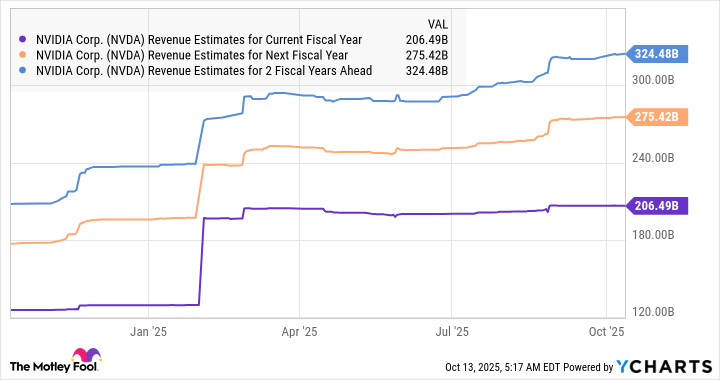

Nvidia stands today as a colossus, stretching across the landscape of technology with a market capitalization that looms at $4.5 trillion. It has woven itself tightly into the very fabric of artificial intelligence, its seeds bearing the weight of untold billions destined for the construction of robust data center infrastructures. It is within this vast and ambitious future that whispers flutter through the hallowed halls of Wall Street, hints urging us to consider that Nvidia might one day reach the exalted $10 trillion threshold.

One might think such a projection is as natural as the sunrise, owing to Nvidia’s established stronghold and the estimate of $5.2 trillion earmarked for AI data centers over the coming five years. Yet, the winds of competition stir restlessly. Rivals like Broadcom and AMD present challenges that could dampen the anticipated triumphs of Nvidia, creating waves in the placid pool of its growth trajectory.

However, there looms another contender, a company in the shadows, seemingly dwarfed by Nvidia-yet this company may ascend first towards that monumental $10 trillion height. Let us turn our gaze to the unseen efforts that might unfurl before us.

This behemoth of cloud infrastructure holds promise

Oracle (ORCL) has seen its stock surge upward by 76% in 2025 thus far, a remarkable feat overshadowing Nvidia’s own 36% climb this year. With the stock’s ascent, Oracle now boasts a market cap of $835 billion, claiming its place as the 12th most significant player on the global stage, echoing the struggle of the common folk moving up in a world often tilted against them.

You may be pondering the path that Oracle walks, one wrought with trials yet infused with tenacity, propelling it toward that golden number. A careful examination reveals the workings of Oracle’s business model, vital to the expansive reach of AI, and the rapid pace at which it builds its revenue like an artist crafting a masterpiece in a sun-drenched field.

Oracle’s robust global data centers are the beating heart of numerous clouds, with governments and technology companies flocking to glean the fruits of its labor. The burden of fulfilling contracts has become so substantial that Oracle finds itself unable to meet every request that arrives at its doorstep. This predicament has led to a meteoric rise in what is known as remaining performance obligations (RPO), reflective of contracts awaiting fulfillment, a sign of prosperity in a flourishing harvest.

To illustrate, Oracle witnessed a 12% rise in revenue year-over-year during the first quarter of fiscal 2026-a modest yet satisfying return. In stark contrast, its RPO surged by 359%, reaching an astounding $455 billion, courtesy of “four multi-billion-dollar deals with three divergent customers.” Company leadership unveiled hopes that Oracle’s contracts might blossom into “several additional multi-billion-dollar customers,” hinting that their RPO could eclipse half-a-trillion dollars as the seasons change.

Good fortune did soon favor Oracle, as it announced a monumental five-year agreement with OpenAI worth a staggering $300 billion, just a day after revealing its fiscal Q1 earnings. Set to mature from 2027, this behemoth of a contract suggests Oracle’s RPO could easily crest the $750 billion mark now, possibly blossoming even further.

Coupled with other large-scale deals simmering in the background, one can hardly dismiss the prospect of Oracle’s RPO nearing the $1 trillion summit. Their innovative multicloud database services, extensions allowing clients to operate databases across Google, Microsoft, and Amazon cloud platforms are gathering momentum akin to a river swelling after a rainstorm.

Remarkably, the demand for Oracle’s multicloud solutions has burgeoned, with reports suggesting a staggering 1,529% spike in its revenue during the fiscal first quarter. Unsurprisingly, implementation plans predict that Oracle will ramp its multicloud data centers from a modest 34 to an ambitious 71 before the next tidal wave of growth crashes upon the shore.

The horizon illuminating the AI-focused cloud computing market offers a treasure trove, projected to swell to $3.7 trillion in revenue by 2034, as overall cloud computing revenue is anticipated to soar toward $5.1 trillion. In this vibrant landscape, Oracle can cultivate an impressive long-term revenue stream set to fuel its growth for years ahead.

Oracle’s Road to a $10 trillion Valuation

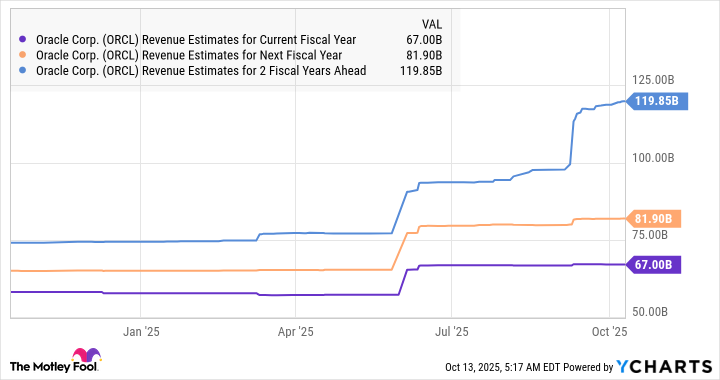

Despite a previous quarter that may not have enticed the overly ambitious, Oracle’s expanding revenue pipeline paints a promising picture for the future, one that invites hope amid uncertainty.

Yet, recognize this: Oracle’s RPO dwarfs the income expected over the next three fiscal years. As anticipation swells over potential new contracts, one must remain steady amidst the storm, as it would not be wise to dismiss the likelihood of accelerated revenue growth piercing through the haze beyond the forthcoming years.

In contrast, Nvidia’s anticipated growth seems poised to wane, much like the fading glow of twilight.

If we anchor our expectations firmly, assuming a 40% annual growth rate for Oracle in the five fiscal years following 2028, we could see revenue peaks soaring to $645 billion by 2033-an achievable trajectory, given the projections for the cloud computing market disclosed earlier.

At present, Oracle’s stock rests at a price-to-sales ratio of 14, but such numbers could climb to warrant a substantial premium in the face of promising growth-trading at 16 times sales may very well propel the company into the upper stratosphere of a $10 trillion valuation. Conversely, Nvidia may find itself adrift in a turbulent sea of valuation decline, as the forecasted slowdown stirs questions regarding its previous trajectories. Thus, the possibility remains credible: Oracle could indeed emerge as the first to touch that majestic milestone.

🌱

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-10-16 03:45