Nasdaq Begs SEC: Let Us Gamble Bigger on Crypto ETFs!

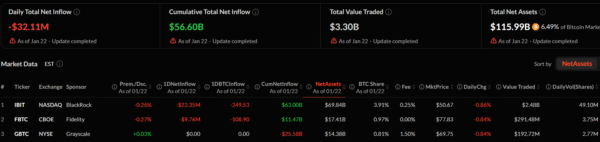

Nasdaq, ever the eager suitor, has beseeched the SEC to loosen the reins on Bitcoin ETF options. “Let us play with larger stakes!” they cry, as if the market were a grand ball and they, the most ardent of dancers. Data, that cold and impartial observer, reveals a steady waltz of volume and open interest in these BTC-tied investments. Yet, like a chaperone at a Victorian soiree, strict caps curb the ardor of traders, leaving Nasdaq to lament the stifled romance of the crypto-linked options markets.