Mining’s Quantum Leap: Muons & The Future of Digging

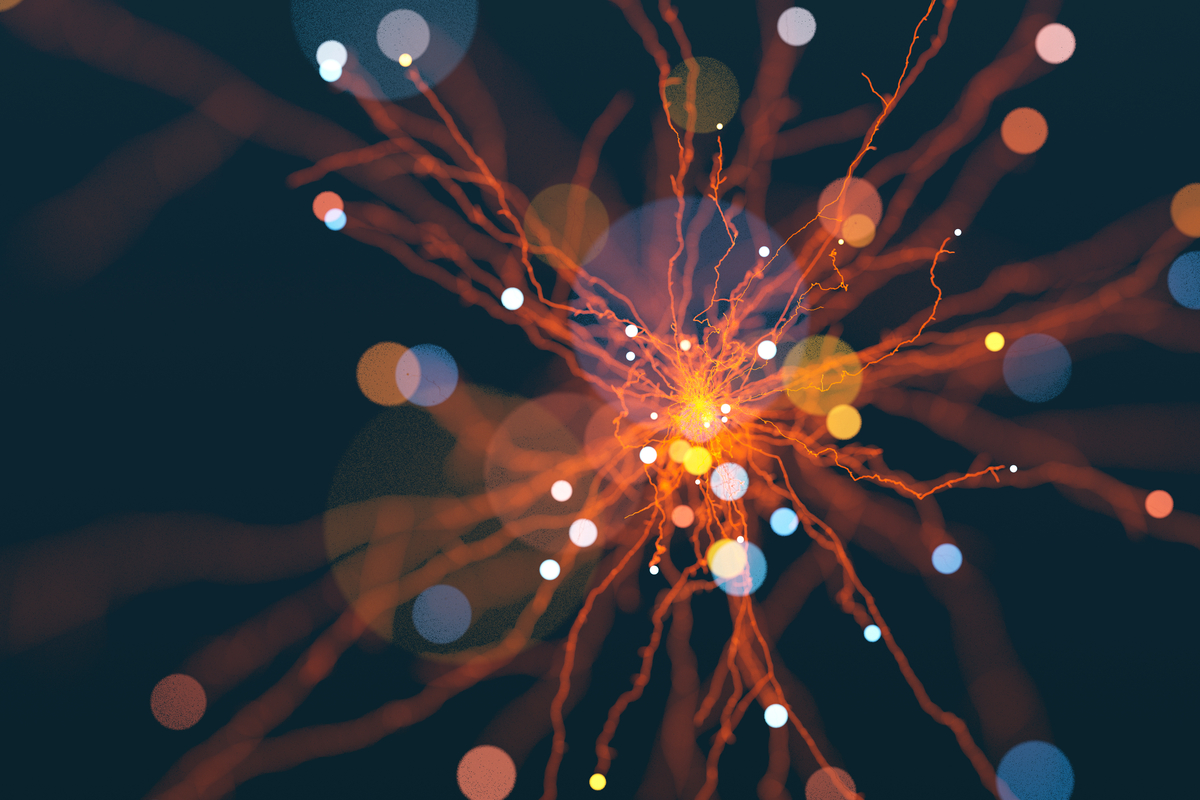

It all starts with cosmic rays. These aren’t rays in the sun-tanning sense, but incredibly energetic particles flung out by, well, exploding stars – supernovas, to be precise. Think of it as stellar shrapnel, travelling at nearly the speed of light. When these particles collide with Earth’s atmosphere, they create a cascade of other particles, including muons. Now, muons are fleeting – they exist for only a few microseconds – but travelling at such speeds, they can cover vast distances. One muon hits every square centimeter of the Earth every minute, apparently. Which, when you think about it, is a frankly astonishing statistic. They’re also about 200 times heavier than electrons, which is important because when they collide with materials, they lose energy, and that energy loss tells you something about what they hit.