Plug Power: A Stock or a Sideshow?

High-growth stocks are typically those that exhibit a trajectory of explosive revenue expansion, innovative disruption, or possess a dominant position within a growing sector. Several critical factors contribute to their identification:

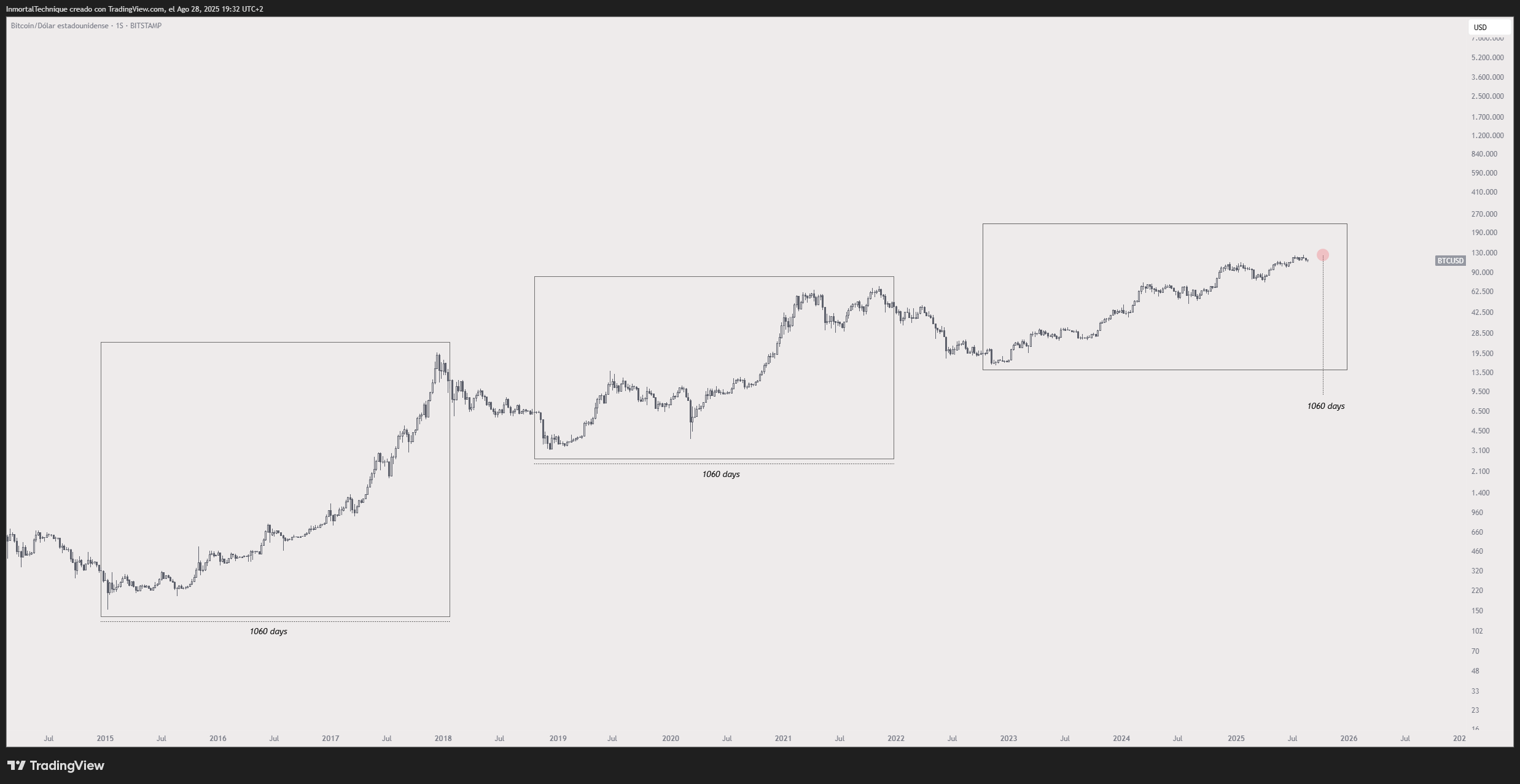

These concerns arise as Bitcoin prepares to enter September, historically the weakest month of the year. Because nothing says “financial genius” like betting on a month that’s been known to crash portfolios faster than a poorly timed joke at a party. 😅

Here’s the problem: Everyone’s rushing to pile into AI like it’s a buffet where the salad is free and the meat is just a suggestion. But let’s dissect this. Nvidia’s stock isn’t just riding a tech wave-it’s being propped up by a story. A story where GPUs are the new oil, and everyone’s a refiner. Except, oil’s tangible. You can spill it on your shoe and know you’ve made a mistake. With AI? You just keep pouring money into a spreadsheet until the numbers look like a modern art masterpiece.

The first, a phoenix rising from the ashes of Moore’s Law, breathes life into silicon wafers with a grace that defies entropy; its quarterly earnings calls echo with the thunder of tectonic plates shifting. The second, a leviathan of the digital deep, hoards petabytes like dragon’s gold, its value growing as invisibly as roots in rain-soaked earth. And the third, a trickster whose code dances between currencies, turns every transaction into a sacrament of modernity, where dollars and pesos and yen dissolve into the universal language of the swipe.

One must, of course, acknowledge the infinite complexities of such a decision. The world of value investing, which on the surface seems to be governed by numbers and logic, is perhaps more akin to a bureaucratic machine with no discernible purpose. Loeb’s decision to relinquish TSMC, despite its solid footing in a market that is, by all accounts, essential to the global economy, does not simply reflect an analytical choice. It is, rather, an act of surrender to the absurd forces of speculation-forces that, like invisible cogs in a larger mechanism, churn ceaselessly without any tangible end in sight.

To speak plainly-though with due deference to the unspoken codes of polite society-the recent utterances of President Trump have cast yet another shadow upon an already precarious scene. One might say it is not unlike observing Lady Catherine de Bourgh enter a ballroom; all eyes are drawn, whether willingly or no, to her commanding presence. And so it is here: his words ripple through the markets like ripples across a pond disturbed by an ill-timed stone.

One might argue that dividends are the financial world’s version of a comforting blanket-warm, predictable, and utterly unreliable in a crisis. SCHD, with its portfolio of “dividend aristocrats,” promises stability, but stability is the kind of thing that makes the universe yawn. After all, if the market were a person, it would be the one who says, “Sure, let’s all jump off a cliff, but first, let’s buy some bonds.”

To answer this, let us first consider what Palantir actually does-or at least claims to do. The company provides software that sifts through staggering amounts of data to uncover patterns invisible to mere mortals. Think of it as hiring Sherlock Holmes if he were reincarnated as both an Excel spreadsheet and something out of a dystopian sci-fi novel. Governments love it because apparently no one can resist the allure of knowing everything about everyone, while corporations adore it for reasons they probably wouldn’t admit in polite conversation.

Buffett built Berkshire Hathaway like a madman stacking cash in a burning roulette hall, betting on “core holdings” with grim optimism, as if capitalism were some old horse you just keep riding until it drops dead in front of the casino. The vultures now circle: the new guy, whoever they unmask behind the velvet curtain, is rumored to be so eager to flex that he’ll sell one of Buffett’s sacred cows before the saddle warm.