Is That TOWN Token Worth a Plug Nickel, or Just Snake Oil?

00 UTC sharp. Imagine the excitement! 🕰️

00 UTC sharp. Imagine the excitement! 🕰️

And yet, dear reader, let us not mistake panic for truth. For beneath this tempest lies a curious signal: at just 13 weeks, VK2735 achieved a weight loss of 12.2%. Compare this, though imperfectly, to Eli Lilly‘s orforglipron and Novo Nordisk‘s oral semaglutide, whose respective triumphs of 12.4% and 15% were measured over 68 to 72 weeks. Yes, tolerability concerns loomed large-the discontinuation rate was 28%, compared to placebo’s 18%, driven chiefly by gastrointestinal woes-but is this not merely a matter of refinement? Surely, dosing protocols can be tempered, as one might calm a skittish horse.

Ten years ago, Berkshire’s $330 billion crown was unchallenged save for the titans of Silicon Valley-Apple, Alphabet, and Microsoft. But time, that relentless sculptor, has reshaped the terrain. Today, eight American titans dwarf Berkshire’s $1.05 trillion girth. Nvidia, once a mere speck in the cosmic expanse of finance, now looms with a market cap four times greater, its ascent a testament to the alchemy of innovation.

Now, before you roll your eyes and accuse me of being overly dramatic, allow me to explain why investing in this pet-focused juggernaut might just be the most delightfully shrewd decision you’ll make this year. After all, who could resist a company that caters to our four-legged overlords with such panache?

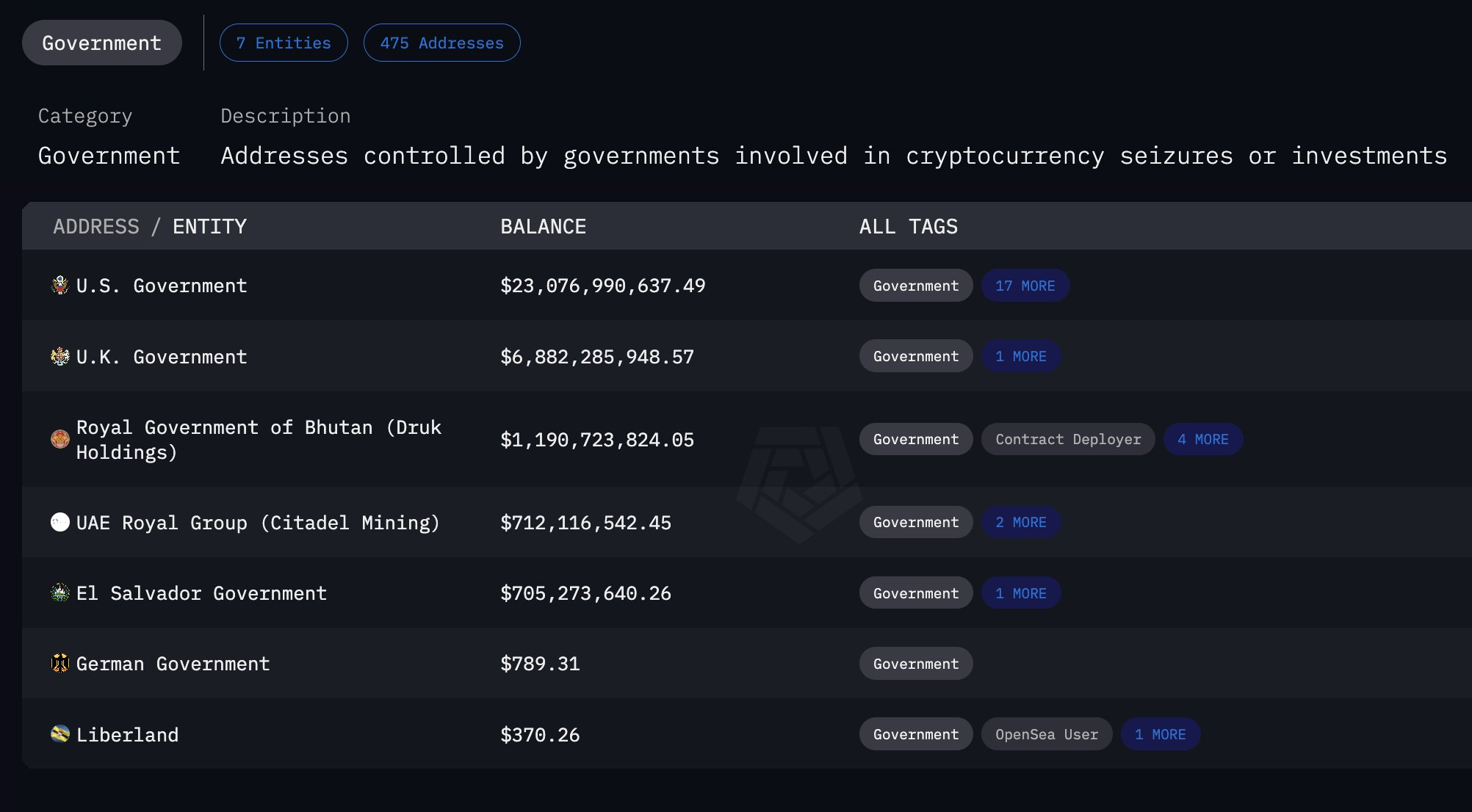

The findings-because of course, it’s a finding and not a mere suspicion-reveal the United Arab Emirates (UAE) hoards 6,333 BTC. These were mined with the elegance of a symphony orchestra, not purchased like a loaf of bread or seized like a rogue’s treasure.

Michael Saylor, with the flair of a man who hath never met a ledger he did not adore, declared that Strategy (formerly MicroStrategy) hath procured an additional 3,081 Bitcoin [BTC], at a cost of $357 million, as if such sums were mere pocket change. 🤑

Palantir Technologies-a name that rings like a conjurer’s incantation-has soared like a firebird in the firmament of AI stocks. Since 2023, its shares have multiplied 23-fold, a feat that would make even Midas blush. True, the bird has dipped its wings recently, shedding double-digit feathers from its peak. Yet year-to-date, it still doubles as both phoenix and ashes, reigning as the S&P 500’s unrivaled belle of the ball.

In the grand theatre of finance, few actors can steal the spotlight like regulation. And, as ever, it is the hand of regulation that will either shackle or liberate the rebellious XRP. August saw Ripple-her enigmatic creator-settle its long-standing battle with the Securities and Exchange Commission (SEC), a gesture that, for a brief moment, promised a clearer path. The administration, with a penchant for crypto, seemed to usher in a golden age of clarity, suggesting that Ripple and XRP could once again dance freely in the marketplace.

Now, let’s cut to the chase-or should I say “cut to the cloud”? Workday specializes in financial and human capital management software, which sounds boring until you realize it’s basically running half the corporate world behind the scenes. And yet here we are, watching investors fret over how artificial intelligence might disrupt everything. Why? Because AI is like that cousin who shows up uninvited at Thanksgiving dinner and starts doing everyone else’s jobs better than they can. Seat-based pricing models? Suddenly looking as outdated as rotary phones.