Micron: The Quiet Backbone of the AI Hype

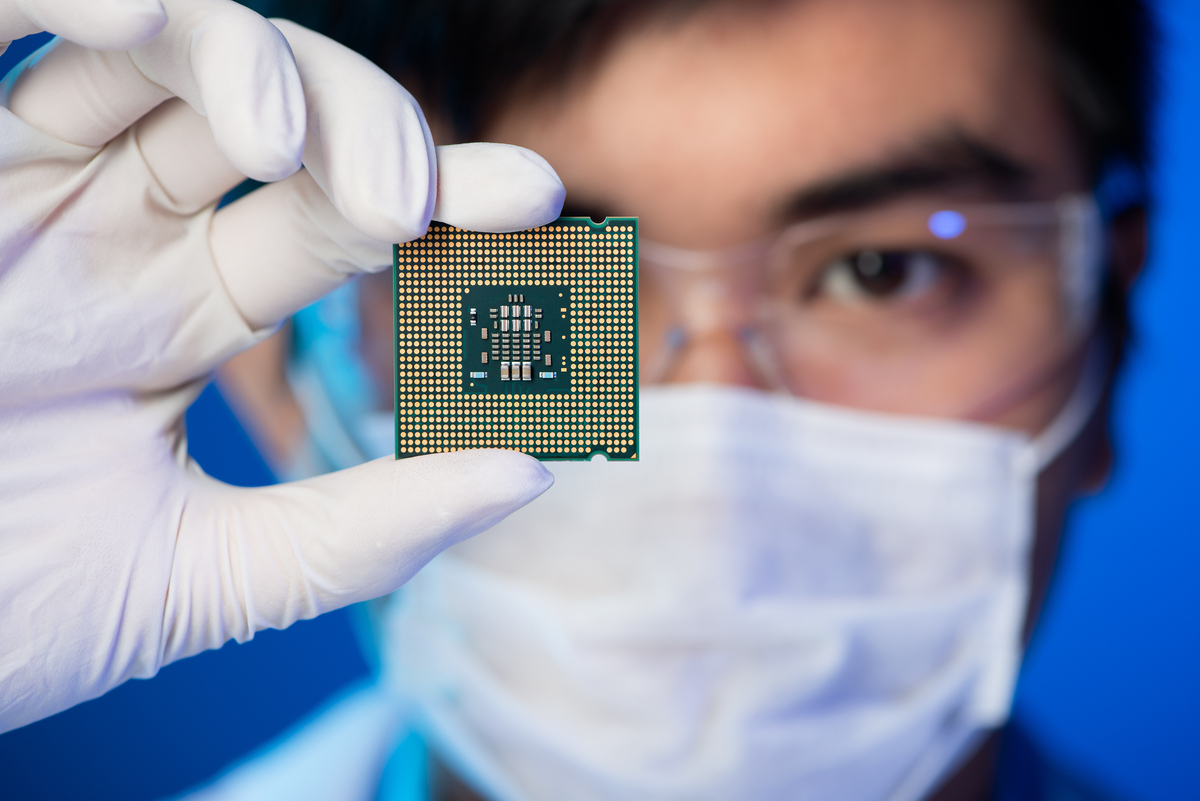

My Aunt Carol, who believes 5G causes migraines, tried to explain AI to me over Thanksgiving. It involved a lot of hand-waving and references to “the cloud” as if it were a physical place. She thought Nvidia was building robots. I didn’t correct her. It was easier. But what I should have explained is that all those clever algorithms need somewhere to, well, remember things. And that’s where Micron comes in. They don’t build the robots, they build the brains’ short-term memory.