Bitcoin Miner IREN’s AI Push Gains Momentum, Price Target Hiked 60% to $37: Canaccord

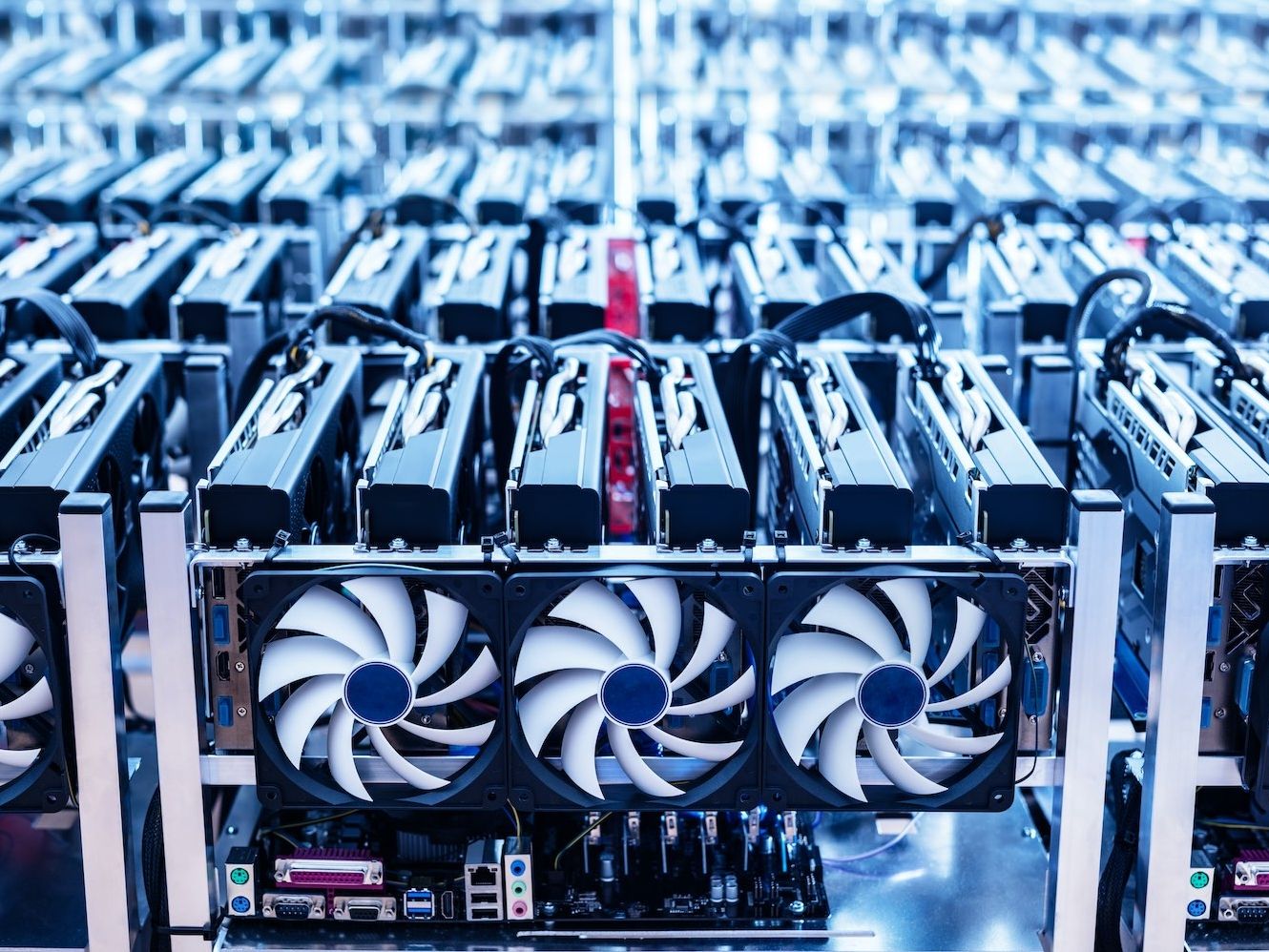

So, what’s the big deal? IREN (because acronyms are fun) just reported a fourth-quarter haul that shows it’s not just mining bitcoin, but also dabbling in artificial intelligence like it’s the next big thing. According to Canaccord Genuity, the stock is set for a big boost, with the price target skyrocketing by a whopping 60%. That’s more than most people’s yearly raise!