Crypto’s Latest Race: ICP Dominates, Prices Play Hard to Get

The rest of the top ten was as crowded as a Mississippi steamboat during Mardi Gras, mixin’ layer-1 networks and fancy protocols like a hot biscuit. Among ‘em:

The rest of the top ten was as crowded as a Mississippi steamboat during Mardi Gras, mixin’ layer-1 networks and fancy protocols like a hot biscuit. Among ‘em:

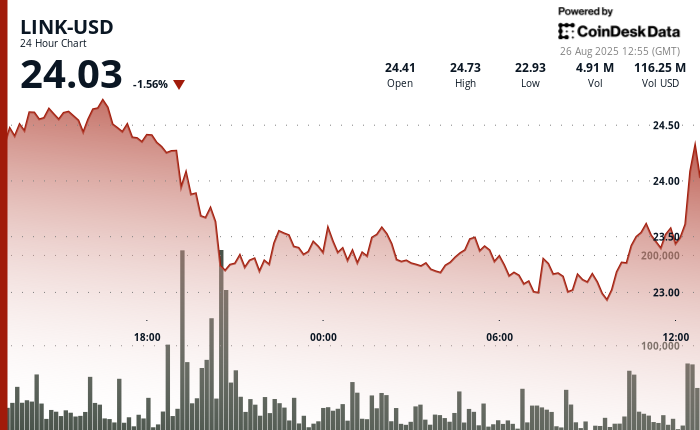

According to the S-1 registration statement filed with the U.S. Securities and Exchange Commission on Tuesday (those busy bees!), the Bitwise Chainlink ETF aims to dangle direct exposure to LINK in front of investors. And who’s the lucky custodian? None other than Coinbase Custody, of course! 🏦🔐

The curtain rises: SharpLink now clutches 797,704 Ether-cue the drumroll-which is a cool $3.7 billion. Plus, there’s still $200 million in cash, seemingly begging to be thrown at more coins. The company dropped this revelation on a Tuesday, as if Tuesdays weren’t dramatic enough.

A whale, this leviathan of the meme-deeps, moving not with the herd but through it, a silent mountain shifting its snow. Is this the prelude to a great shedding, a winter for jests? Or merely a giant, weary of his solitary hoard, deciding to mingle with the merchants? The exchange, that great bazaar, receives the avalanche into its vaults without a flinch, its own coffers swelling by a silent, staggering two percent.

According to a press release dated August 26, Trump Media & Technology Group, Crypto.com, and Yorkville Acquisition Corp. have entered into what can only be described as a crypto-themed marriage. Together, they’ve birthed Trump Media Group CRO Strategy, Inc., a publicly-traded company destined to dazzle-or confuse-the masses on Nasdaq under the ticker MCGA.

But let’s rewind with the grace of a sugar-plumed peacock to last Friday, shall we?

Over the past decade, QQQ has returned 445% versus the S&P 500’s 260%. That’s not luck-it’s the result of the Nasdaq 100 being a curated list of companies that think “growth” is a verb, not a buzzword. If you’re investing in a fund that owns 60% tech stocks and 20% discretionary consumer goods, you’re essentially betting against the idea that people will stop buying shoes or upgrading their GPUs. A fool’s errand, to say the least.

CROCRO$0.1953◢21.03%

But wait, there’s more! New intel suggests that things might not be as reckless as they sound-surprise, surprise. 😏

When queried about the Solana-versus-Ethereum skirmish, King minced no words: “Ethereum, the silverback gorilla of crypto, sits comfortably in the number two spot. Solana, our radiant underdog, is among the top five, poised to dethrone the incumbent. This debate is so heated, I might as well have suggested that the Earth is flat!”