Let’s talk Carnival (ticker: CCL), the floating city-state of the cruise world. This company, buoyed by demand so persistent it must be hereditary, has watched its stock rise around 18% this year—well ahead of the S&P 500, that most unadventurous of benchmarks. Eight successive quarters of record revenue and an admirably plump bookings ledger stretching towards a future that looks, to Carnival at least, like one continuous deck party.

And what is a cruise except a floating controlled environment in which consumer confidence is measurable in buffet plates per hour?2 While sales of socks and sundries wane—all those would-be shoppers are now queuing for trivia night somewhere off Corfu—Carnival is, quite literally, full steam ahead.

Consider the oracular numbers: anticipation yawns towards $25 billion in revenue by 2025, with $2.00 expected in adjusted earnings per share (doubtless adjusted with the same precision a ship’s purser brings to the dessert table). All this while the broader travel industry’s fate remains subject to the benevolence of mischievous minor deities, such as Grobnar the God of Random Price Hikes.

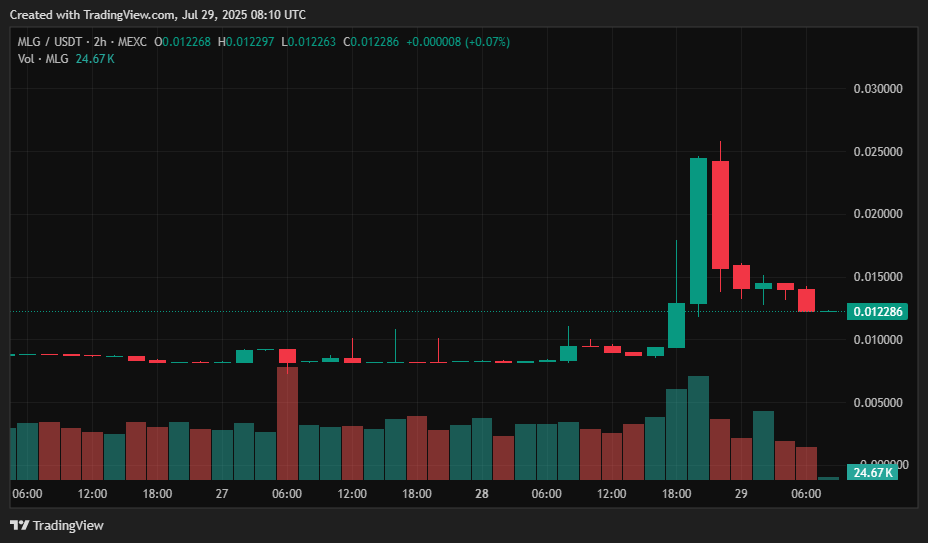

[stock_chart symbol="NYSE:CCL" f_id="203067" language="en"]

Industry statistics, which are only accurate to the nearest expert guess, suggest 82% of those who have endured, er, enjoyed a cruise plan to return3. Carnival’s own management, speaking at their Q2 conclave, virtually beamed about bookings filling cabins all the way to 2026, and made it clear there was only so much cruise ship to go ’round. Scarcity, it turns out, is excellent for margins.

And should you be tempted to mutter “overvalued,” consider this: with a forward price-to-earnings multiple of 15, Carnival remains priced more like a humble soapmaker and less like a circus impresario. Analysts, who are to predictions what seers are to chickens’ entrails, expect earnings growth to pace at an annualized 21%. Of course, the only certainty about predictions is that time, like the tide, will one day put them out to sea.