Can Dogecoin Find Its Feet Again? Investors Hold Their Breath at $0.12!

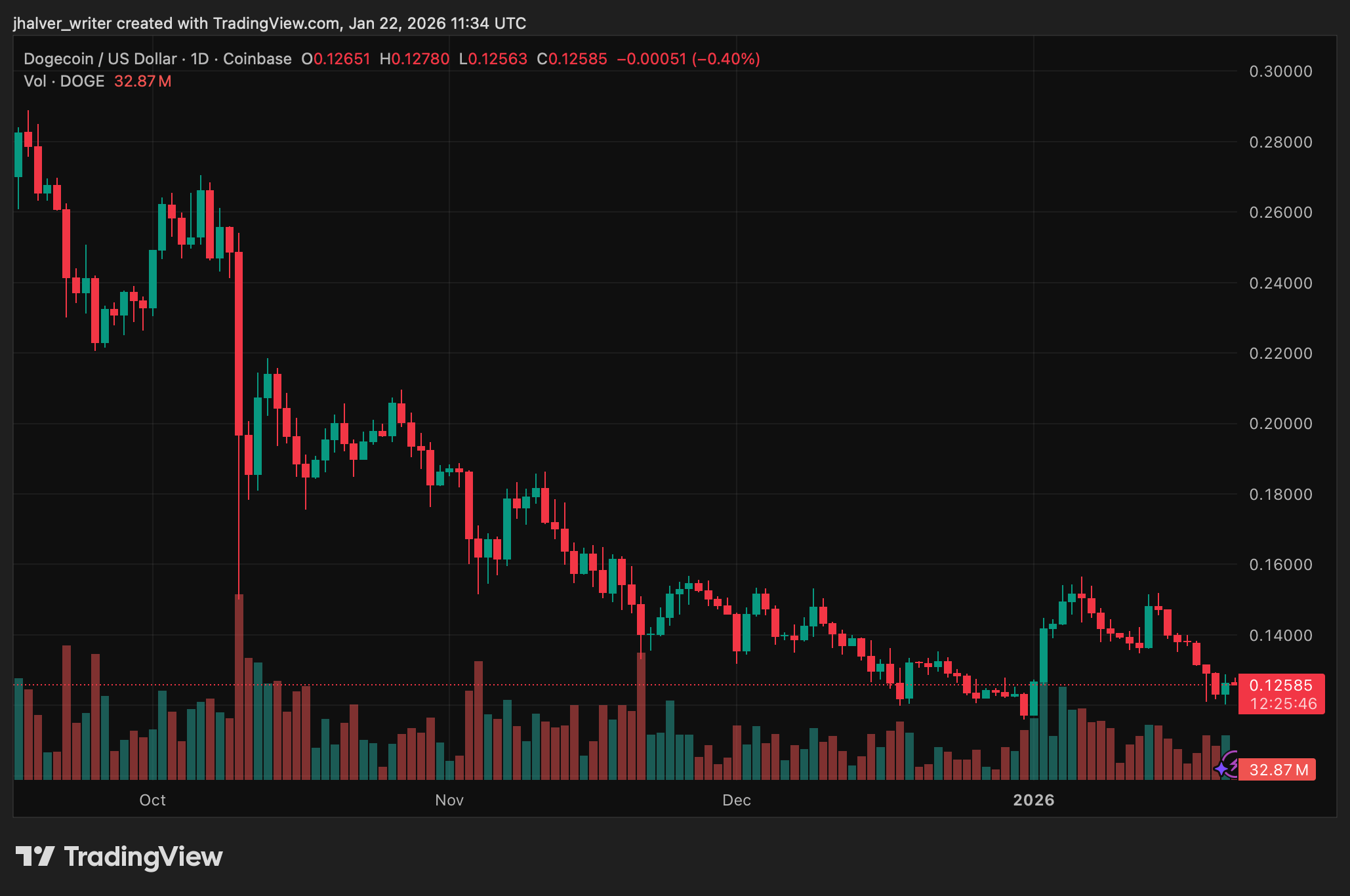

This charming little meme coin has lost over 20% from its recent heights of $0.15, but fret not! The latest price escapades suggest that perhaps, just perhaps, the selling pressure is beginning to ease like an old man’s sigh on a Sunday morning. Meanwhile, on-chain data and fresh developments regarding token usage provide some intriguing context for DOGE’s fleeting short-term prospects.