Atomic Bets & Miniature Suns

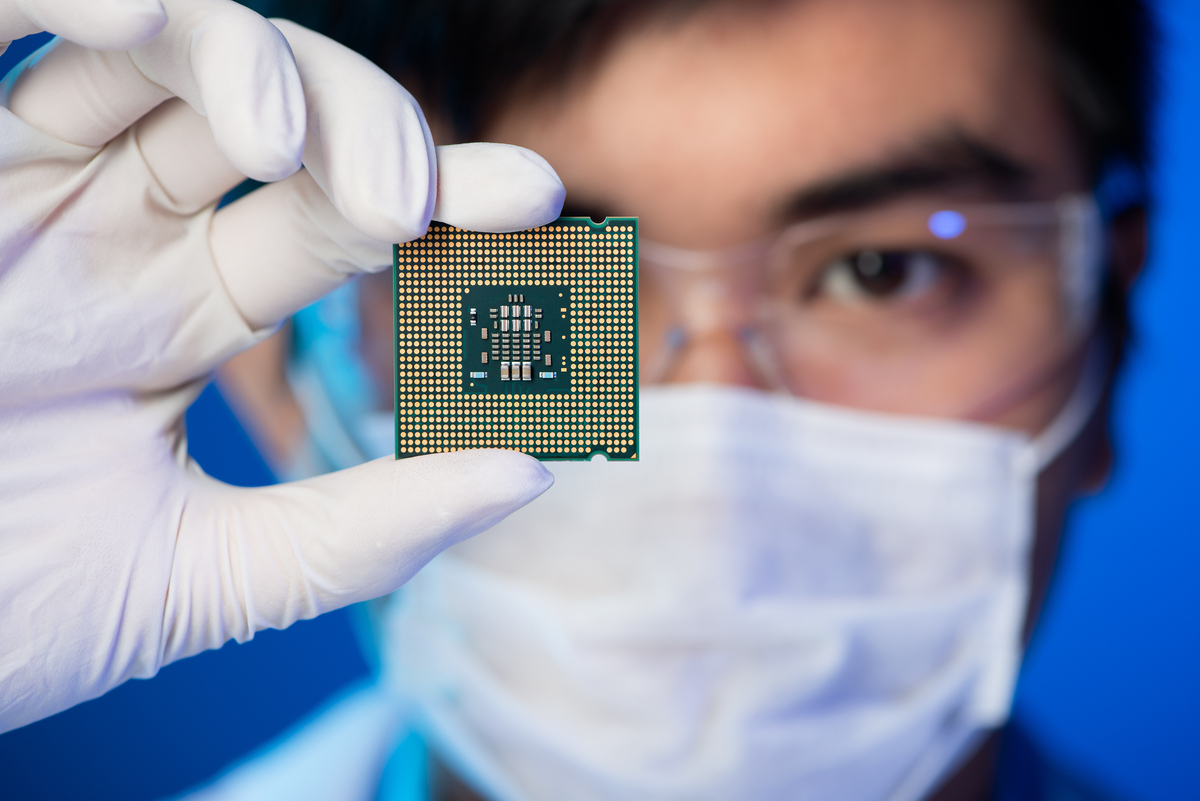

You see, we’re entering an age of insatiable power demands. Not just for keeping the lights on (though that’s still important), but for feeding the digital gods. Artificial intelligence, data centers… these aren’t powered by good intentions and wishful thinking. They require serious juice. And while some continue to believe in the fairy tale of 100% renewables, reality has a habit of being stubbornly… atomic. Nuclear delivers. Safely, reliably, and with a carbon footprint smaller than a pixie’s footprint in a snowdrift.