A Question of Favors and Fortunes

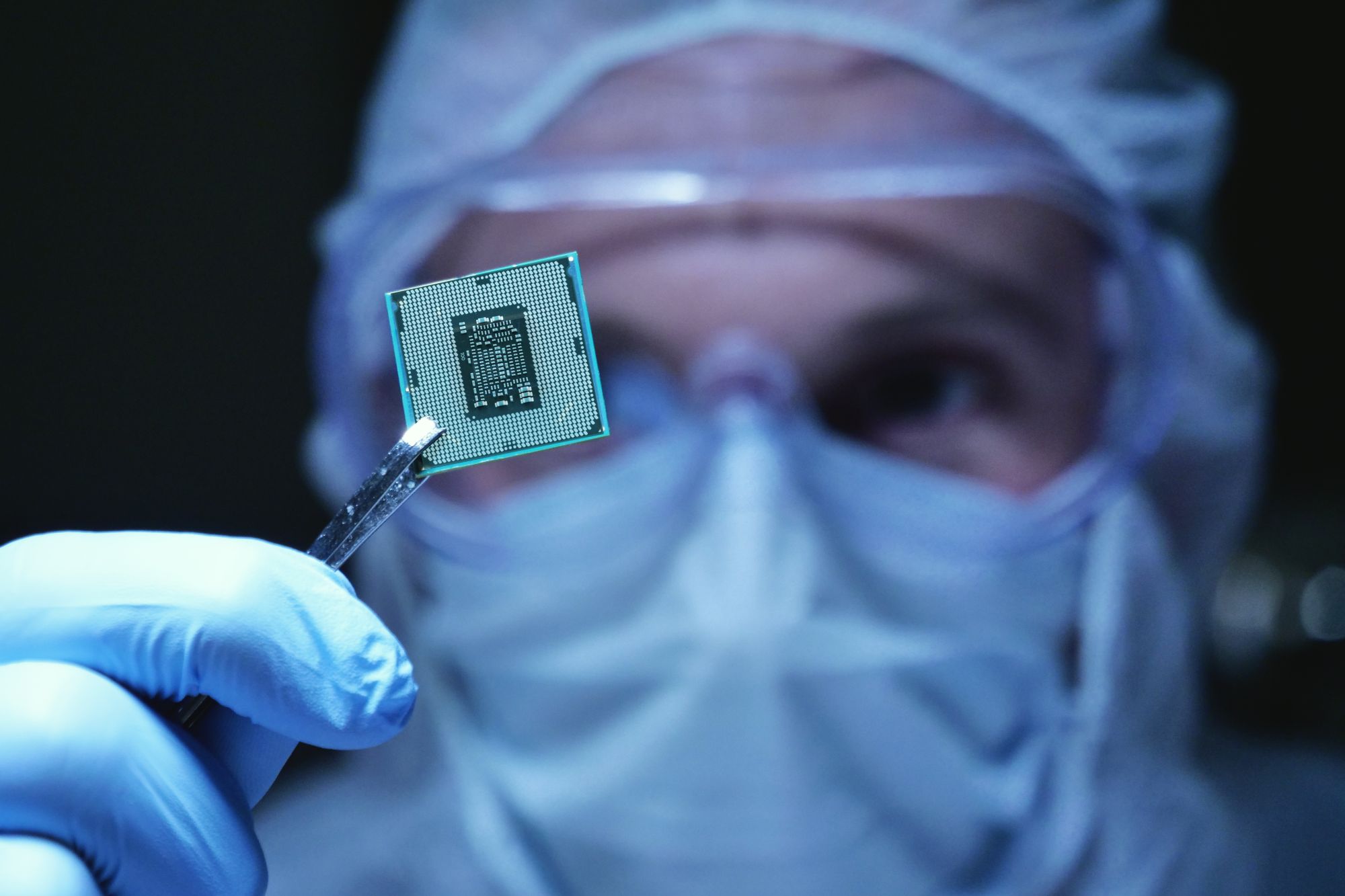

Micron Technology has, of late, benefited from the generous favor of Nvidia, supplying components crucial to the production of their increasingly sought-after graphics processing units. A most agreeable arrangement, certainly, though one founded, as all such are, upon a delicate balance of necessity and esteem. However, it now transpires that the terms of this association may be subject to alteration, a circumstance which cannot fail to give pause to those acquainted with the vagaries of the market.