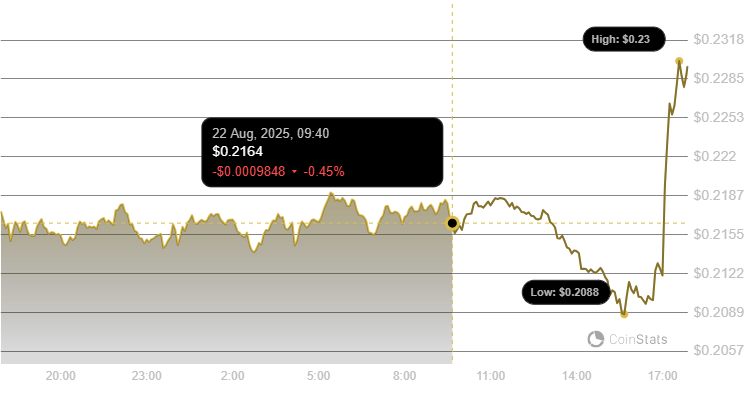

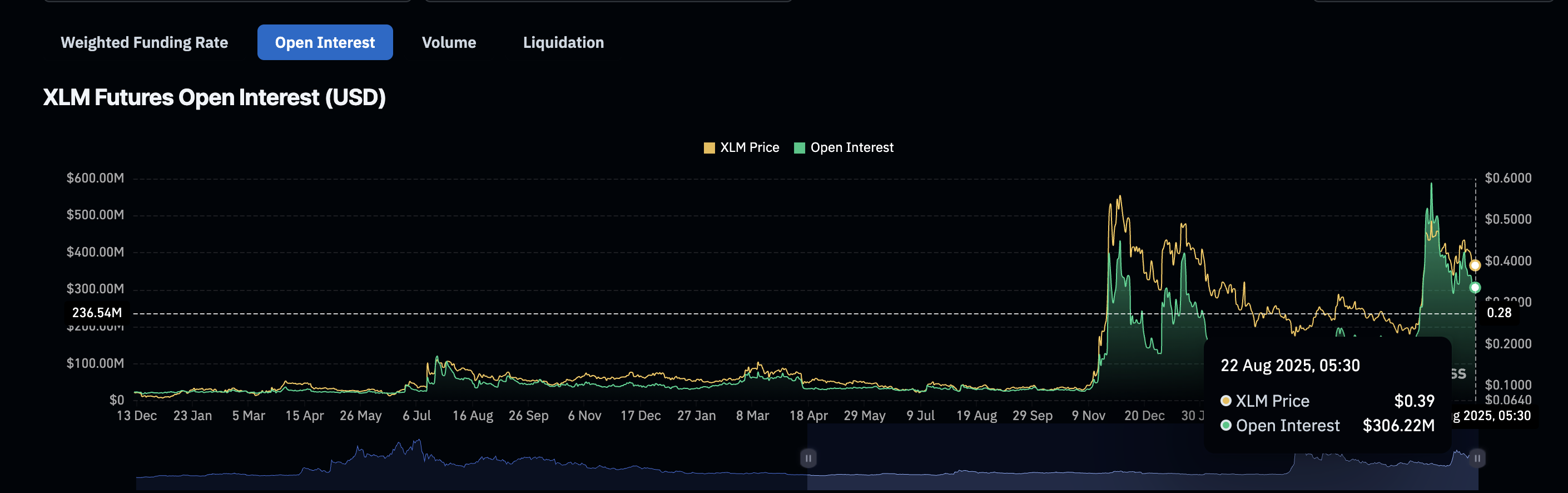

Stellar Price Risks 40% Drop As Three Bearish Setups Align

For those of you holding on to your Stellar bags for dear life, brace yourselves. The next few sessions might just determine whether Stellar can hold the line, or if it’s heading for a serious faceplant. 🍿