoring her.

Can BONK Bulls Rise Again? A Tale of Support and Sarcasm 🐂💥

a veritable buffet of technical support just lying in wait

Kinsale’s Stock: A Tale of Rise and Resilience

A spark of triumph illuminated the quarter, as the company’s earnings, like a well-tended flame, outshone the expectations of those who had cast their bets upon the scales of doubt. This luminosity, however fleeting, lifted the stock by 7%, a brief dance with the heavens before the weight of earthly concerns settled once more.

Gilead Sciences Stock Surges: A Catalyst Analysis

Central to the analyst’s thesis is Yeztugo, Gilead’s pre-exposure prophylaxis (PrEP) medication for HIV-1, which has emerged as a focal point in an expanding market. Physician surveys cited by Needham suggest a 49% compound annual growth rate in the PrEP sector through 2030, with Yeztugo projected to capture 38% market share—a figure exceeding current consensus estimates.

Dogecoin’s Hilarious Hiccup: Next Boom or Total Bust? 🚀😂

Over the past few days, Dogecoin has been hogging the spotlight, thanks to Bit Origin, those Singapore-based pork processors who’ve pivoted to Bitcoin mining and now, hilariously, Dogecoin hoarding. They raised a whopping $500 million—split between $400 million in shares and $100 million in debt—to kick off their “multi-phase DOGE monetization strategy.” I mean, who wouldn’t want to hedge their bets with a cryptocurrency that’s basically a Shiba Inu meme on steroids? 😂

ETH to Smash BTC? Novogratz’s Bold Bet Shocks Crypto World!

#GalaxyDigital has transferred nearly 30,000 $BTC($3.5B) out today, most of which went directly to exchanges and were sold.

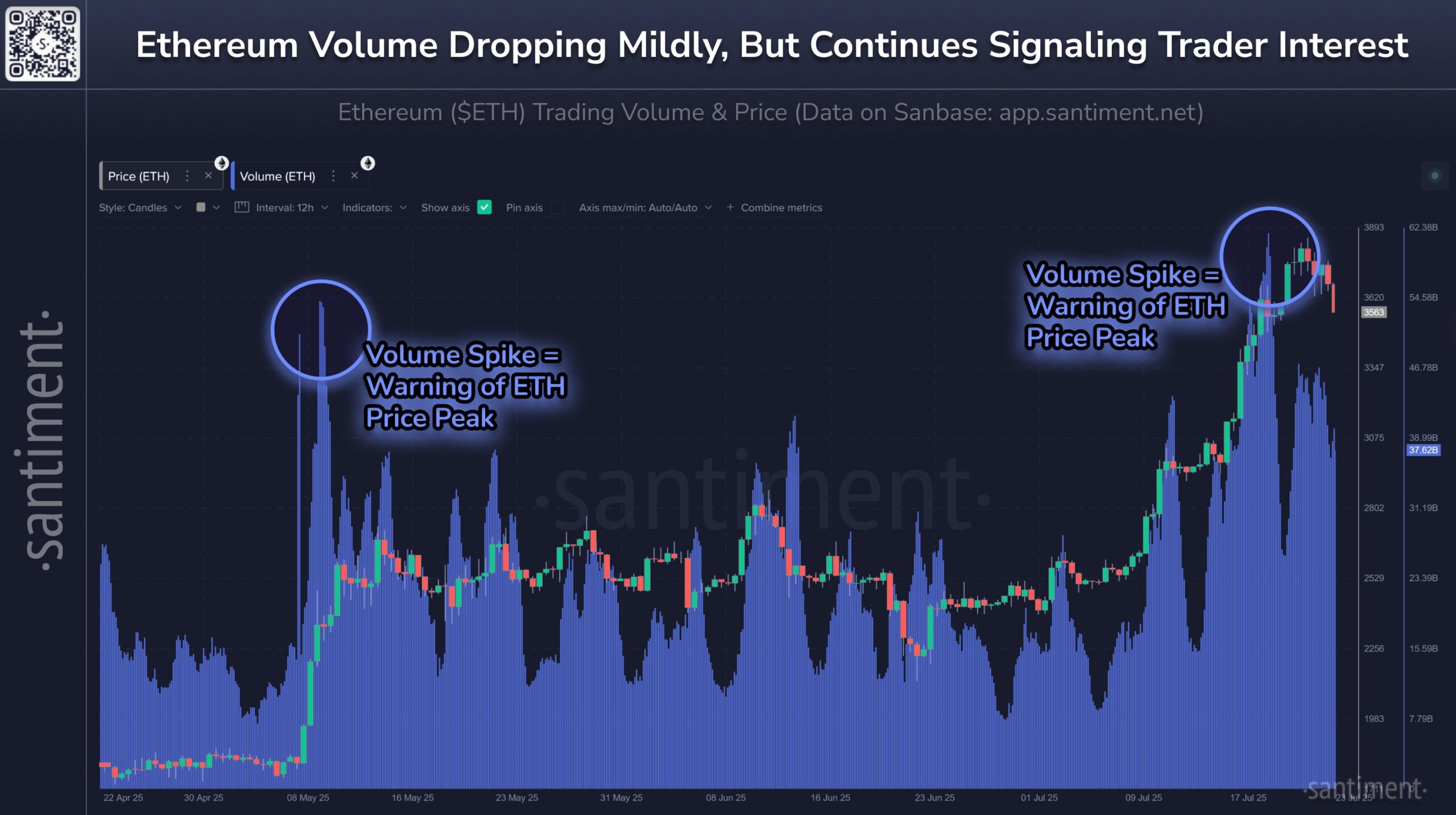

Ethereum: The Rollercoaster Ride Everyone’s Been Waiting For! 🎢💰

Sure, the market feels a bit full—like a Thanksgiving dinner gone wrong—but don’t count Ethereum out just yet! This little hiccup is probably just taking a breather before it sprints up faster than a cat on a hot tin roof!

Deciphering GM’s 35% Income Plummet: Tariffs and Tantalizing Triumphs

Picture, if you will, the economic landscape as a ponderous sea, beset by squalls and surges. Amidst these tempests, GM, ever the audacious navigator, reported commendable second-quarter earnings on July 22, rather like a ship piercing through a turgid wave. Yet, lurking in the shadows of success, the omnipresent specter of tariffs looms formidable. Indeed, a staggering 45% of GM’s vehicles—a veritable flotilla—sailed into the American harbor from foreign shores, most notably Mexico and South Korea, thus exposing them to the unrelenting tide of import tariffs.