🇯🇵 CZ & Japan Post Bank: DeFi, AI, and Trillions – Oh My! 🚀💸

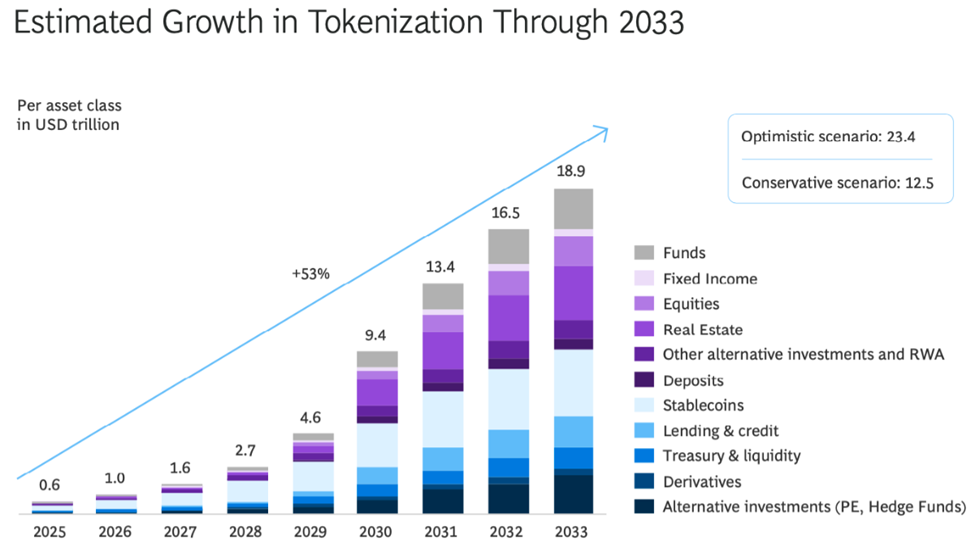

Meanwhile, Japan Post Bank is like, “Hold my ¥190 trillion ($1.29 trillion) in deposits,” as it gears up to unleash a digital currency that’ll make blockchain trading as easy as ordering sushi. 🍣💳