Amazon (AMZN), a dominant player in the financial world, consistently posts impressive earnings, plays a significant part in both online retail and cloud services, and boasts a market value exceeding 2.3 trillion dollars.

However, Amazon’s shares have risen less than 2% this year, and its supremacy in the cloud computing market is waning as competitors like Microsoft Azure and Google Cloud from Alphabet are gaining ground. Furthermore, President Donald Trump’s tariff threats have resurfaced, with several tariffs set to be implemented in August, which could negatively impact Amazon’s e-commerce sector.

When considering an investment in Amazon stock, it’s only logical to ponder about how the firm intends to preserve its lead in cloud computing and rekindle stock price growth. Here’s a crucial aspect you should keep a close eye on right now.

For Amazon, follow the money

Amazon serves as a significant revenue generator. In the first quarter alone, the company reported earnings of an impressive $155.7 billion, marking an 8.6% increase compared to the same period last year. Notably, profits also saw a significant rise, reaching $17.1 billion and $1.59 per share. This is a substantial improvement over the figures from the corresponding quarter of the previous year which stood at $10.4 billion and $0.98 per share.

It seems that Amazon is spending the funds nearly instantaneously after earning them. One might wonder where all these resources are being directed.

Operating an e-commerce business like Amazon involves numerous expenses such as warehouse management, vehicle fleets for deliveries, employee wages, inventory, and logistics, which significantly impact the company’s overall profit margin.

| Segment | Q1 2025 Sales | Q1 2025 Expenses | Q1 2025 Profit | Q1 2025 Margin |

|---|---|---|---|---|

| North America | $92.88 billion | $87.04 billion | $5.84 billion | 6.3% |

| International | $33.51 billion | $32.49 billion | $1.01 billion | 3% |

| AWS | $29.26 billion | $17.72 billion | $11.54 billion | 39.4% |

Although Amazon’s online retail sector plays a significant role, I personally find Amazon Web Services (AWS) to be a more profitable venture due to its superior profit margins. However, the success of AWS could potentially be at risk if Amazon fails to exercise caution.

In the year 2022, Amazon Web Services (AWS) controlled approximately 33% of the cloud computing market, followed by Microsoft Azure at around 22% and Google Cloud at about 10%. However, as we approach the end of 2024, Amazon’s share has decreased slightly to around 30%, while Google Cloud has seen a rise, holding approximately 12% of the market.

Leading cloud computing firms such as Alibaba, Oracle, Salesforce, IBM, Tencent, and even Amazon (with smaller competitors), are investing heavily to expand their cloud services, enhancing both capacity and functionalities. A significant portion of Amazon’s investment is directed towards acquiring new Nvidia chips, designed to drive artificial intelligence capabilities and products with extensive language modules, along with the AWS Trainium chip, which caters to AI and machine learning applications.

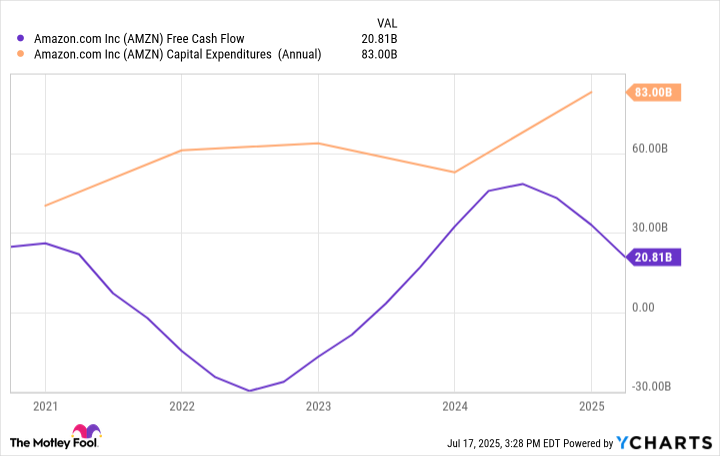

The reason for Amazon’s increased spending in recent years has led to a decrease in its free cash flow. Last year, Amazon invested $83 billion in capital expenditures, and it is projected to spend over $100 billion this year. In Q1 alone, Amazon spent $24.3 billion.

Most of our expenditure is geared towards meeting the rising demand for technology foundations. This mainly pertains to AWS, as we allocate resources to cater to our AI service requirements, and more so in developing custom chips like Trainium, along with tech infrastructure to bolster both our North American and global divisions,” stated Brian Olsavsky during the company’s Q1 2025 earnings conference.

The bottom line

It’s crucial for Amazon to invest this money at the moment. The success of AWS is vital to the company’s financial health, and as businesses increasingly adopt cloud solutions for their AI applications, Amazon has a unique chance to transform into a leading AI-as-a-Service provider. This transformation could yield profit margins that significantly surpass what its e-commerce sector can achieve.

As an ardent Amazon investor, I’m all about witnessing that capital expenditure (captivatingly known as capex) climbing higher. My dream is for Amazon to continuously enhance its data centers, making them not just faster and more powerful, but also incredibly agile to accommodate whatever demands its customers might have. I yearn for Amazon to stay at the forefront of cloud computing, keeping its competitors at bay. This ambition doesn’t come cheap – it takes substantial investment.

Currently, Amazon is doing well as a business, but its stocks are experiencing a temporary slump. To preserve and grow its leadership role in cloud computing, I am paying close attention to their capital expenditures at this moment.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-22 13:06