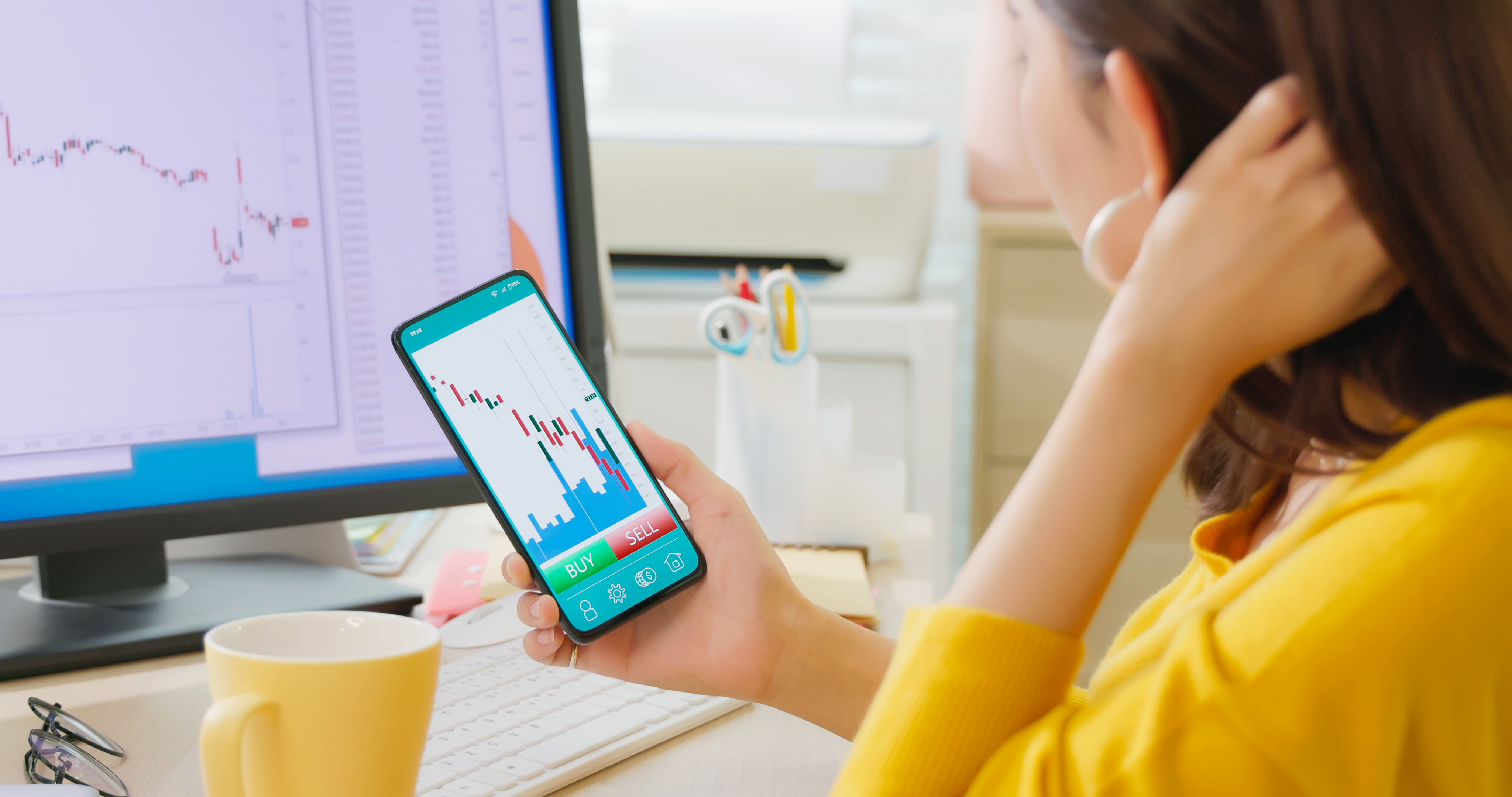

Shifting Sands: A Wealth Manager’s View

They still hold a piece of it, mind you. A reduced stake, now representing just over half a percent of their total managed assets. It’s a familiar story, this paring down. A farmer doesn’t hold onto all his land in a single season; he harvests what he needs, and lets the rest lie fallow, or perhaps plants a different seed. The fund itself, LMBS, remains a part of the larger field, though its portion has diminished.